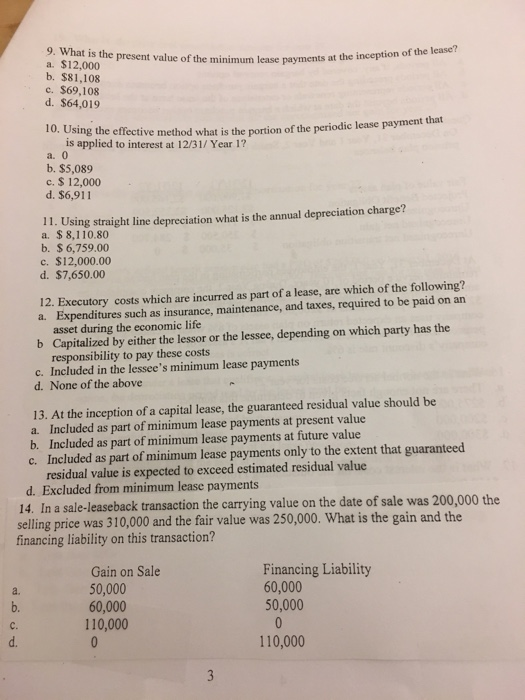

9. What is the present value of the mini a. $12,000 ade of the minimum lease payments at the inception of the case b. $81,108 c. $69,108 d. $64,019 Using the effective method what is the portion of the periodic lease payment that is applied to interest at 12/31/ Year 1? a. O b. $5,089 c. $ 12,000 d. $6,911 11. Using straight line depreciation what is the annual depreciation charge? a. $ 8,110.80 b. $ 6,759.00 c. $12,000.00 d. $7,650.00 12. Executory costs which are incurred as part of a lease, are which of the following? a. Expenditures such as insurance, maintenance, and taxes, required to be paid on an asset during the economic life b Capitalized by either the lessor or the lessee, depending on which party has the responsibility to pay these costs c. Included in the lessee's minimum lease payments d. None of the above 13. At the inception of a capital lease, the guaranteed residual value should be a. Included as part of minimum lease payments at present value b. Included as part of minimum lease payments at future value c. Included as part of minimum lease payments only to the extent that guaranteed residual value is expected to exceed estimated residual value d. Excluded from minimum lease payments 14. In a sale-leaseback transaction the carrying value on the date of sale was 200,000 the selling price was 310,000 and the fair value was 250,000. What is the gain and the financing liability on this transaction? Gain on Sale 50,000 60,000 110,000 Financing Liability 60,000 50,000 110,000 9. What is the present value of the mini a. $12,000 ade of the minimum lease payments at the inception of the case b. $81,108 c. $69,108 d. $64,019 Using the effective method what is the portion of the periodic lease payment that is applied to interest at 12/31/ Year 1? a. O b. $5,089 c. $ 12,000 d. $6,911 11. Using straight line depreciation what is the annual depreciation charge? a. $ 8,110.80 b. $ 6,759.00 c. $12,000.00 d. $7,650.00 12. Executory costs which are incurred as part of a lease, are which of the following? a. Expenditures such as insurance, maintenance, and taxes, required to be paid on an asset during the economic life b Capitalized by either the lessor or the lessee, depending on which party has the responsibility to pay these costs c. Included in the lessee's minimum lease payments d. None of the above 13. At the inception of a capital lease, the guaranteed residual value should be a. Included as part of minimum lease payments at present value b. Included as part of minimum lease payments at future value c. Included as part of minimum lease payments only to the extent that guaranteed residual value is expected to exceed estimated residual value d. Excluded from minimum lease payments 14. In a sale-leaseback transaction the carrying value on the date of sale was 200,000 the selling price was 310,000 and the fair value was 250,000. What is the gain and the financing liability on this transaction? Gain on Sale 50,000 60,000 110,000 Financing Liability 60,000 50,000 110,000