Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. You are working as a budget analyst for a company, and you have been tasked with the fixed asset analysis of the budget.

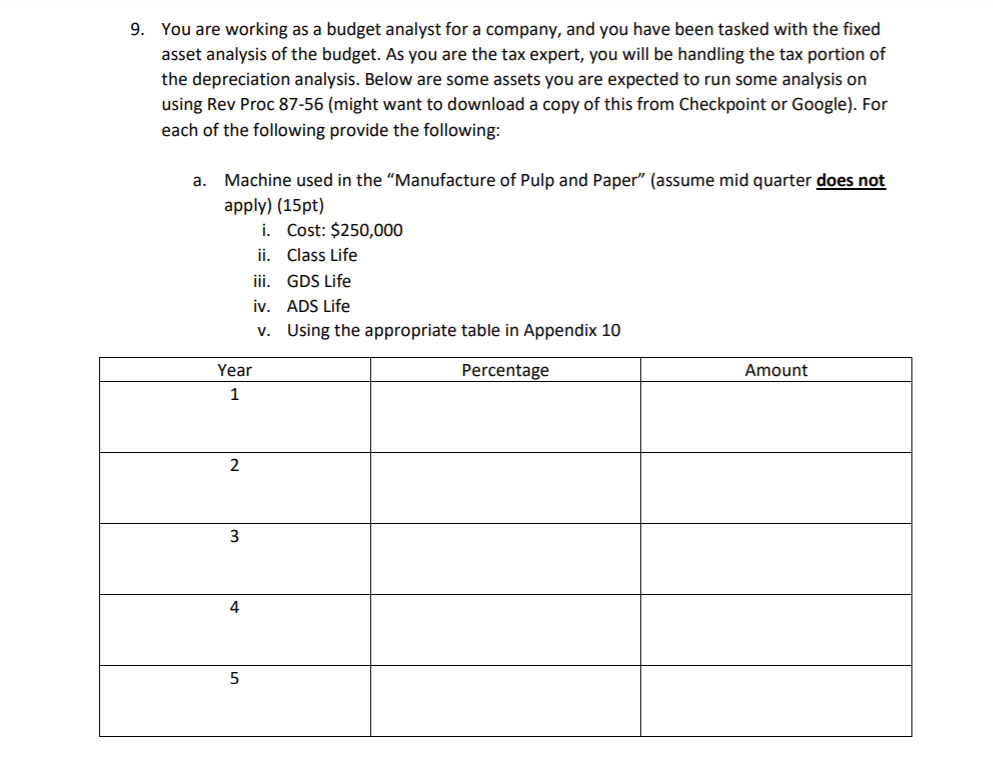

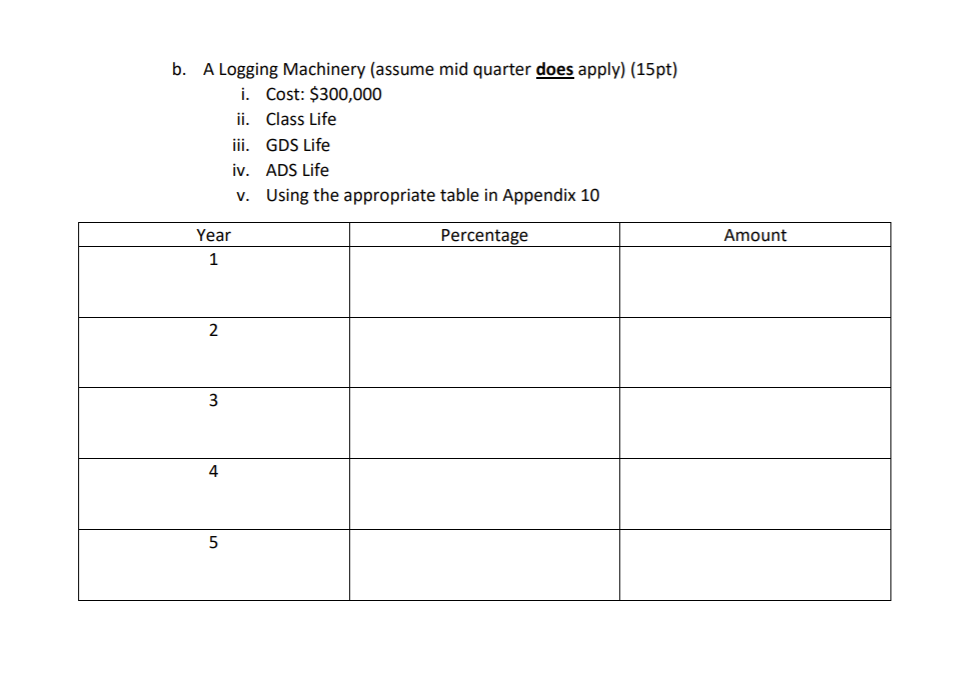

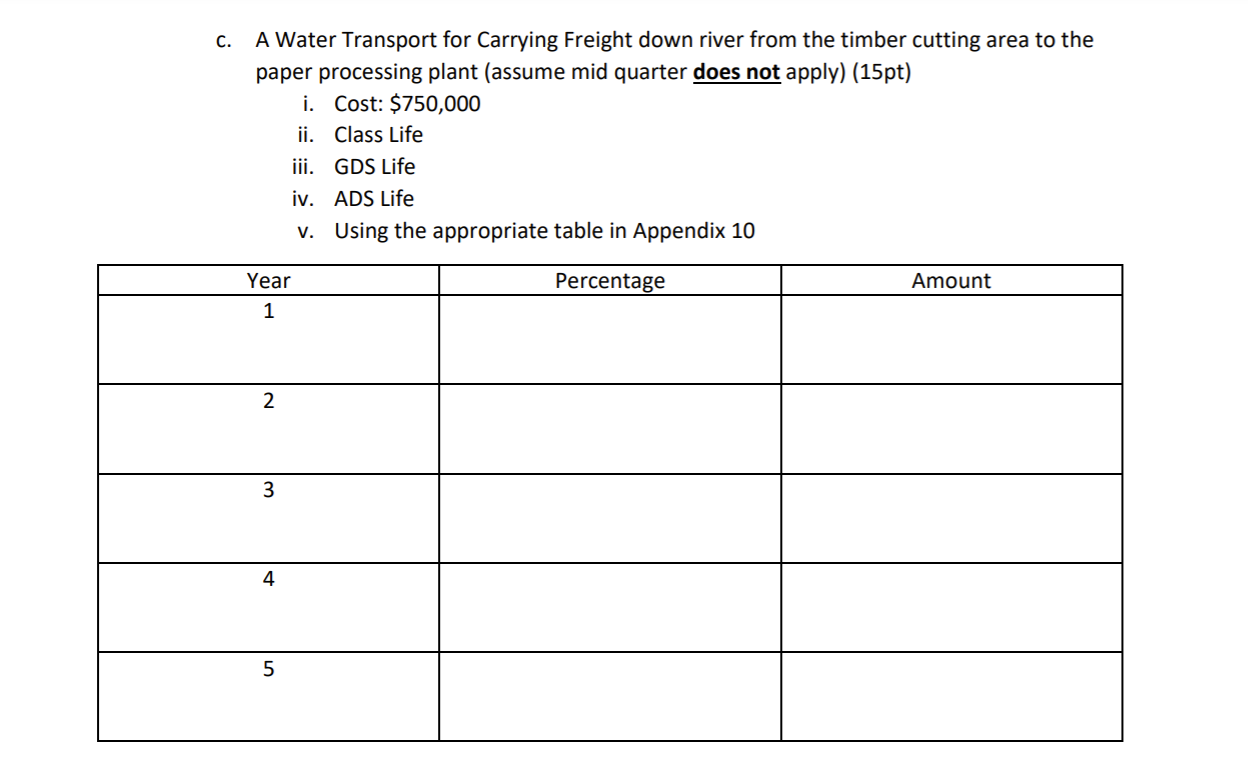

9. You are working as a budget analyst for a company, and you have been tasked with the fixed asset analysis of the budget. As you are the tax expert, you will be handling the tax portion of the depreciation analysis. Below are some assets you are expected to run some analysis on using Rev Proc 87-56 (might want to download a copy of this from Checkpoint or Google). For each of the following provide the following: a. Machine used in the "Manufacture of Pulp and Paper" (assume mid quarter does not apply) (15pt) Cost: $250,000 Class Life Year 1 2 3 4 i. ii. iii. iv. v. Using the appropriate table in Appendix 10 Percentage 5 GDS Life ADS Life Amount b. A Logging Machinery (assume mid quarter does apply) (15pt) i. Cost: $300,000 ii. Class Life Year 1 2 3 4 5 iii. GDS Life iv. ADS Life v. Using the appropriate table in Appendix 10 Percentage Amount C. A Water Transport for Carrying Freight down river from the timber cutting area to the paper processing plant (assume mid quarter does not apply) (15pt) i. Cost: $750,000 ii. Class Life iii. GDS