Question

9-12 Mini-CaseAPV Valuation Flowmaster Forge Inc. is a designer and manufacturer of industrial air-handling equipment that is a wholly owned subsidiary of Howden Industrial Inc.

9-12 Mini-CaseAPV Valuation

Flowmaster Forge Inc. is a designer and manufacturer of industrial air-handling equipment that is a wholly owned subsidiary of Howden Industrial Inc. Howden is interested in selling Flowmaster to an investment group formed by company CFO Gary Burton.

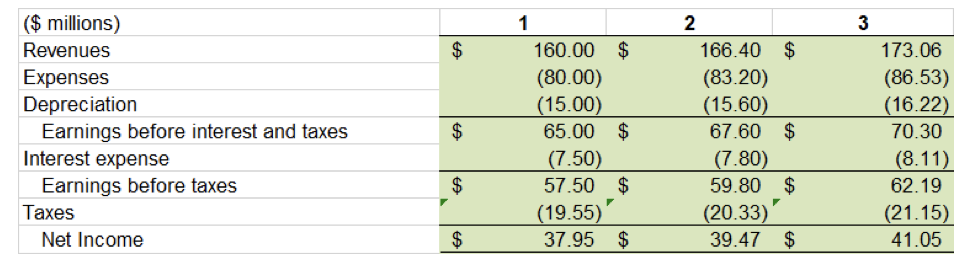

Burton prepared a set of financial projections for Flowmaster under the new ownership. For the first year of operations, firm revenues were estimated to be $160 million, variable and fixed operating expenses (excluding depreciation expense) were projected to be $80 million, and depreciation expense was estimated to be $15 million. Revenues and expenses were projected to grow at a rate of 4% per year in perpetuity.

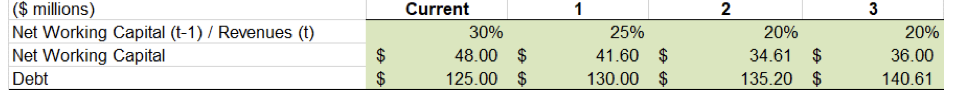

Flowmaster currently has $125 million in debt outstanding that carries an interest rate of 6%. The debt trades at par (i.e., at a price equal to its face value). The investment group intends to keep the debt outstanding after the acquisition is completed, and the level of debt is expected to grow by the same 4% rate as firm revenues.

Projected income statements for the first three years of operation of Flowmaster following the acquisition are as follows:

Burton anticipates that efficiency gains can be implemented that will allow Flowmaster to reduce its needs for net working capital. Currently, Flowmaster has net working capital equal to 30% of anticipated revenues for year 1. He estimates that, for year 1, the firms net working capital can be reduced to 25% of year 2 revenues, then 20% of revenues for all subsequent years. Estimated net working capital for years 1 through 3 is as follows:

To sustain the firms expected revenue growth, Burton estimates that annual capital expenditures that equal the firms annual depreciation expense will be required.

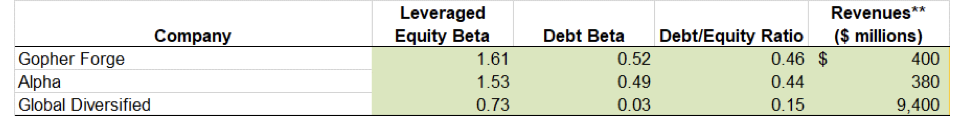

Burton has been thinking for some time about whether to use Howdens corporate cost of capital of 9% to value Flowmaster and has come to the conclusion that an independent estimate should be made. To make the estimate, he collected the following information on the betas and leverage ratios for three publicly traded firms with manufacturing operations that are very similar to Flowmasters:

1. Calculate the unlevered cash flows (i.e., the firm FCFs for Flowmaster for years 1 to 3).

2. Calculate the unlevered cost of equity capital for Flowmaster. The risk-free rate of interest is 4.5% and the market risk premium is estimated to be 6%.

3. Calculate the value of Flowmasters unlevered business.

4. What is the value of Flowmasters interest tax savings, based on the assumption that the $125 million in debt remains outstanding (i.e., the investment group assumes the debt obligation) and that the firms debt and consequently its interest expenses grow at the same rate as revenues?

5. What is your estimate of the enterprise value of Flowmaster based on your analysis in Problem 9-13(a) to (d)? How much is the equity of the firm worth today, assuming the $125 million in debt remains outstanding?

| *The leverage ratio is the ratio of the market value of debt to the sum of the market values of debt and equity. Debt ratios are assumed to be constraint. Revenues are the entire firms revenues for the most recent fiscal year. Note 1Property, plant, and equipment grow at the same rate as revenues so that depreciation expenses grow at 4% per year. Note 2The initial debt level of $125 million is assumed to grow with firm assets at a rate of 4% per year. |

|

|

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started