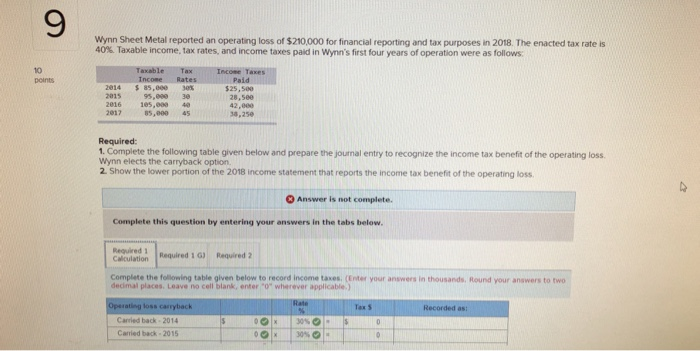

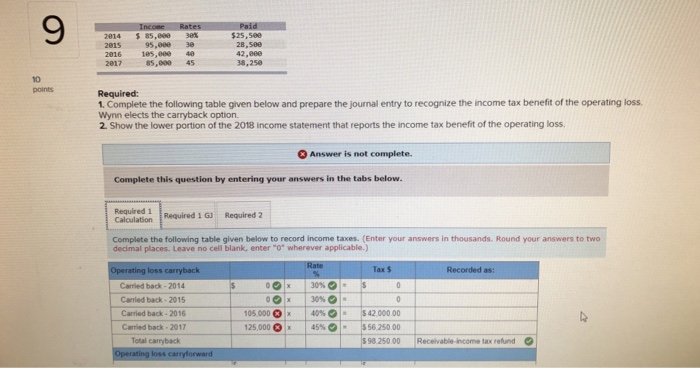

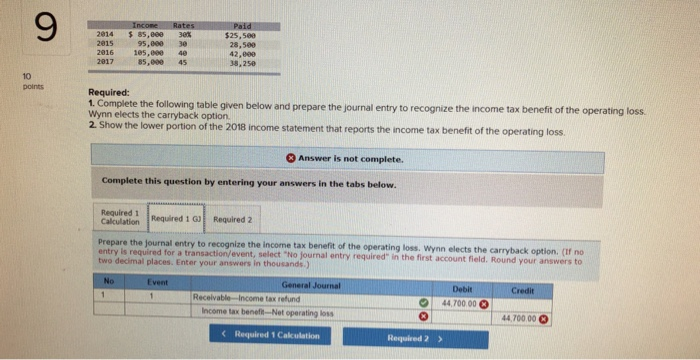

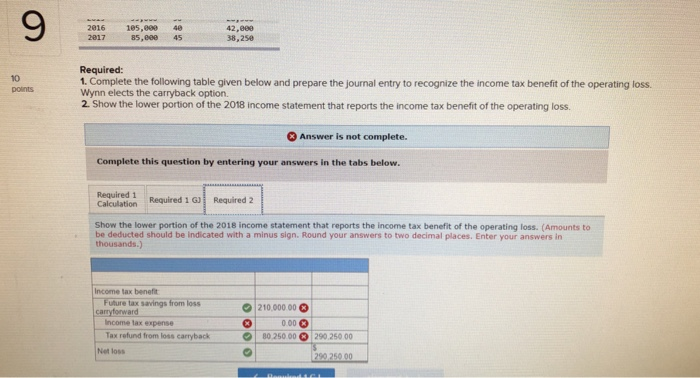

9 Wynn Sheet Metal reported an operating loss of $210,000 for financial reporting and tax purposes in 2018 The enacted tax rate is 40% Taxable income, tax rates, and income taxes paid in wynn's first four years of operation were as follows: 10 points Income 1 Taxes Paid $25,500 28,5e0 42,000 38,250 2014 $85,000 30% 2015 95,000 38 2016 165,000 40 2017 85,000 45 Required: 1. Complete the following table given below and prepare the journal entry to recognize the income tax benefit of the operating loss. Wynn elects the carryback option 2 Show the lower portion of the 2018 income statement that reports the income tax benefit of the operating loss Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 1 G) Required 2 Calculatiorn Complete the following table given below to record income taxes. (Enter your answers in thousands, fRound your answers to two decimal places. Leave no cell blank, enter 0" wherever applicable,) Carried back 201 Carried back 2015 9 2014 $85,000 36% 2015 95,0093 2016 105,006 4 2017 85,000 45 $25,se0 28,5e0 42,068 38,250 10 points Required: 1. Complete the following table given below and prepare the journal entry to recognize the income tax benefit of the operating loss Wynn elects the carryback option. 2. Show the lower portion of the 2018 income statement that reports the income tax benefit of the operating loss Answer is not complete. Complete this question by entering your answers in the tabs below Required 1 Calculation Reguired 1GJ Required 2 Complete the following table given below to record income taxes.(Enter your answers in thousands. Round your answers to two dedmal places. Leave no cell blank, enter "0" wherever applicable.) loss carryback Tax $ Carried back- 2014 Carried back 2015 Carried back -2016 Carried back 2017 Total carryback 101-30% 10500001 | 40% - 125,00001 | 45%|- |s42.000 00 |s5625000 598 250 00 Receivable-income tax refund 9 2014 $85,000 30% 201595,000 30 2016 185,000 4 281785,008 45 $25,560 28,500 42,800 38,250 10 points Required: 1. Complete the following table given below and prepare the journal entry to recognize the income tax benefit of the operating loss. Wynn elects the carryback option 2. Show the lower portion of the 2018 income statement that reports the income tax benefit of the operating loss Answer is not complete. Complete this question by entering your answers in the tabs below Required 1 Calculation Required 1G Required 2 entry is required for a transaction/event, two decimal places. Enter your answers in thousands.) to recognize the income tax benefit of the operating loss. Wynn elects the carryback option. (tf no select "No journal entry required" in the first account field. Round your answers to No General Journal Receivable-Income tax refund 44,700 00 Income tax benefit-Net operating loss 44,700 00 C Required 1 Cakulation Required 2> 9 2016 185,000 40 281785,0ee 45 42,080 38,250 Required: 10 points 1. Complete the following table given below and prepare the journal entry to recognize the income tax benefit of the operating loss Wynn elects the carryback option. 2. Show the lower portion of the 2018 income statement that reports the income tax benefit of the operating loss. 3 Answer is not complete. Complete this question by entering your answers in the tabs below Calculation Required 1 GRequired2 Show the lower portion of the 2018 income statement that reports the income tax benefit of the operating loss. (Amounts to be deducted should be indicated with a minus sign. Round your answers to two decimal places. Enter your answers in thousands) Income tax benefit Future tax savings from Income lax expense Tax refund from loss carryback 210,00000 carryforward O0 250 00 290 250 00 Net loss