Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. You own 5% of the shares in a company that is financed with 80% equity and 20% debt. Like Millennium Motors, the company generates

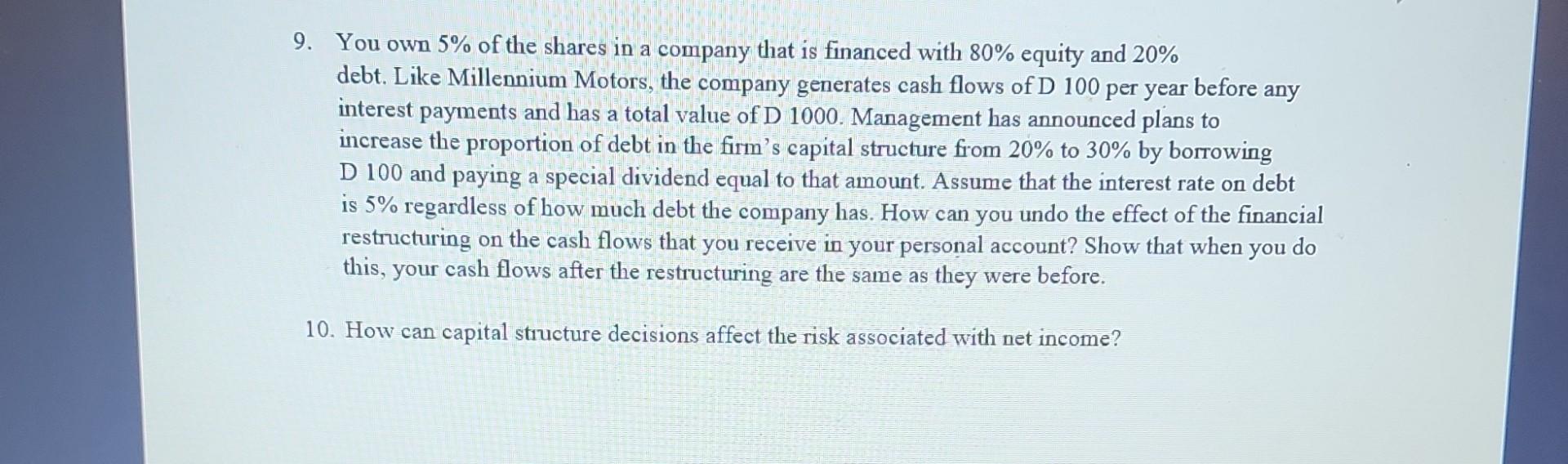

9. You own 5% of the shares in a company that is financed with 80% equity and 20% debt. Like Millennium Motors, the company generates cash flows of D 100 per year before any interest payments and has a total value of D 1000. Management has announced plans to increase the proportion of debt in the firm's capital structure from 20% to 30% by borrowing D 100 and paying a special dividend equal to that amount. Assume that the interest rate on debt is 5% regardless of how much debt the company has. How can you undo the effect of the financial restructuring on the cash flows that you receive in your personal account? Show that when you do this, your cash flows after the restructuring are the same as they were before. 10. How can capital structure decisions affect the risk associated with net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started