Life iv. ADS Life v. Year 1 2 3 4 5 Using the appropriate table in Appendix 10 Percentage Amount 9. You are working as a budget analyst for a company, and you have been tasked with the fixed asset analysis of the budget. As you are the tax expert, you will be handling the tax portion of the depreciation analysis. Below are some assets you are expected to run some analysis on using Rev Proc 87-56 (might want to download a copy of this from Checkpoint or Google). For each of the following provide the following: a. Machine used in the "Manufacture of Pulp and Paper" (assume mid quarter does not apply) (15pt) Cost: $250,000 Class Life Year 1 2 3 4 i. ii. iii. iv. v. Using the appropriate table in Appendix 10 Percentage 5 GDS Life ADS Life Amount b. A Logging Machinery (assume mid quarter does apply) (15pt) i. Cost: $300,000 ii. Class Life Year 1 2 3 4 5 iii. GDS Life iv. ADS Life v. Using the appropriate table in Appendix 10 Percentage Amount C. A Water Transport for Carrying Freight down river from the timber cutting area to the paper processing plant (assume mid quarter does not apply) (15pt) i. Cost: $750,000 ii. Class Life iii. GDS Life iv. ADS Life v. Year 1 2 3 4 5 Using the appropriate table in Appendix 10 Percentage Amount 9. You are working as a budget analyst for a company, and you have been tasked with the fixed asset analysis