Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. Which one of the following statements is correct? A) An exposure to exchange rate risk can be the risk that a positive net present

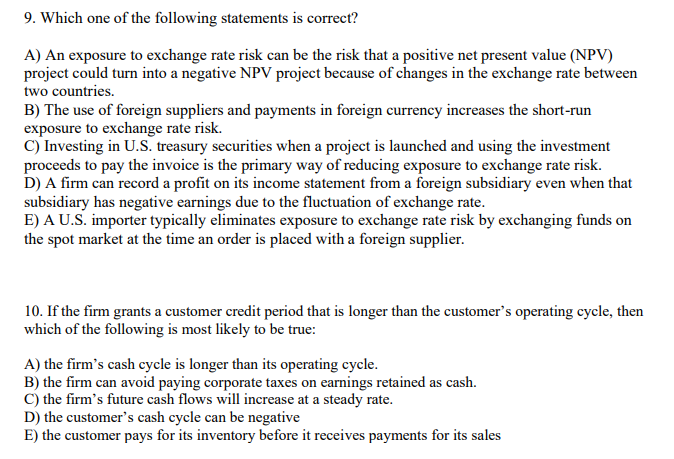

9. Which one of the following statements is correct? A) An exposure to exchange rate risk can be the risk that a positive net present value (NPV) project could turn into a negative NPV project because of changes in the exchange rate between two countries. B) The use of foreign suppliers and payments in foreign currency increases the short-run exposure to exchange rate risk. C) Investing in U.S. treasury securities when a project is launched and using the investment proceeds to pay the invoice is the primary way of reducing exposure to exchange rate risk. D) A firm can record a profit on its income statement from a foreign subsidiary even when that subsidiary has negative earnings due to the fluctuation of exchange rate. E) A U.S. importer typically eliminates exposure to exchange rate risk by exchanging funds on the spot market at the time an order is placed with a foreign supplier. 10. If the firm grants a customer credit period that is longer than the customer's operating cycle, then which of the following is most likely to be true: A) the firm's cash cycle is longer than its operating cycle. B) the firm can avoid paying corporate taxes on earnings retained as cash. C) the firm's future cash flows will increase at a steady rate. D) the customer's cash cycle can be negative E) the customer pays for its inventory before it receives payments for its sales

9. Which one of the following statements is correct? A) An exposure to exchange rate risk can be the risk that a positive net present value (NPV) project could turn into a negative NPV project because of changes in the exchange rate between two countries. B) The use of foreign suppliers and payments in foreign currency increases the short-run exposure to exchange rate risk. C) Investing in U.S. treasury securities when a project is launched and using the investment proceeds to pay the invoice is the primary way of reducing exposure to exchange rate risk. D) A firm can record a profit on its income statement from a foreign subsidiary even when that subsidiary has negative earnings due to the fluctuation of exchange rate. E) A U.S. importer typically eliminates exposure to exchange rate risk by exchanging funds on the spot market at the time an order is placed with a foreign supplier. 10. If the firm grants a customer credit period that is longer than the customer's operating cycle, then which of the following is most likely to be true: A) the firm's cash cycle is longer than its operating cycle. B) the firm can avoid paying corporate taxes on earnings retained as cash. C) the firm's future cash flows will increase at a steady rate. D) the customer's cash cycle can be negative E) the customer pays for its inventory before it receives payments for its sales Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started