Question

9. Why estimate the stand-alone value of the target? 10. Should you use the target or the acquirers discount rate to calculate the value of

9. Why estimate the stand-alone value of the target?

10. Should you use the target or the acquirers discount rate to calculate the value of the target to the acquirer? Does your answer differ if the acquirer and target are in different industries? What does the estimate assume about the capital structure of the target? What if you are unsure about the targets COC- what else can you do?

11. An unlevered Beta measures business risk, what does a levered beta measure? Why would one calculate an unlevered beta?

12. How do you measure the value of Equity after calculating the enterprise value with DCF?

Please Help

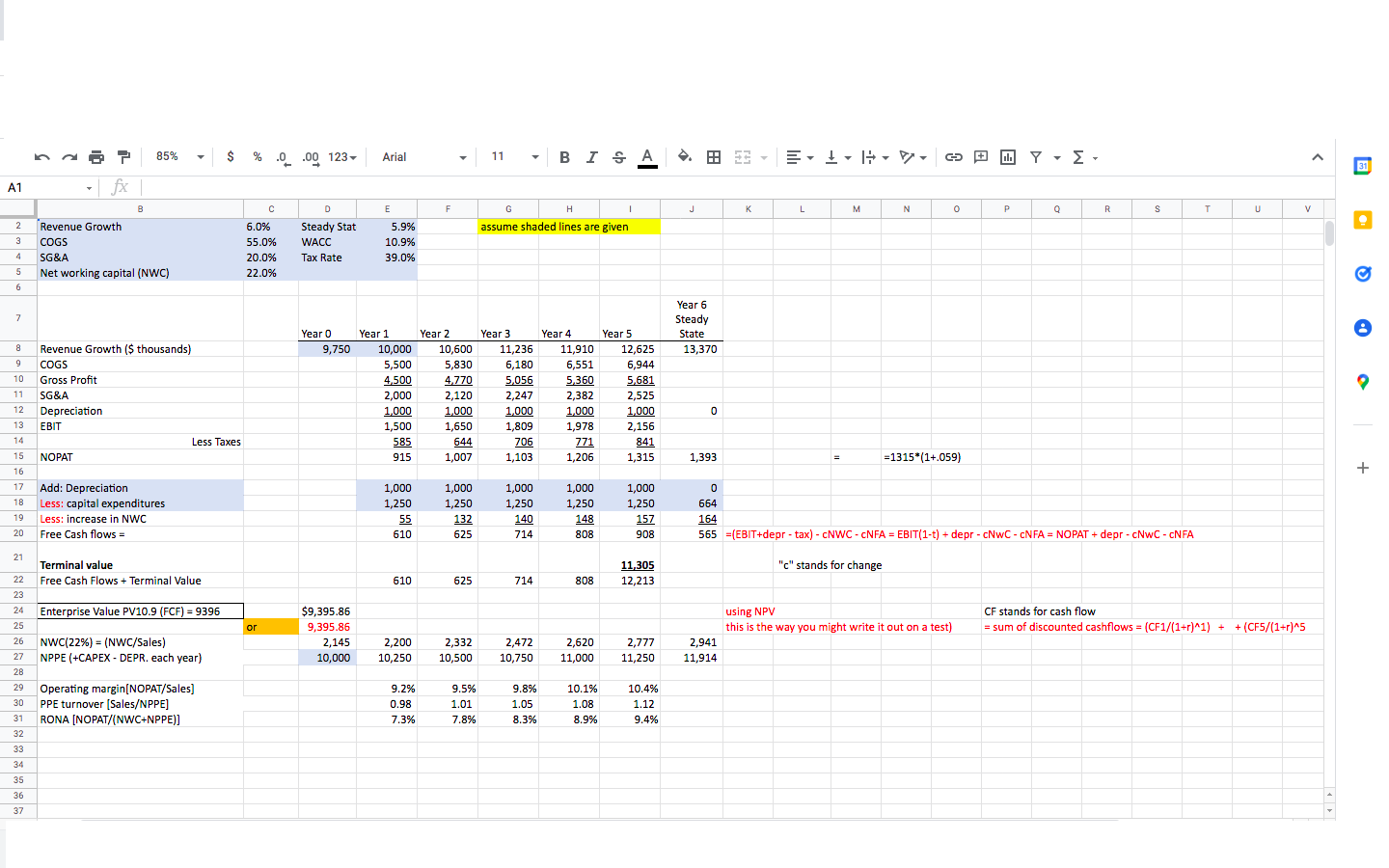

$ % 0 .00 123 .0 Arial 11 BISA - ' 1 G 1. , ^ 31 A1 F G H 1 J J L M na? 85% - fx B Revenue Growth COGS SG&A Net working capital (NWC) N O Q R S T U v 2 assume shaded lines are given 6.0% 55.0% 20.0% 22.0% D D Steady Stat WACC Tax Rate E 5.9% 10.9% 39.0% 3 4 5 6 7 Year 6 Steady State 13,370 Year o 9,750 8 9 10 11 Revenue Growth ($ thousands) COGS Gross Profit SG&A Depreciation EBIT Less Taxes NOPAT Year 1 10,000 5,500 4,500 2,000 1,000 1,500 585 915 Year 2 10,600 5,830 4,770 2,120 1,000 1,650 644 1,007 Year 3 11,236 6,180 5,056 2,247 1,000 1,809 706 1,103 Year 4 Year 5 11,910 12,625 6,551 6,944 5,360 5,681 2,382 2,525 1,000 1,000 1,978 2,156 771 841 1,206 1,315 0 12 13 14 1,393 =1315*(1+.059) 15 16 + 17 18 Add: Depreciation Less: capital expenditures Less: increase in NWC Free Cash flows = 1,000 1,250 55 610 1,000 1,250 132 625 1,000 1,250 140 714 1,000 1,250 148 808 1,000 1,250 157 908 0 o 664 164 565 =(EBIT+depr-tax) - CNWC-CNFA = EBIT(1-t) + depr - NWC-CNFA = NOPAT + depr - CNWC-CNFA 19 20 21 "c" stands for change Terminal value Free Cash Flows + Terminal Value 11,305 12,213 22 610 625 714 808 23 24 Enterprise Value PV10.9 (FCF) = 9396 using NPV this is the way you might write it out on a test) $9,395.86 9,395.86 2,145 10,000 CF stands for cash flow = sum of discounted cashflows = (CF1/(1+r)^1) + + (CF5/(1+r)^5 = ^ +^ or 25 26 27 28 NWC(22%) = (NWC/Sales) NPPE (+CAPEX - DEPR. each year) 2,200 10,250 2,332 10,500 2,472 10,750 2,620 11,000 2,777 11,250 2,941 11,914 29 30 Operating margin(NOPAT/Sales) PPE turnover (Sales/NPPE] RONA [NOPAT/(NWC+NPPE)] 9.2% 0.98 7.3% 9.5% 1.01 7.8% 9.8% 1.05 8.3% 10.1% 1.08 8.9% 10.4% 1.12 9.4% 31 32 33 34 35 36 37Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started