Answered step by step

Verified Expert Solution

Question

1 Approved Answer

910 I need 200% perfect answer of both parts. Please please give answer in less than 30 minutes. Just give perfect answer. No explanation needed.

910 I need 200% perfect answer of both parts. Please please give answer in less than 30 minutes. Just give perfect answer. No explanation needed. I will give positive rating.

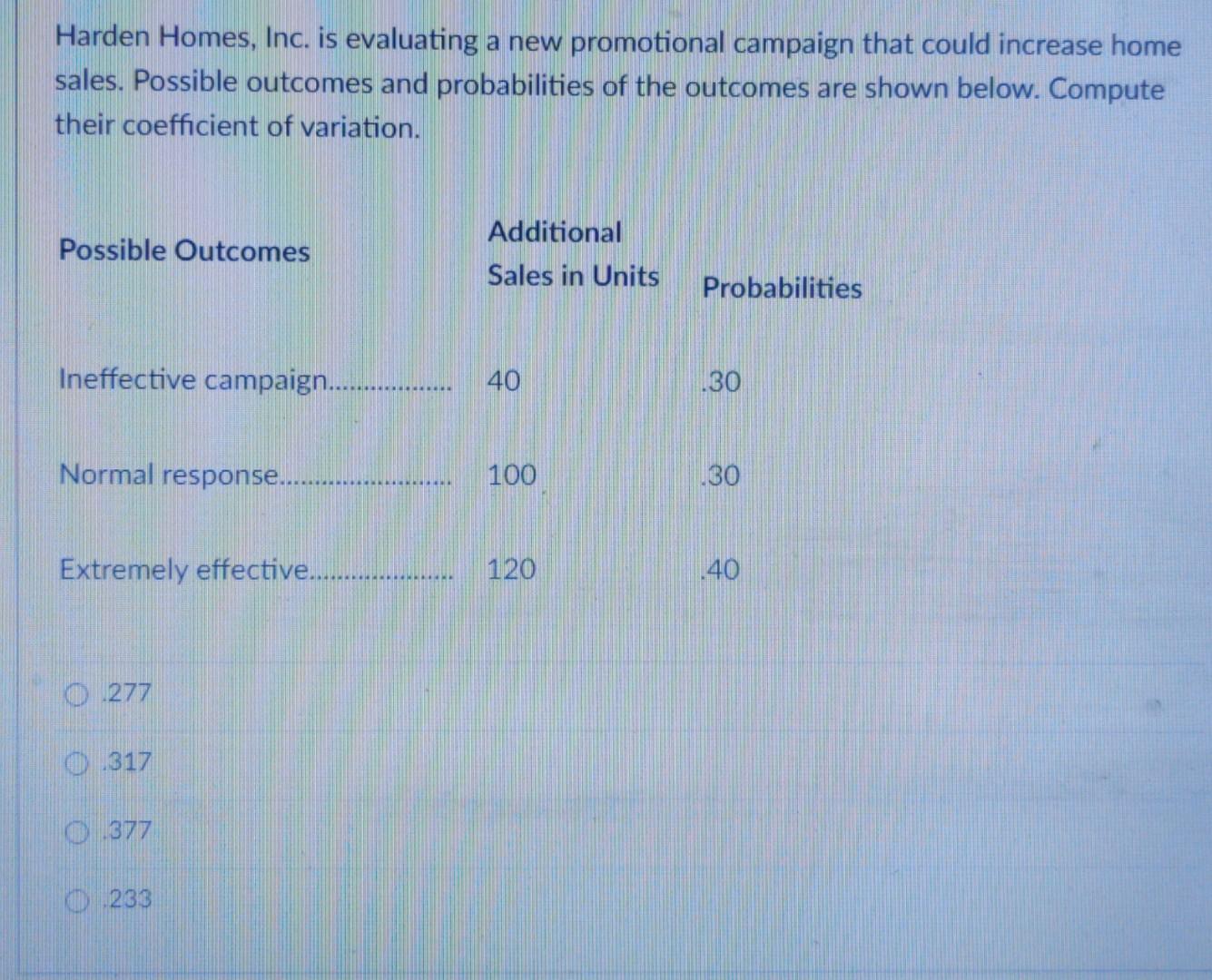

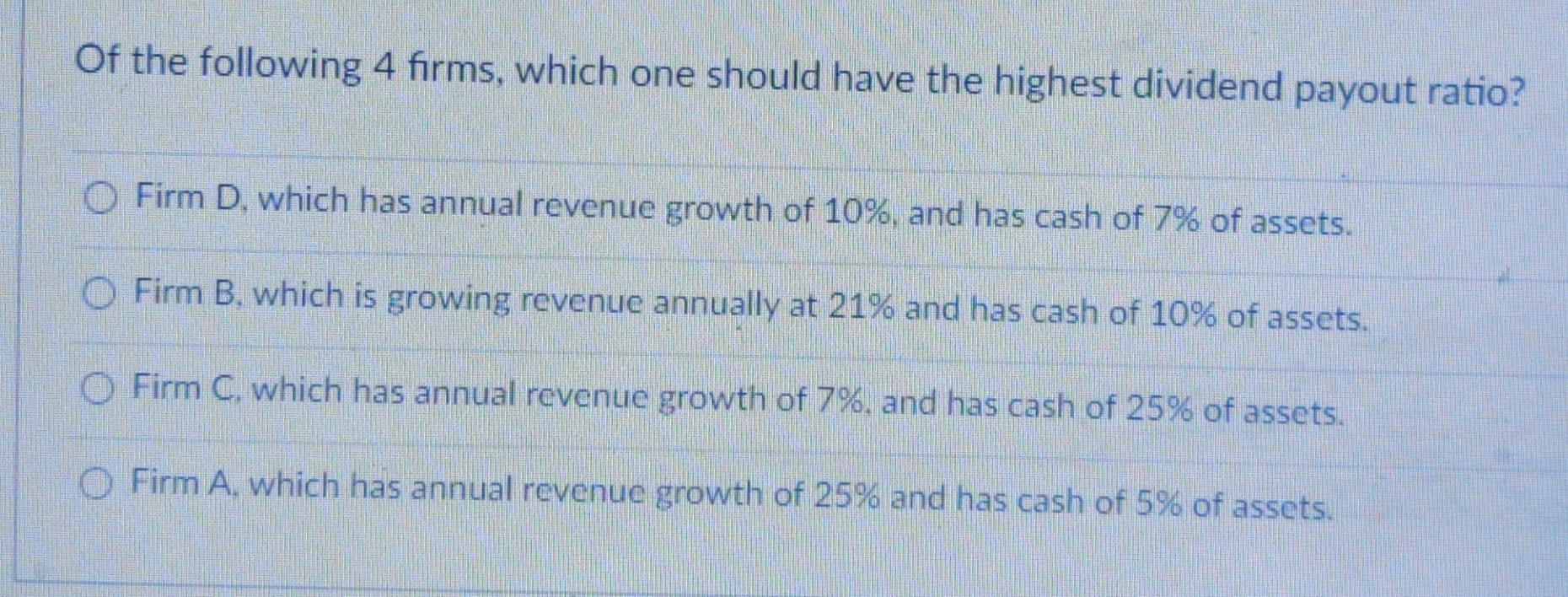

Harden Homes, Inc. is evaluating a new promotional campaign that could increase home sales. Possible outcomes and probabilities of the outcomes are shown below. Compute their coefficient of variation. Possible Outcomes Additional Sales in Units Probabilities Ineffective campaign............. ... 40 .30 Normal response... 100 130 Extremely effective. 120 40 0277 0 317 377 D233 Of the following 4 firms, which one should have the highest dividend payout ratio? O Firm D, which has annual revenue growth of 10%, and has cash of 7% of assets. Firm B. which is growing revenue annually at 21% and has cash of 10% of assets. O Firm C. which has annual revenue growth of 7%, and has cash of 25% of assets. Firm A. which has annual revenue growth of 25% and has cash of 5% of assetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started