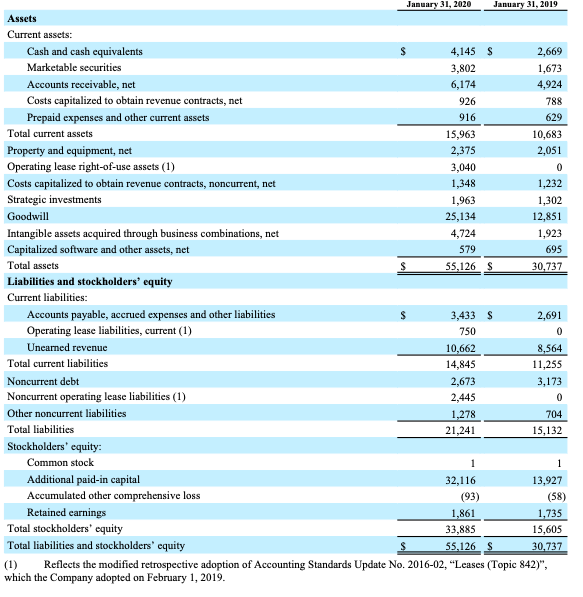

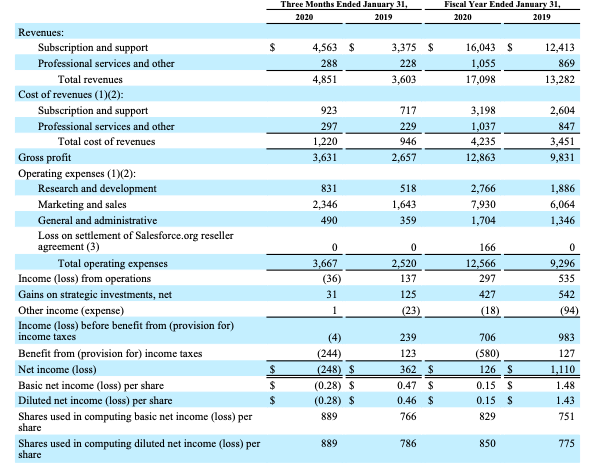

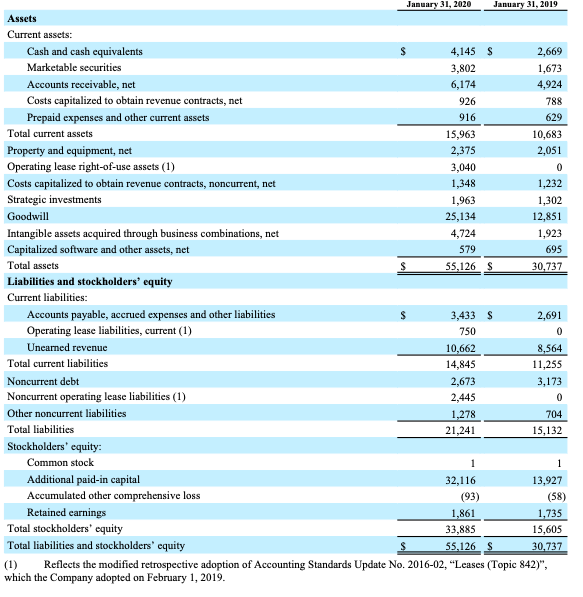

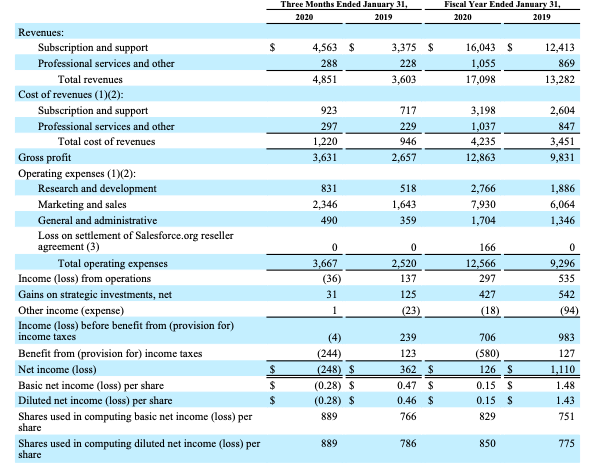

916 629 January 31, 2020 January 31, 2019 Assets Current assets: Cash and cash equivalents $ 4,145 S 2,669 Marketable securities 3,802 1,673 Accounts receivable, net 6,174 4,924 Costs capitalized to obtain revenue contracts, net 926 788 Prepaid expenses and other current assets Total current assets 15,963 10,683 Property and equipment, net 2,375 2,051 Operating lease right-of-use assets (1) 3,040 0 Costs capitalized to obtain revenue contracts, noncurrent, net 1,348 1,232 Strategic investments 1,963 1,302 Goodwill 25,134 12,851 Intangible assets acquired through business combinations, net 4,724 1,923 Capitalized software and other assets, net 579 695 Total assets $ 55,126 S 30,737 Liabilities and stockholders' equity Current liabilities: Accounts payable, accrued expenses and other liabilities 3,433 2,691 Operating lease liabilities, current (1) 750 Unearned revenue 10,662 8,564 Total current liabilities 14,845 11,255 Noncurrent debt 2,673 3,173 Noncurrent operating lease liabilities (1) 2,445 Other noncurrent liabilities 1,278 704 Total liabilities 21,241 15,132 Stockholders' equity: Common stock Additional paid-in capital 32,116 13,927 Accumulated other comprehensive loss (93) (58) Retained earnings 1,861 1,735 Total stockholders' equity 33,885 15,605 Total liabilities and stockholders' equity $ 55,126 S 30.737 (1) Reflects the modified retrospective adoption of Accounting Standards Update No. 2016-02, Leases (Topic 842)", which the Company adopted on February 1, 2019. S S 0 0 1 1 Three Months Ended January 31, 2020 2019 Fiscal Year Ended January 31, 2020 2019 4,563 $ 288 4,851 3,375 $ 228 3,603 16,043 S 1,055 17,098 12,413 869 13,282 923 297 1.220 3,631 717 229 946 2,657 3,198 1,037 4,235 12,863 2,604 847 3,451 9,831 831 2,346 490 518 1,643 359 2,766 7,930 1,704 1,886 6,064 1,346 Revenues: Subscription and support Professional services and other Total revenues Cost of revenues (1)(2): Subscription and support Professional services and other Total cost of revenues Gross profit Operating expenses (1)(2): Research and development Marketing and sales General and administrative Loss on settlement of Salesforce.org reseller agreement (3) Total operating expenses Income (loss) from operations Gains on strategic investments, net Other income (expense) Income (loss) before benefit from (provision for) income taxes Benefit from (provision for) income taxes Net income (loss) Basic net income (loss) per share Diluted net income (loss) per share Shares used in computing basic net income (loss) per share Shares used in computing diluted net income (loss) per share 0 0 3,667 (36) 31 1 0 2,520 137 125 (23) 166 12,566 297 427 (18) 9,296 535 542 (94) $ $ (4) (244) (248) $ (0.28) $ (0.28) $ 889 239 123 362 $ 0.47 $ 0.46 $ 766 706 (580) 126 S 0.15 S 0.15 S 829 983 127 1,110 1.48 1.43 751 889 786 850 775 23:30 1. Using the company Salesforce (CRM), develop a set of financial ratios and provide an opinion on the financial health of the company. Highlight the major financial components of the entity and explain and/or analyze areas that you believe it is performing