Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#9 What are bond ratings and why are they assigned? Bonds are like loans the issuers get from investors. Just as your credit worthiness is

#9

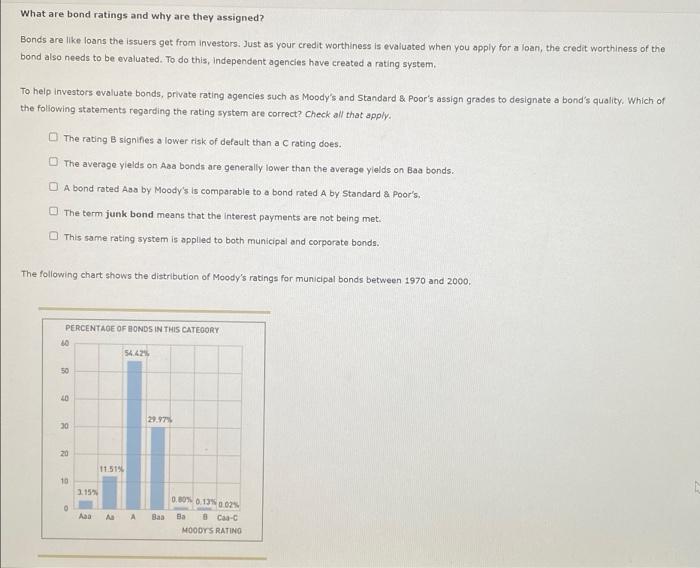

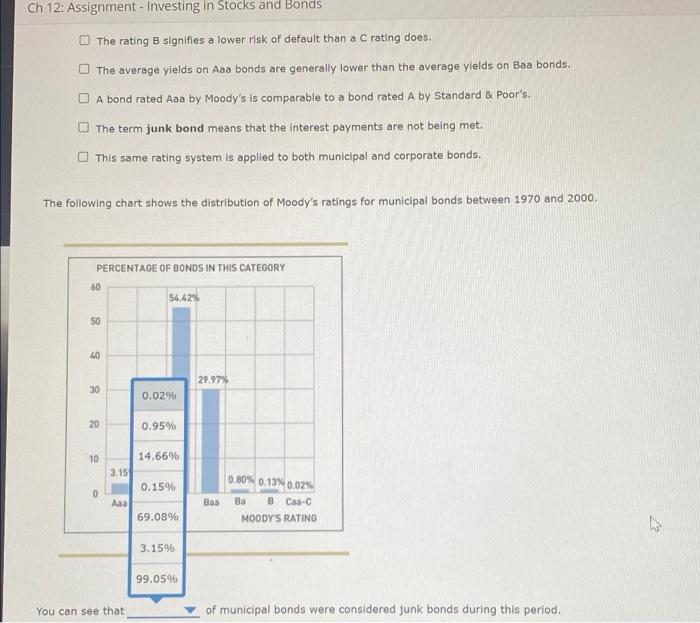

What are bond ratings and why are they assigned? Bonds are like loans the issuers get from investors. Just as your credit worthiness is evaluated when you apply for a loan, the credit worthiness of the bond also needs to be evaluated. To do this, Independent agencies have created a rating system To help investors evaluate bonds, private rating agencies such as Moody's and Standard & Poor's assign grades to designate a bond's quality. Which of the following statements regarding the rating system are correct? Check all that apply. The rating B signifies a lower risk of default than a rating does. The average yields on Asa bonds are generally lower than the average yields on Baa bonds. A bond rated Ana by Moody's is comparable to a bond rated A by Standard & Poor's. The term junk bond means that the interest payments are not being met This same rating system is applied to both municipal and corporate bonds. The following chart shows the distribution of Moody's ratings for municipal bonds between 1970 and 2000, PERCENTAGE OF BONDS IN THIS CATEGORY 54.42 50 LO 30 29.97 20 11.51% 10 3.15% 0.00 0.125 0.025 -c Aaa A A Baa Ba MOODYS RATINO Ch 12: Assignment - Investing in Stocks and Bonds The rating B signifies a lower risk of default than a C rating does. The average yields on Aaa bonds are generally lower than the average yields on Baa bonds. A bond rated Aaa by Moody's is comparable to a bond rated A by Standard & Poor's, The term junk bond means that the interest payments are not being met This same rating system is applied to both municipal and corporate bonds. The following chart shows the distribution of Moody's ratings for municipal bonds between 1970 and 2000. PERCENTAGE OF BONDS IN THIS CATEGORY 60 56.42% 50 40 29.97% 30 0.02% 20 0.95% 10 14.66% 3.15 0.15% 0.00% 0.13% 0.02% B Cas-C 0 Asa Baa 83 MOODY'S RATING 69.08% 3.15% 99.05% You can see that of municipal bonds were considered junk bonds during this period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started