Question

9. What variable manufacturing overhead cost would be included in the companys flexible budget for March? 10. What is the variable overhead efficiency variance for

9. What variable manufacturing overhead cost would be included in the companys flexible budget for March?

9. What variable manufacturing overhead cost would be included in the companys flexible budget for March?

10. What is the variable overhead efficiency variance for March? (Input the amount as a positive value. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance.).)

11. What is the variable overhead rate variance for March? (Do not round intermediate calculations. Input the amount as a positive value. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance.).)

12. What amounts of advertising, sales salaries and commissions, and shipping expenses would be included in the companys flexible budget for March?

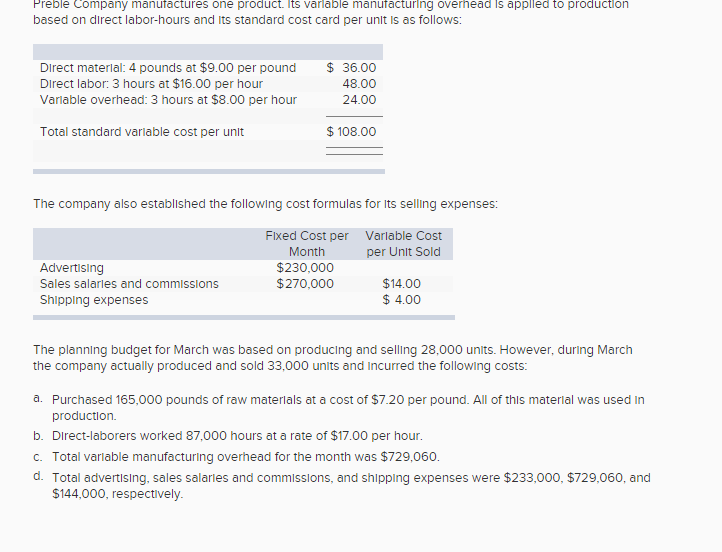

Preble Company manufactures one product. its varlable manufacturing overnead is applled to production based on direct labor-hours and Its standard cost card per unit is as follows: Direct materlal: 4 pounds at $9.00 per pound Direct labor: 3 hours at $16.00 per hour Varlable overhead: 3 hours at $8.00 per hour $36.00 48.00 24.00 Total standard variable cost per unlt $108.00 The company also established the following cost formulas for Its selling expenses: Fixed Cost per Month $230,000 $270,000 Varlable Cost Advertising Sales salarles and commisslons Shlpping expenses $14.00 $4.00 The planning budget for March was based on producing and selling 28,000 units. However, during March the company actually produced and sold 33,000 units and Incurred the following costs: a. Purchased 165,000 pounds of raw materials at a cost of $7.20 per pound. All of this material was used In production. b. Direct-laborers worked 87,000 hours at a rate of $17.00 per hour. c. Total variable manufacturing overhead for the month was $729,060. d. Total advertising, sales salarles and commissions, and shipping expenses were $233,000, $729,060, and $144,000, respectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started