well, if at all, and your interpretation/ rationale. T Na SN No 1:1 1 Cleme 1 TA 916 629 January 31, 2020 January 31, 2019 Assets Current assets: Cash and cash equivalents $ 4,145 S 2,669 Marketable securities 3,802 1,673 Accounts receivable, net 6,174 4,924 Costs capitalized to obtain revenue contracts, net 926 788 Prepaid expenses and other current assets Total current assets 15,963 10,683 Property and equipment, net 2,375 2,051 Operating lease right-of-use assets (1) 3,040 0 Costs capitalized to obtain revenue contracts, noncurrent, net 1,348 1,232 Strategic investments 1,963 1,302 Goodwill 25,134 12,851 Intangible assets acquired through business combinations, net 4,724 1,923 Capitalized software and other assets, net 579 695 Total assets $ 55,126 S 30,737 Liabilities and stockholders' equity Current liabilities: Accounts payable, accrued expenses and other liabilities 3,433 2,691 Operating lease liabilities, current (1) 750 Unearned revenue 10,662 8,564 Total current liabilities 14,845 11,255 Noncurrent debt 2,673 3,173 Noncurrent operating lease liabilities (1) 2,445 Other noncurrent liabilities 1,278 704 Total liabilities 21,241 15,132 Stockholders' equity: Common stock Additional paid-in capital 32,116 13,927 Accumulated other comprehensive loss (93) (58) Retained earnings 1,861 1,735 Total stockholders' equity 33,885 15,605 Total liabilities and stockholders' equity $ 55,126 S 30.737 (1) Reflects the modified retrospective adoption of Accounting Standards Update No. 2016-02, Leases (Topic 842)", which the Company adopted on February 1, 2019. S S 0 0 1 1 Three Months Ended January 31, 2020 2019 Fiscal Year Ended January 31, 2020 2019 4,563 $ 288 4,851 3,375 $ 228 3,603 16,043 S 1,055 17,098 12,413 869 13,282 923 297 1.220 3,631 717 229 946 2,657 3,198 1,037 4,235 12,863 2,604 847 3,451 9,831 831 2,346 490 518 1,643 359 2,766 7,930 1,704 1,886 6,064 1,346 Revenues: Subscription and support Professional services and other Total revenues Cost of revenues (1)(2): Subscription and support Professional services and other Total cost of revenues Gross profit Operating expenses (1)(2): Research and development Marketing and sales General and administrative Loss on settlement of Salesforce.org reseller agreement (3) Total operating expenses Income (loss) from operations Gains on strategic investments, net Other income (expense) Income (loss) before benefit from (provision for) income taxes Benefit from (provision for) income taxes Net income (loss) Basic net income (loss) per share Diluted net income (loss) per share Shares used in computing basic net income (loss) per share Shares used in computing diluted net income (loss) per share 0 0 3,667 (36) 31 1 0 2,520 137 125 (23) 166 12,566 297 427 (18) 9,296 535 542 (94) $ $ (4) (244) (248) $ (0.28) $ (0.28) $ 889 239 123 362 $ 0.47 $ 0.46 $ 766 706 (580) 126 S 0.15 S 0.15 S 829 983 127 1,110 1.48 1.43 751 889 786 850 775 23:30 1. Using the company Salesforce (CRM), develop a set of financial ratios and provide an opinion on the financial health of the company. Highlight the major financial components of the entity and explain and/or analyze areas that you believe it is performing well, if at all, and your interpretation/ rationale. T Na SN No 1:1 1 Cleme 1 TA