of the budget. As you are the tax expert, you will be handling the tax portion of the depreciation analysis. Below are some assets you are expected to run some analysis on using Rev Proc 87-56 (might want to download a copy of this from Checkpoint or Google). For each of the following provide the following: a. Machine used in the "Manufacture of Pulp and Paper" (assume mid quarter does not apply) (15pt) Cost: $250,000 Class Life Year 1 2 3 4 i. ii. iii. iv. v. Using the appropriate table in Appendix 10 Percentage 5 GDS Life ADS Life Amount b. A Logging Machinery (assume mid quarter does apply) (15pt) i. Cost: $300,000 ii. Class Life Year 1 2 3 4 5 iii. GDS Life iv. ADS Life v. Using the appropriate table in Appendix 10 Percentage Amount C. A Water Transport for Carrying Freight down river from the timber cutting area to the paper processing plant (assume mid quarter does not apply) (15pt) i. Cost: $750,000 ii. Class Life iii. GDS Life iv. ADS Life v. Year 1 2 3 4 5 Using the appropriate table in Appendix 10 Percentage Amount

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Machine used in the Manufacture of Pulp and Paper i Cost 250000 ii Class Life 13 years iii GDS Life 7 years iv ADS Life 13 years v Depreciation using the appropriate table in Appendix 10 Year Percen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started