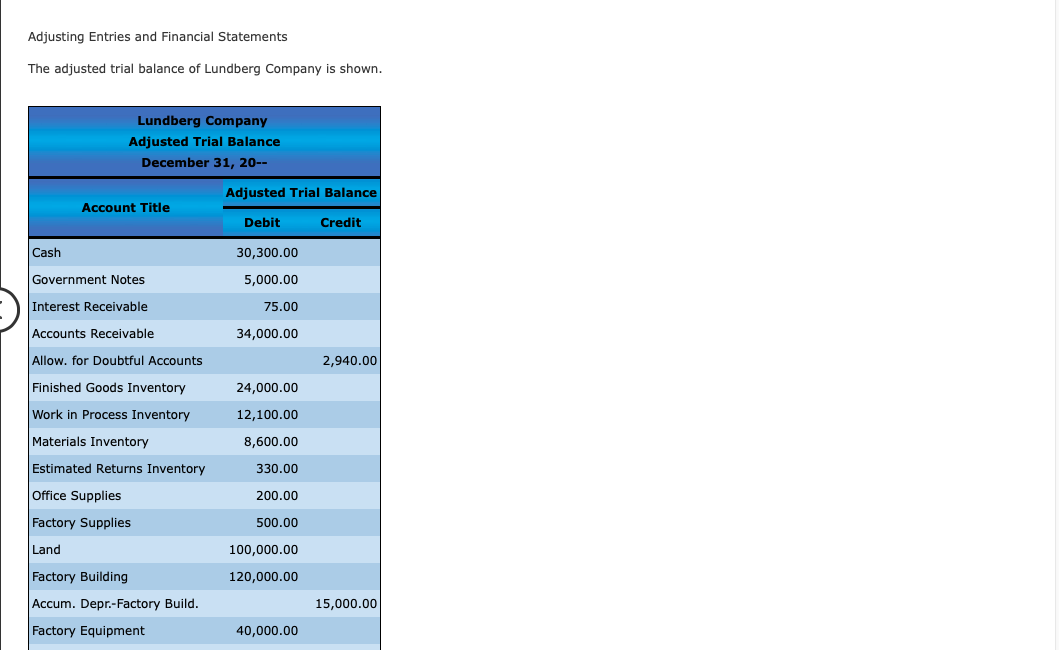

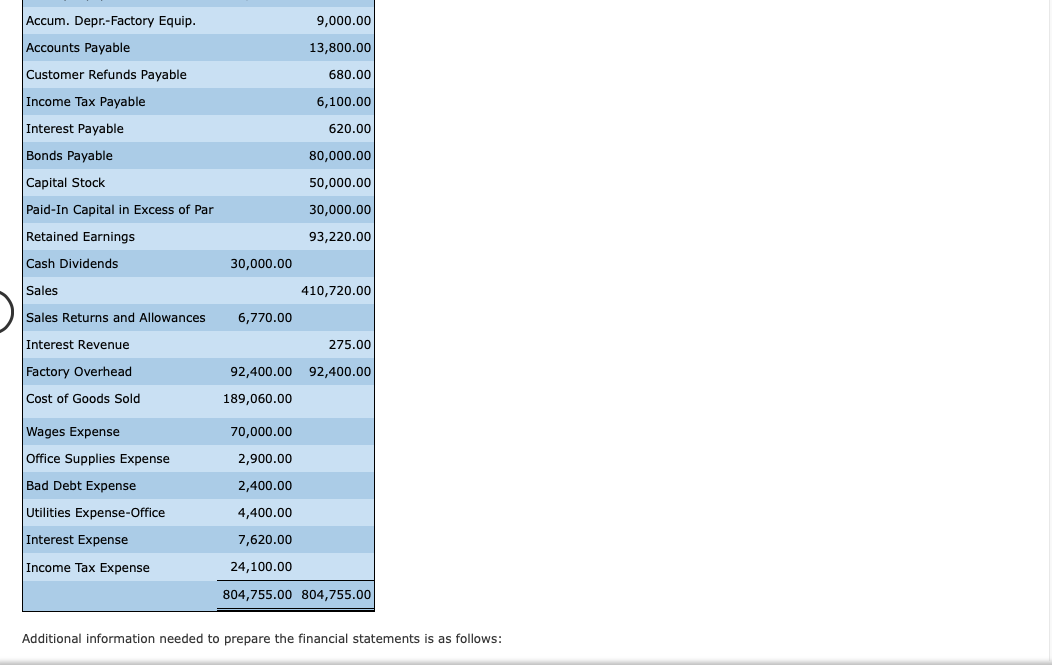

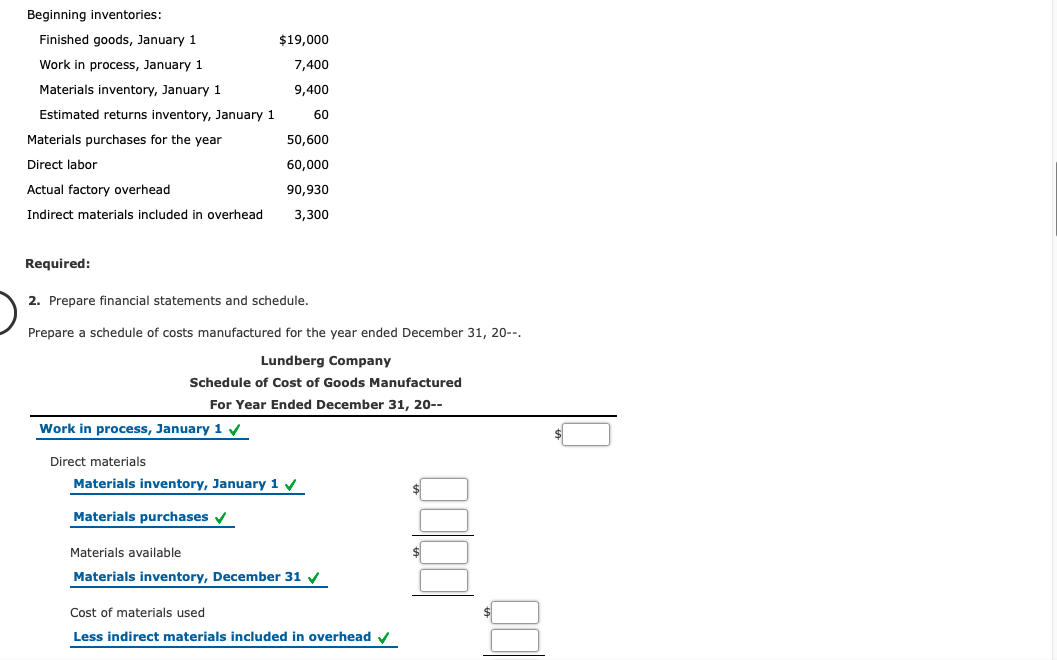

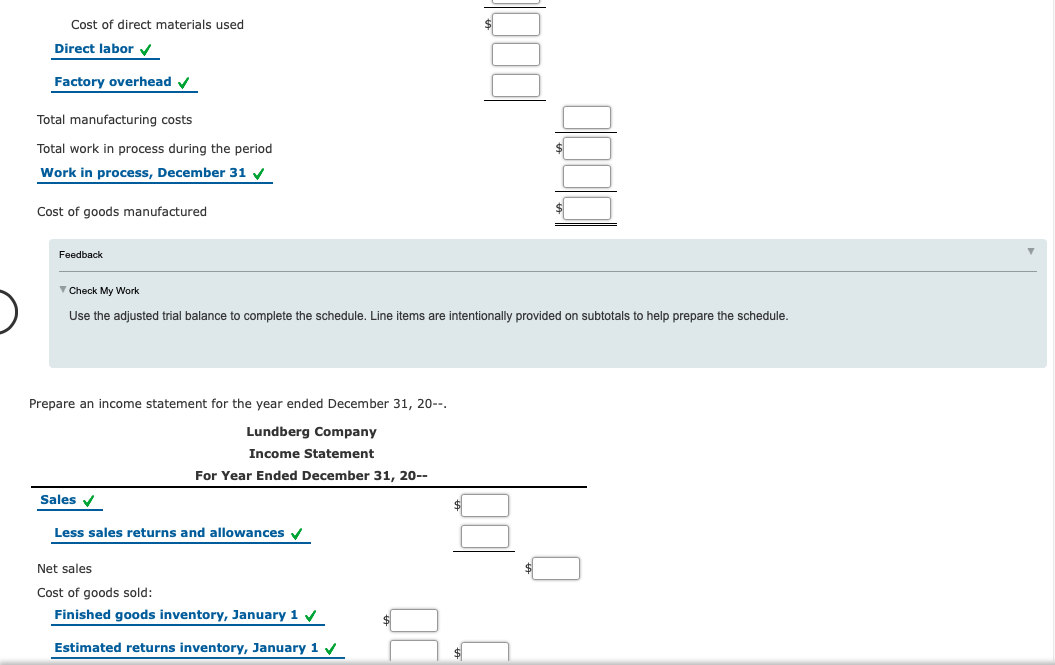

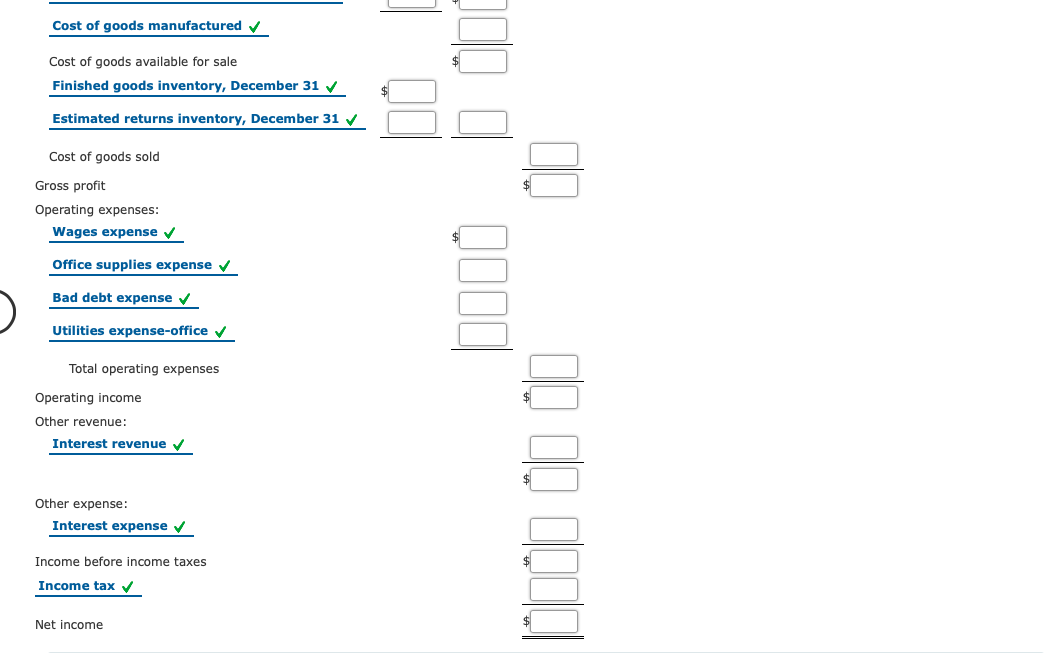

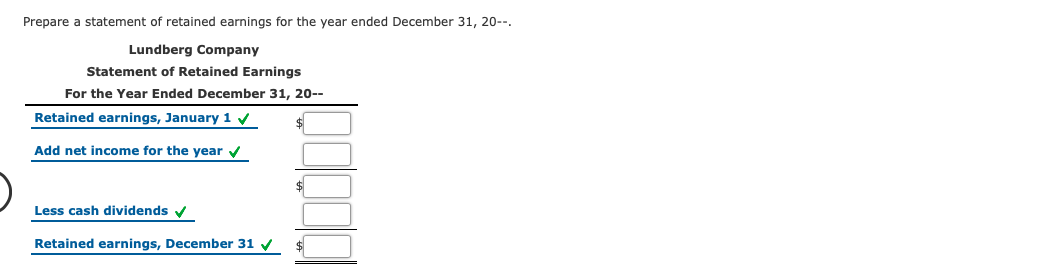

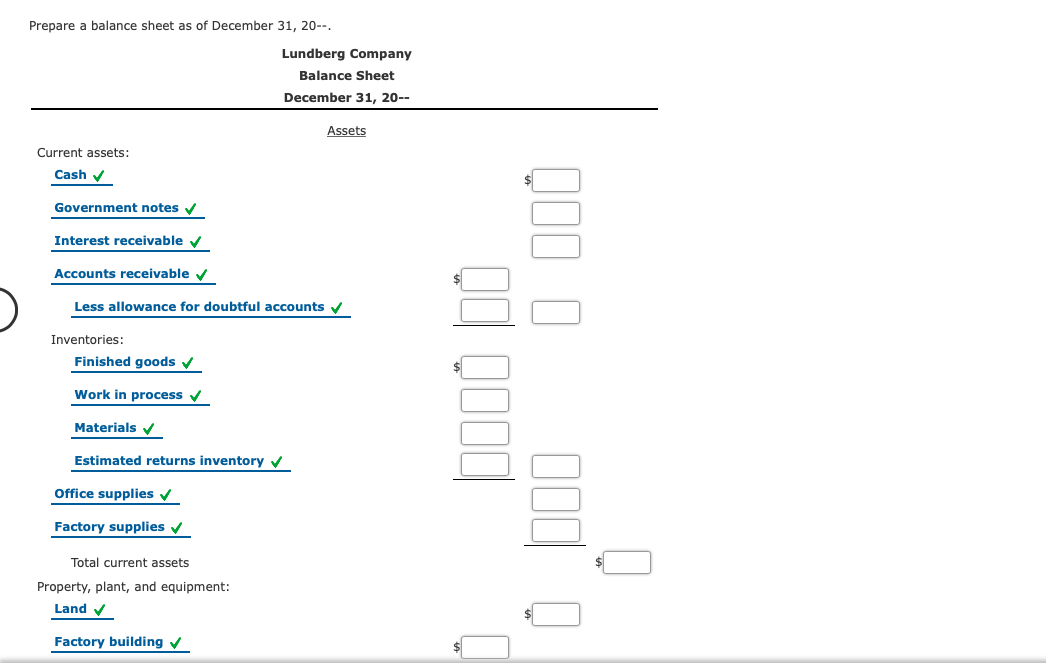

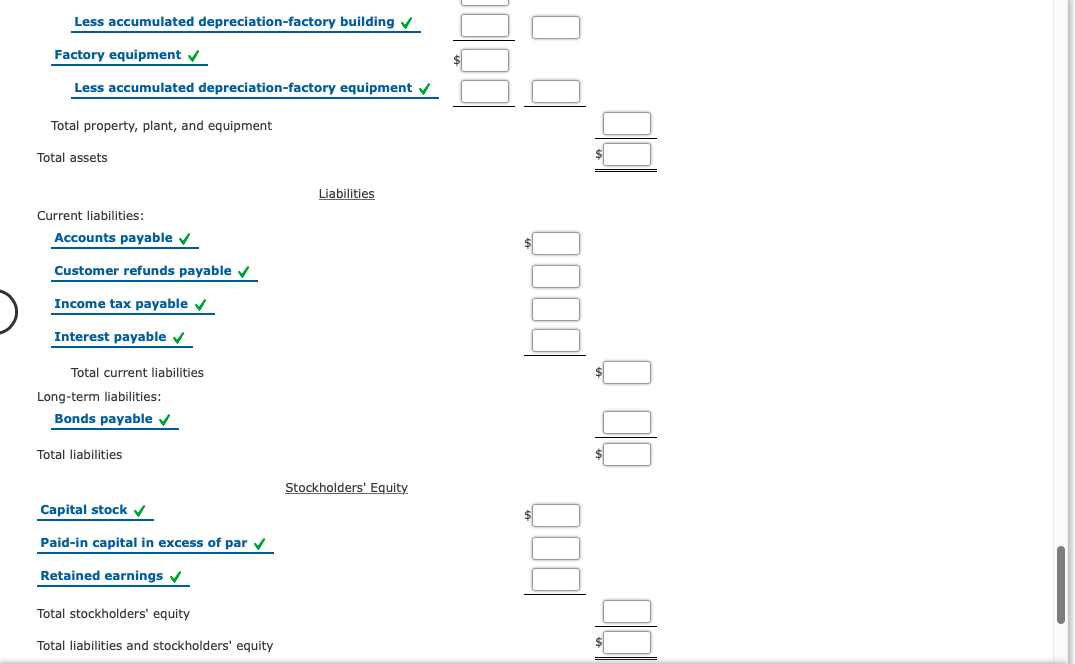

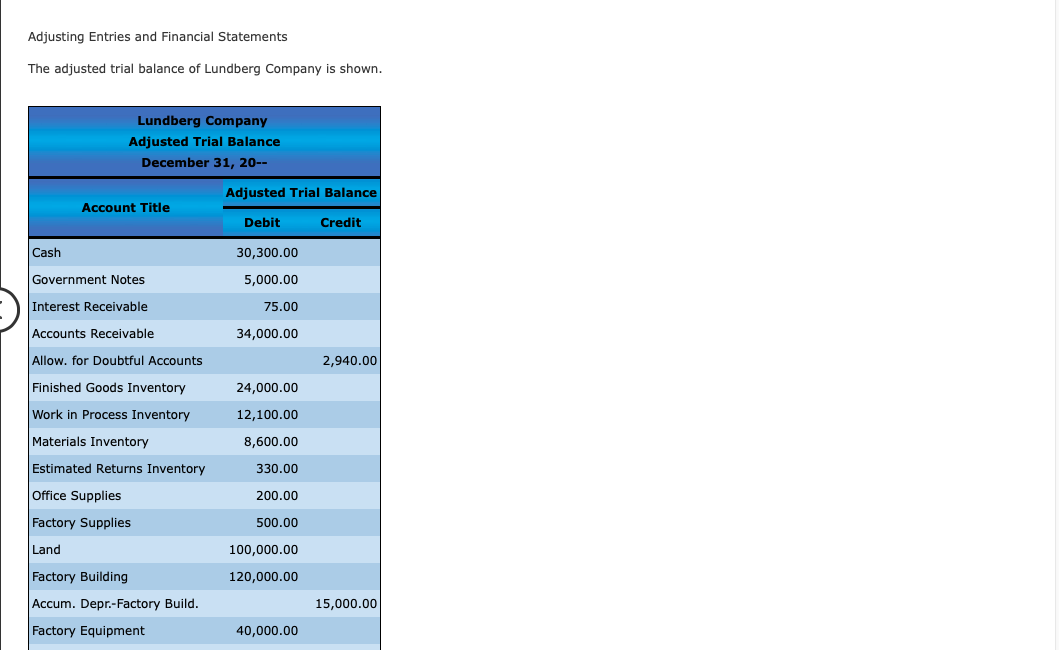

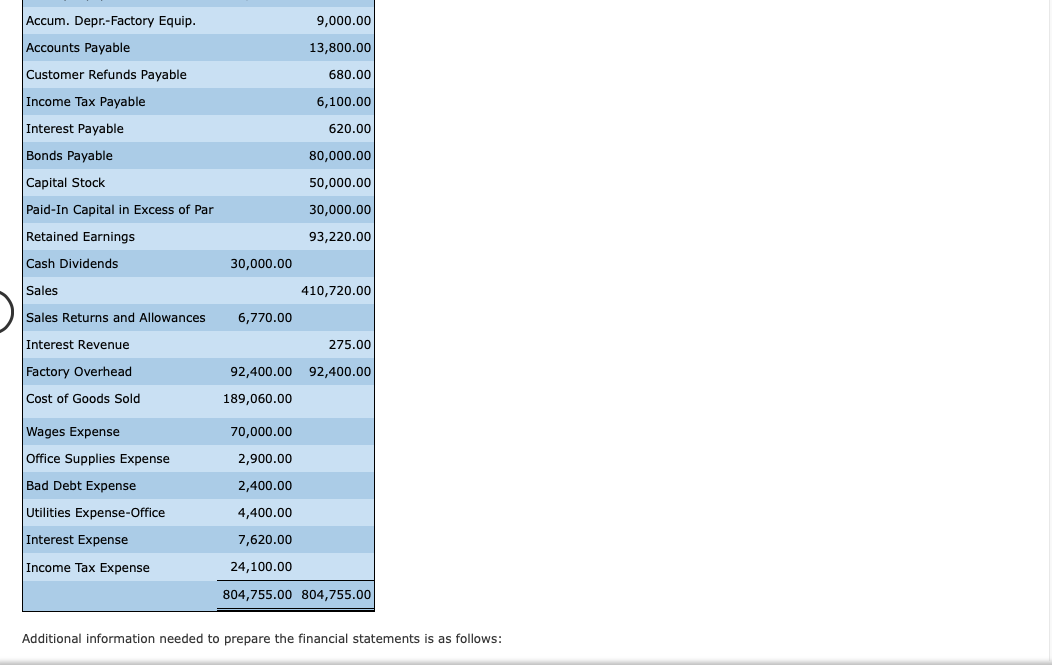

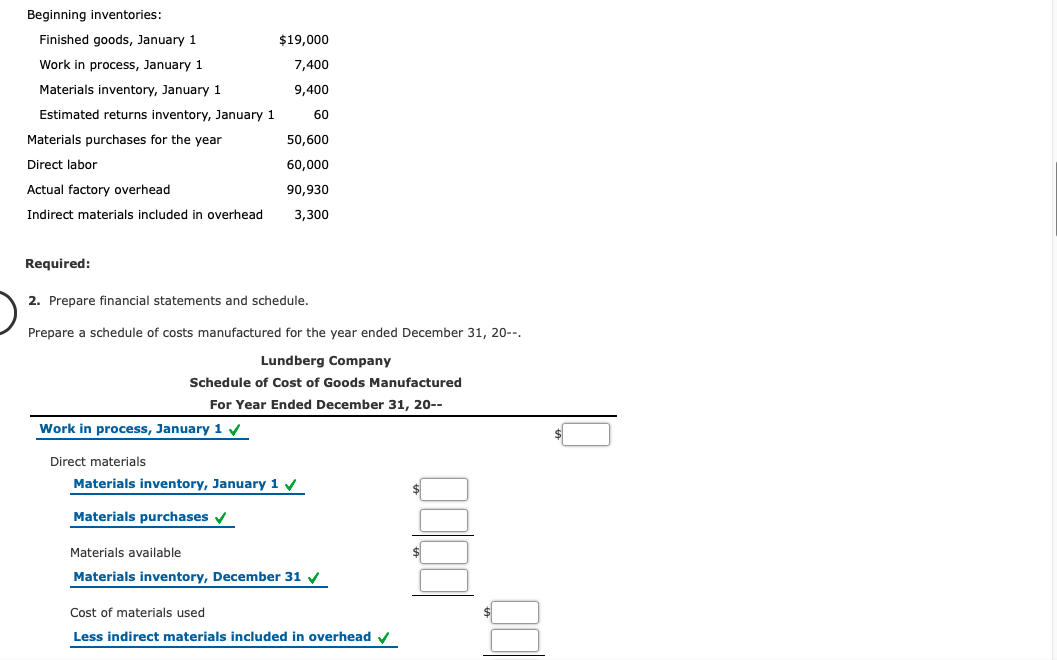

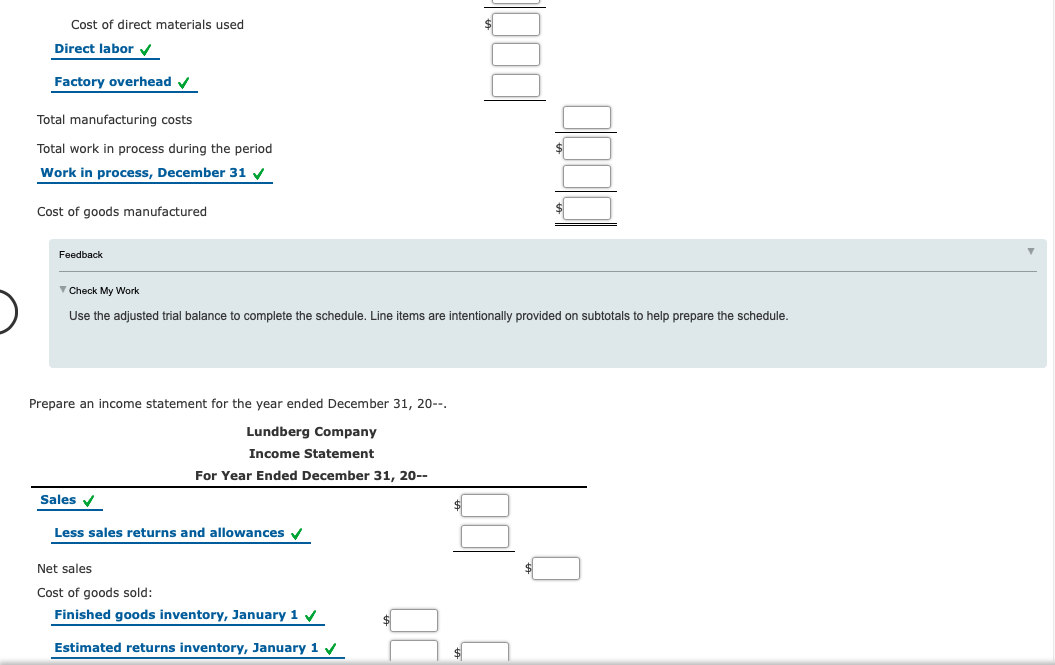

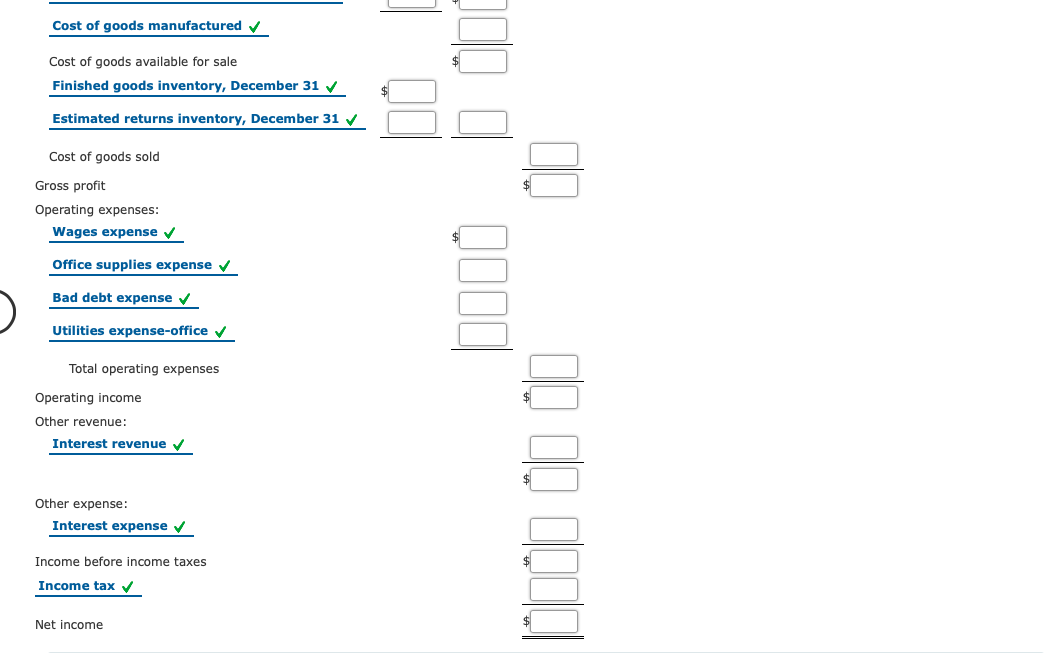

