Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9 You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing Your bois comes into your office, drops

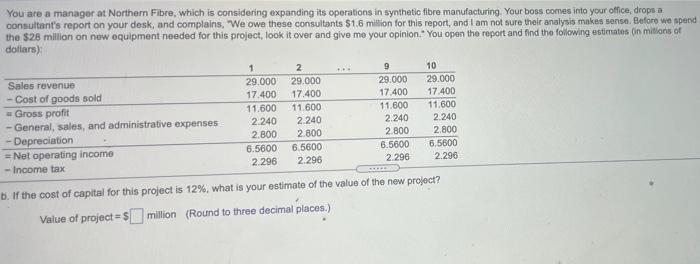

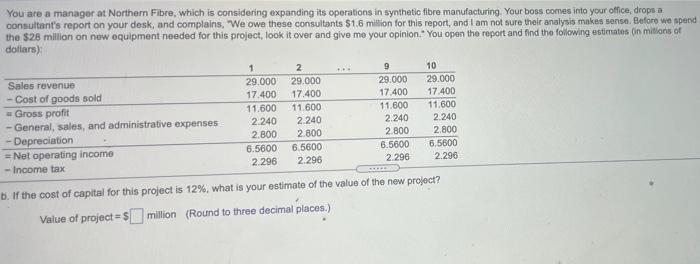

9 You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing Your bois comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.6 million for this report, and I am not sure their analysis makes sense. Before we spend the $20 million on now equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in mitions of dollars) 1 2 10 Sales revenue 29.000 29.000 29.000 29.000 - Cost of goods sold 17.400 17.400 17 400 17.400 Gross profit 11.600 11.600 11.600 11.600 -General, sales, and administrative expenses 2.240 2.240 2.240 2.240 2.800 - Depreciation 2.800 2.800 2.800 6.5600 6.5600 6.5600 = Net operating income 6.5600 2.296 2.296 2.296 - Income tax 2.296 b. If the cost of capital for this project is 12%, what is your estimate of the value of the new project? Value of project=5 million (Round to three decimal places.)

9 You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing Your bois comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.6 million for this report, and I am not sure their analysis makes sense. Before we spend the $20 million on now equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in mitions of dollars) 1 2 10 Sales revenue 29.000 29.000 29.000 29.000 - Cost of goods sold 17.400 17.400 17 400 17.400 Gross profit 11.600 11.600 11.600 11.600 -General, sales, and administrative expenses 2.240 2.240 2.240 2.240 2.800 - Depreciation 2.800 2.800 2.800 6.5600 6.5600 6.5600 = Net operating income 6.5600 2.296 2.296 2.296 - Income tax 2.296 b. If the cost of capital for this project is 12%, what is your estimate of the value of the new project? Value of project=5 million (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started