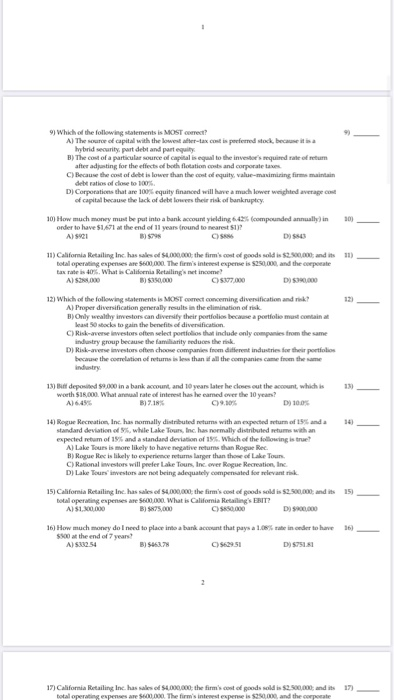

9) Which of the following statements is MOST Correct? A) The Sound of capital with the lowest after-tax cost is performed stock, because hybrid security, put debt and part equity B) The cost of a particular source of capital is equal to the investor's required rate of return after adjusting for the effects of both location costs and corporate taxes C) Because the cost of debt is lower than the cost of equity value-marimiring firms maintain dhe atins de to DJ Corporations that are 100 equity financed will have a much lower weighted average co of capital because the lack of debelow the risk of bankruptcy compounded annually) in 30 10) How much money must be put into a bank account yielding order to have $1,671 at the end of 11 years (round to nearest 1)? A) 5921 595 11) California Retailing Inc. has the firm's cold rods sold is $200.000 and its 11) total operating expenses are the firm's interest expense is $250,000, and the corporate tax rate is 40%. What is California Retailing's net income! AIS S000 57.000 DS 12) 12) Which of the following statements is MOST comet conceming diversification and risk A) Proper diversification generally results in the elimination of risk B) Only wealthy westors can diversity their portfolios because a portfolio must contain at least 50 bocks to gain the benefits of diversification C) Riskaversenwestors often select portfolios that include only com es from the same industry group because the familiarity reduces the risk D) Risk-avere investors often choose companies from different industries for their portfolios because the correlation of returns i les than all the companies came from the same industry 13) 13) deposited $9.000 in a bank account and 10 years later he closes out the account which is worth SIR.000. What a r e interessered over the 10 years? A) 6,456 B) 7.18 09.10 D) 100 14 14) Rogue Recreation, Inc. has normally distributed returns with an expected return of 15 and standard deviation of while Lake Tours, Inc. has normally distributed retums with an expected retum of 19% and a standard deviation of 16. Which of the following is true A) Lake Tours is more likely to have the returns than Rogue Rec. B) Rogue Rec is likely to experience returns larger than those of Lake Tours C) Rationalwestors will prefer Lake Tours Inc over Rogue Recreation, Inc DJ Lake Tours'investors are not being adequately compensated for relevant 15) 15) California Retailing Inc. has sales of $4,000,000, the firm's cost of goods sold is $2.500.000 and its total operating expenses 000. What is California Retailing's EBIT? A) $1.000 75.000 DISCO 16) 16) How much money do I need to place into a bank account that pays a 1.08% rate inceder to have 500 at the end of 7 years? A) 5332.54 17) 17) California Retailing Inc. hassas od 4.000.000, the firm's cont of goods sold is $2.500,000 and its total operating expenses are 60.000. The firm's interest expense is $250.000and the corporate