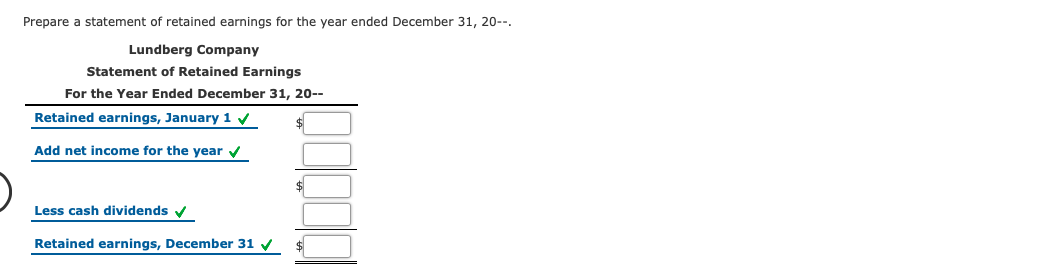

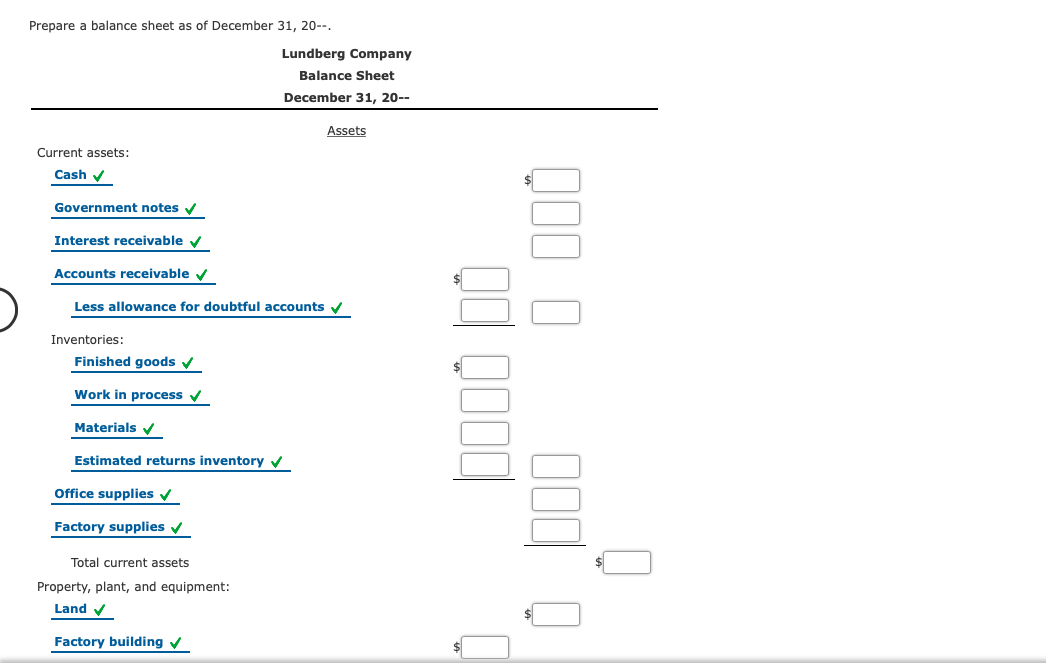

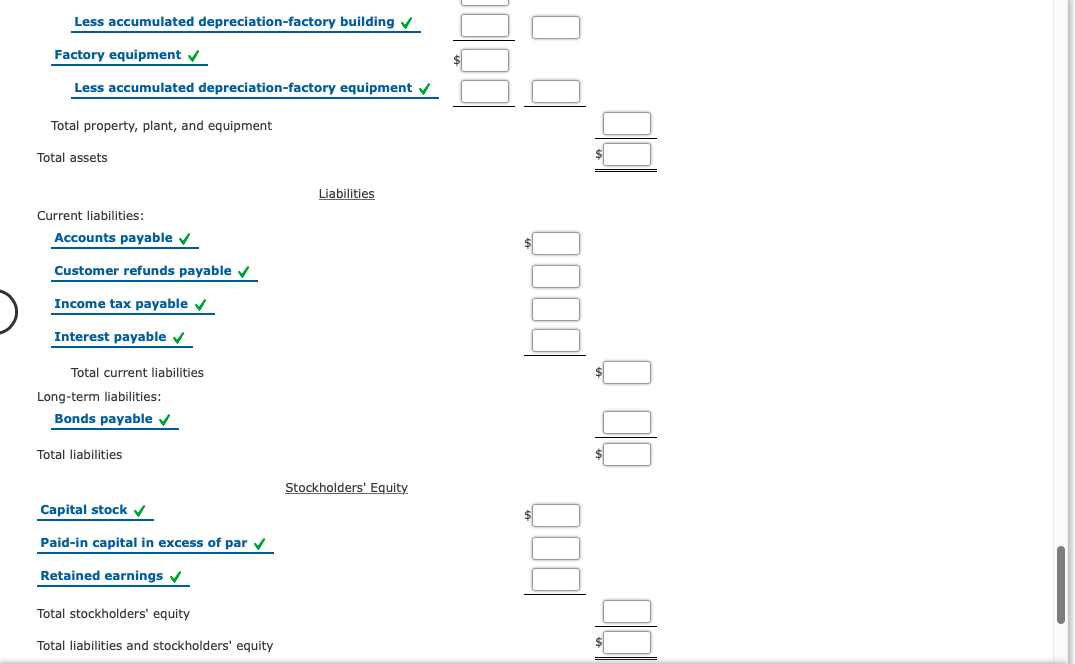

9,000.00 Accum. Depr.-Factory Equip. Accounts Payable 13,800.00 Customer Refunds Payable 680.00 Income Tax Payable 6,100.00 Interest Payable 620.00 Bonds Payable 80,000.00 Capital Stock 50,000.00 Paid-In Capital in Excess of Par 30,000.00 Retained Earnings 93,220.00 Cash Dividends 30,000.00 Sales 410,720.00 Sales Returns and Allowances 6,770.00 Interest Revenue 275.00 Factory Overhead 92,400.00 92,400.00 Cost of Goods Sold 