Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9&10 will upvote Which of the following statements is incorrect? All the answers are correct except one. To generate a forecast based on the trend,

9&10 will upvote

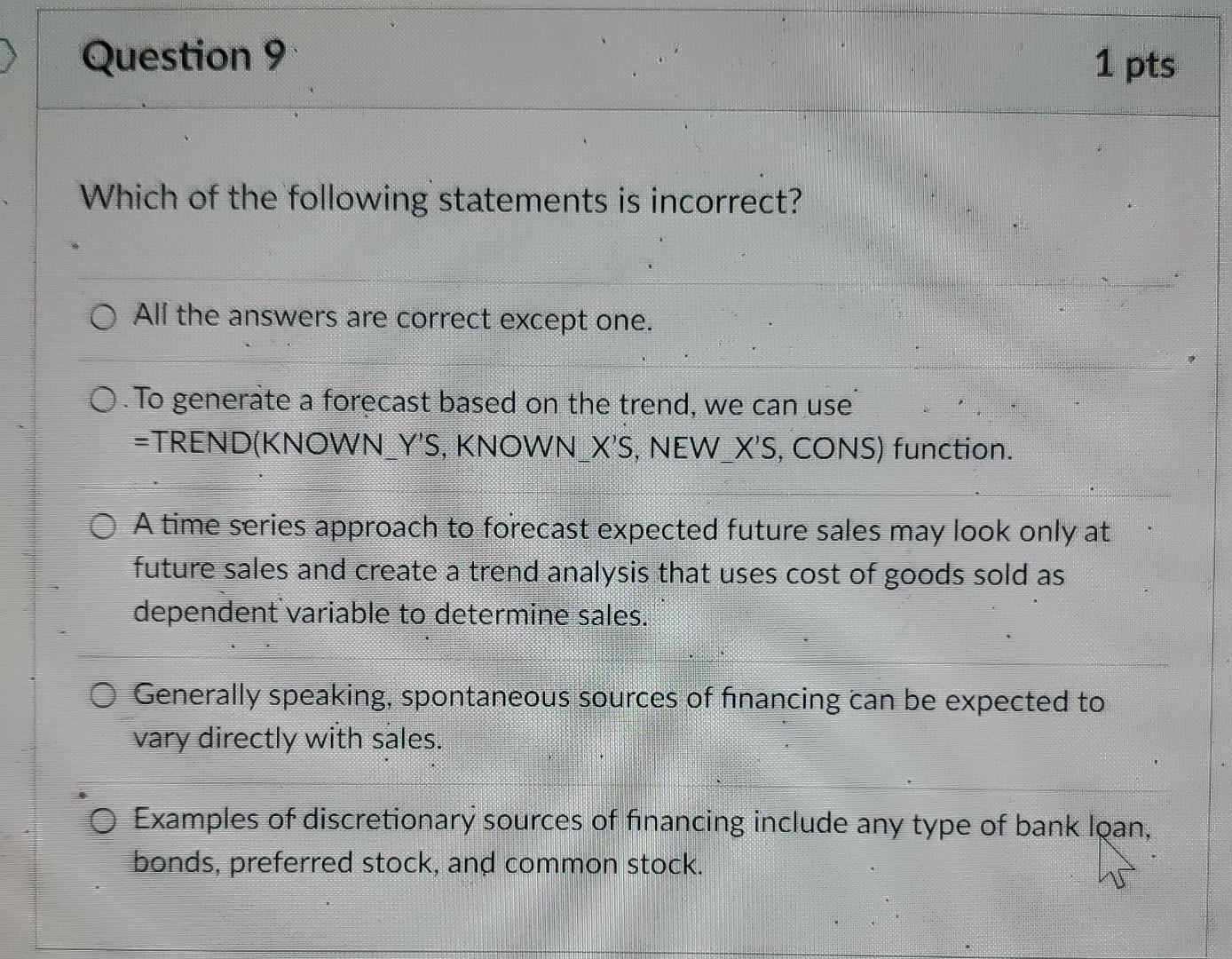

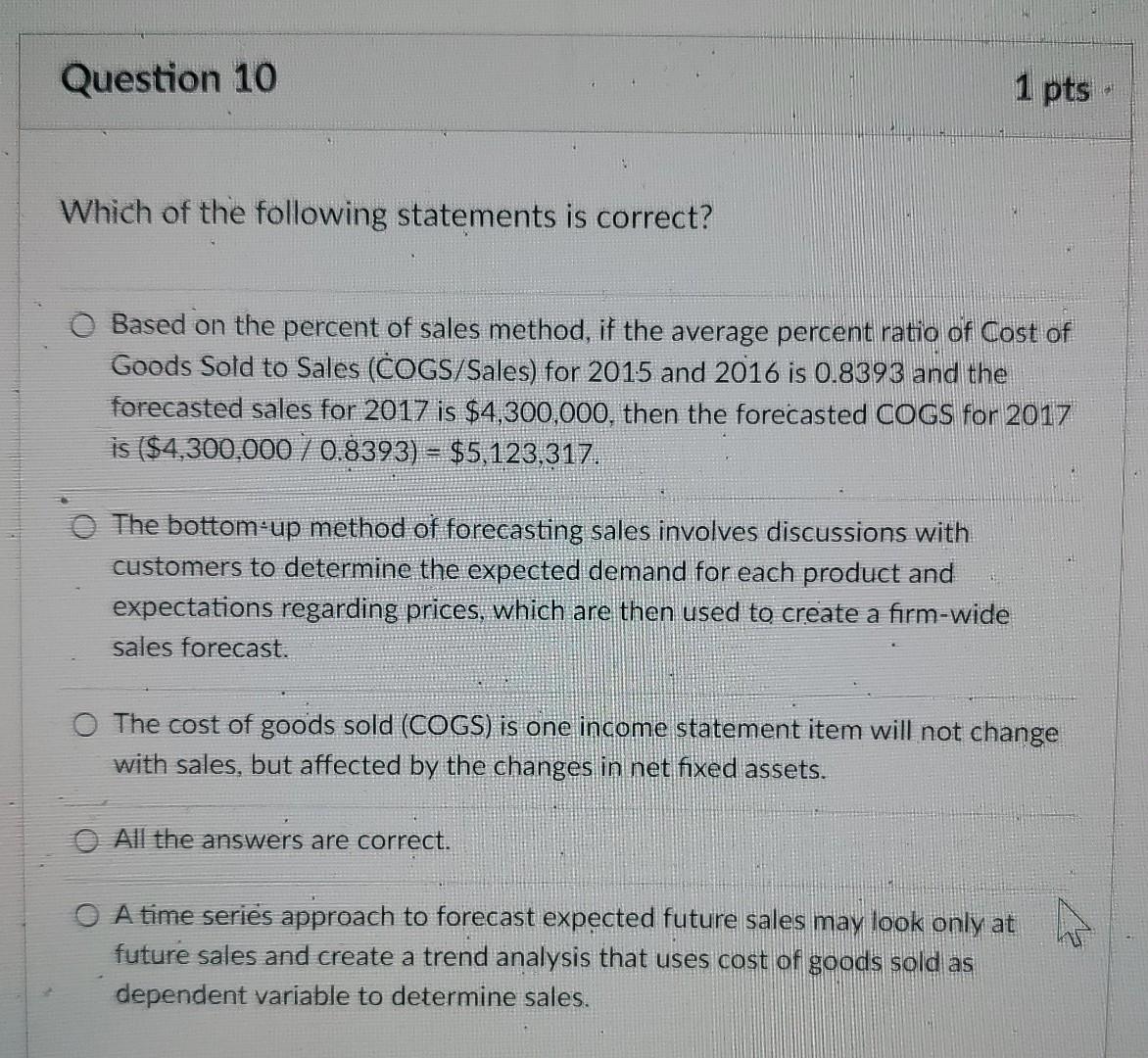

Which of the following statements is incorrect? All the answers are correct except one. To generate a forecast based on the trend, we can use =TREND(KNOWN_Y'S, KNOWN X'S, NEW_X'S, CONS) function. A time series approach to forecast expected future sales may look only at future sales and create a trend analysis that uses cost of goods sold as dependent variable to determine sales. Generally speaking, spontaneous sources of financing can be expected to vary directly with sales. Examples of discretionary sources of financing include any type of bank loan, bonds, preferred stock, and common stock. Which of the following statements is correct? Based on the percent of sales method, if the average percent ratio of Cost of Goods Sold to Sales (COGS/Sales) for 2015 and 2016 is 0.8393 and the forecasted sales for 2017 is $4,300,000, then the forecasted COGS for 2017 is ($4,300,000/0.8393)=$5,123,317. The bottom up method of forecasting sales involves discussions with customers to determine the expected demand for each product and expectations regarding prices, which are then used to create a firm-wide sales forecast. The cost of goods sold (COGS) is one income statement item will not change with sales, but affected by the changes in net fixed assets. All the answers are correct. A time seris approach to forecast expected future sales may look only at future sales and create a trend analysis that uses cost of goods sold as dependent variable to determine salesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started