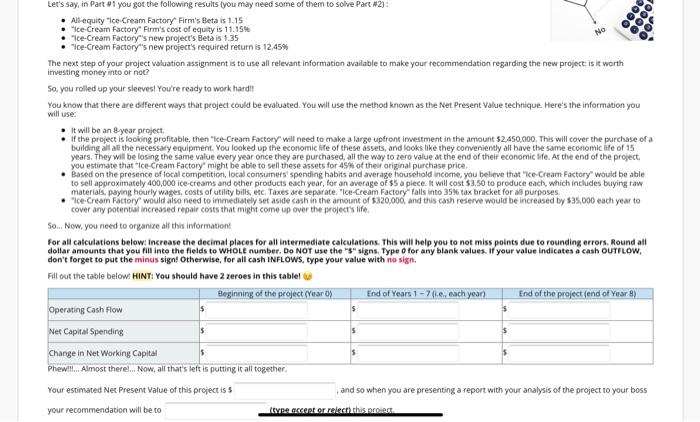

9000 No Let's say, in Part 1 you got the following results you may need some of them to solve Part 2): . Al-equity Ice-Cream Factory Firm's Beta is 1.15 Ice-Cream Factory Firm's cost of equity is 11.15% "Ice-Cream Factory's new project's Beta is 1.35 "Ice-Cream Factory's new project's required return is 12.45% The next step of your project valuation assignment is to use all relevant information available to make your recommendation regarding the new project is it worth So, you rolled up your sleeves! You're ready to work hardi You know that there are different ways that project could be evaluated. You will use the method known as the Net Present Value technique. Here's the information you will use: It will be an 8 year project . If the project is looking profitable, then "ice-Cream Factory' will need to make a large upfront investment in the amount 52,450,000. This will cover the purchase of a building all all the necessary equipment. You looked up the economic life of these assets, and looks like they conveniently all have the same economic life of 15 years. They will be losing the same value every year once they are purchased, all the way to zero value at the end of their economic life. At the end of the project you estimate that "Ice-Cream Factory might be able to sell these assets for 45% of their original purchase price . Based on the presence of local competition, local consumers' spending habits and average household income, you believe that "Ice-Cream Factory would be able to sell approximately 400,000 ice-creams and other products each year, for an average of $5 a plece. It will cost $3.50 to produce each, which includes buying raw . ce-Cream Factory would also need to immediately set aside cash in the amount of 8320,000, and this cash reserve would be increased by $25,000 each year to cover any potential increased repair costs that might come up over the project's life So.. Now, you need to organize all this information For all calculations below. Increase the decimal places for all intermediate calculations. This will help you to not miss points due to rounding errors. Round all dollar amounts that you fill into the fields to WHOLE number. Do NOT use the "S" signs. Type O for any blank values. If your value indicates a cash OUTFLOW, don't forget to put the minus sign! Otherwise, for all cash INFLOWS, type your value with no sign. Fill out the table below. HINT: You should have 2 zeroes in this tablet Beginning of the project (Year) End of Years 1 - 7(., each year) End of the project(end of Year 8) Operating Cash Flow Net Capital Spending 5 Change in Net Working Capital Phewil... Almost there... Now, all that's left is putting it all together. Your estimated Net Present Value of this project is and so when you are presenting a report with your analysis of the project to your boss $ your recommendation will be to De accept or relect this