189,060.00 70,000.00 Wages Expense Office Supplies Expense 2,900.00 Bad Debt Expense 2,400.00 Utilities Expense-Office 4,400.00 Interest Expense 7,620.00 Income Tax Expense 24,100.00 804,755.00 804,755.00 Additional information needed to prepare the financial statements is as follows: $19,000 Beginning inventories: Finished goods, January 1 Work in process, January 1 Materials inventory, January 1 7,400 9,400 Estimated returns inventory, January 1 60 Materials purchases for the year 50,600 Direct labor 60,000 90,930 Actual factory overhead Indirect materials included in overhead 3,300 Required: 2. Prepare financial statements and schedule. Prepare a schedule of costs manufactured for the year ended December 31, 20--. Lundberg Company Schedule of Cost of Goods Manufactured For Year Ended December 31, 20-- Work in process, January 1 Direct materials Materials inventory, January 1 Materials purchases Materials available $ Materials inventory, December 31 Cost of materials used Less indirect materials included in overhead $ Cost of direct materials used Direct labor Factory overhead Total manufacturing costs Total work in process during the period Work in process, December 31 Cost of goods manufactured Feedback Check My Work Use the adjusted trial balance to complete the schedule. Line items are intentionally provided on subtotals to help prepare the schedule. Prepare an income statement for the year ended December 31, 20--. Lundberg Company Income Statement For Year Ended December 31, 20-- Sales $ Less sales returns and allowances Net sales Cost of goods sold: Finished goods inventory, January 1 Estimated returns inventory, January 