Answered step by step

Verified Expert Solution

Question

1 Approved Answer

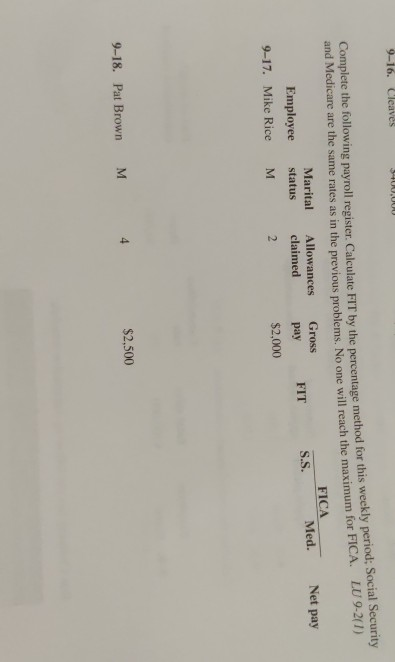

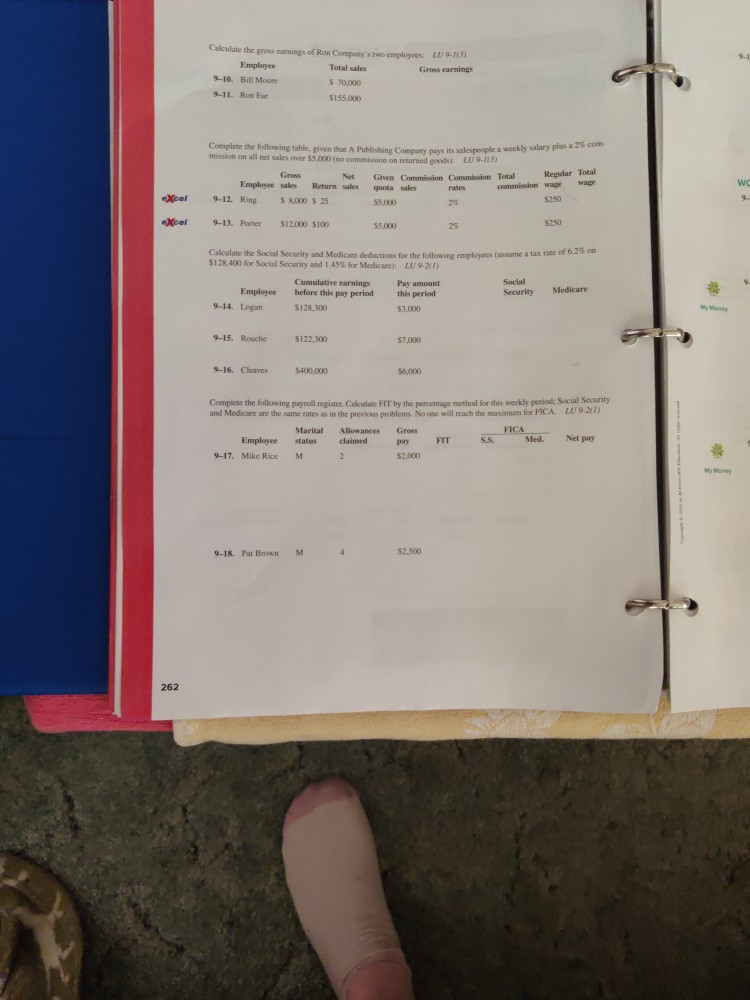

9-16. Cleaves UUUU Complete the following payroll register. Calculate FIT by the percentage method for this weekly period: Social Security and Medicare are the same

9-16. Cleaves UUUU Complete the following payroll register. Calculate FIT by the percentage method for this weekly period: Social Security and Medicare are the same rates as in the previous problems. No one will reach the maximum for FICA. LU 9-2(1) Gross Employee FIT $2,000 Net pay FICA Med. Marital status Allowances claimed S.S. pay 9-17. Mike Rice M 2 $2.500 9-18. Pat Brown M Calculate the gross earnings of Ron Company's two employees L-10) Employee Total sales Gross earnings 9-10. Bill Moore $70,000 9-11. Ron Ear S155.000 mission on all net sales over 55.000 (no commission on returned goods) 9-13) Complete the following table, given that A Publishing Company pays its salespeople a weekly salary plus a 25 com Gruss Net Given Commission Commission Total Employee sales Returnsules quota sales rates commission wag 9-12 Ring 5 80 525 55.000 25 Regular Total 1 WC eXcel $250 Xcel 9-13. Porter $12.000 $100 520 55,000 24 Calculate the Social Security and Medicare deductions for the following employees (assume a tax rate of 6.2% on $128.400 for Social Security and 1.455 for Medicare): LU 9-21) Cumulative earnings Pay amount Social Employee before this pay period this period Security Medicare 9-14. Logan $128 300 53.000 9-15. Rouche 5122,300 57.000 9-16. Cleaves $400,000 $6,000 Complete the following payroll register. Calculate FIT by the percentage method for this weekly period: Social Security and Medicare are the same rates as in the previous problems. No one will reach the maximum for FICA LU 9-21) Marital Allowances Gross FICA Employee status claimed FIT SS. Med. Net pay 9-17. Mike Rice M 2 $2,000 M 9-18, Pat Brown 4 $2.500 262 9-16. Cleaves UUUU Complete the following payroll register. Calculate FIT by the percentage method for this weekly period: Social Security and Medicare are the same rates as in the previous problems. No one will reach the maximum for FICA. LU 9-2(1) Gross Employee FIT $2,000 Net pay FICA Med. Marital status Allowances claimed S.S. pay 9-17. Mike Rice M 2 $2.500 9-18. Pat Brown M Calculate the gross earnings of Ron Company's two employees L-10) Employee Total sales Gross earnings 9-10. Bill Moore $70,000 9-11. Ron Ear S155.000 mission on all net sales over 55.000 (no commission on returned goods) 9-13) Complete the following table, given that A Publishing Company pays its salespeople a weekly salary plus a 25 com Gruss Net Given Commission Commission Total Employee sales Returnsules quota sales rates commission wag 9-12 Ring 5 80 525 55.000 25 Regular Total 1 WC eXcel $250 Xcel 9-13. Porter $12.000 $100 520 55,000 24 Calculate the Social Security and Medicare deductions for the following employees (assume a tax rate of 6.2% on $128.400 for Social Security and 1.455 for Medicare): LU 9-21) Cumulative earnings Pay amount Social Employee before this pay period this period Security Medicare 9-14. Logan $128 300 53.000 9-15. Rouche 5122,300 57.000 9-16. Cleaves $400,000 $6,000 Complete the following payroll register. Calculate FIT by the percentage method for this weekly period: Social Security and Medicare are the same rates as in the previous problems. No one will reach the maximum for FICA LU 9-21) Marital Allowances Gross FICA Employee status claimed FIT SS. Med. Net pay 9-17. Mike Rice M 2 $2,000 M 9-18, Pat Brown 4 $2.500 262

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started