1 Cost of goods manufactured Cost of goods available for sale Finished goods inventory, December 31 Estimated returns inventory, December 31 Cost of goods sold Gross profit Operating expenses: Wages expense Office supplies expense Bad debt expense Utilities expense-office Total operating expenses Operating income Other revenue: Interest revenue $ Other expense: Interest expense 00 00 000, Income before income taxes $ Income tax Net income Prepare a statement of retained earnings for the year ended December 31, 20--. Lundberg Company Statement of Retained Earnings For the Year Ended December 31, 20-- Retained earnings, January 1 $ Add net income for the year $ Less cash dividends Retained earnings, December 31 Prepare a balance sheet as of December 31, 20- Lundberg Company Balance Sheet December 31, 20-- Assets Current assets: Cash Government notes Interest receivable Accounts receivable Less allowance for doubtful accounts Inventories: Finished goods od Qull Work in process Materials Estimated returns inventory Office supplies Factory supplies O Total current assets Property, plant, and equipment: Land Factory building Less accumulated depreciation-factory building Factory equipment $ Less accumulated depreciation-factory equipment Total property, plant, and equipment Total assets $ Liabilities Current liabilities: Accounts payable Customer refunds payable Income tax payable Interest payable Total current liabilities Long-term liabilities: Bonds payable Total liabilities Stockholders' Equity Capital stock Paid-in capital in excess of par Retained earnings Total stockholders' equity 00 Total liabilities and stockholders' equity