Answered step by step

Verified Expert Solution

Question

1 Approved Answer

916 Loon Mountain Mining paid $237,100 for the right to extract mineral assets from a 300,000 -ton deposit. In addition to the purchase price, Loon

916

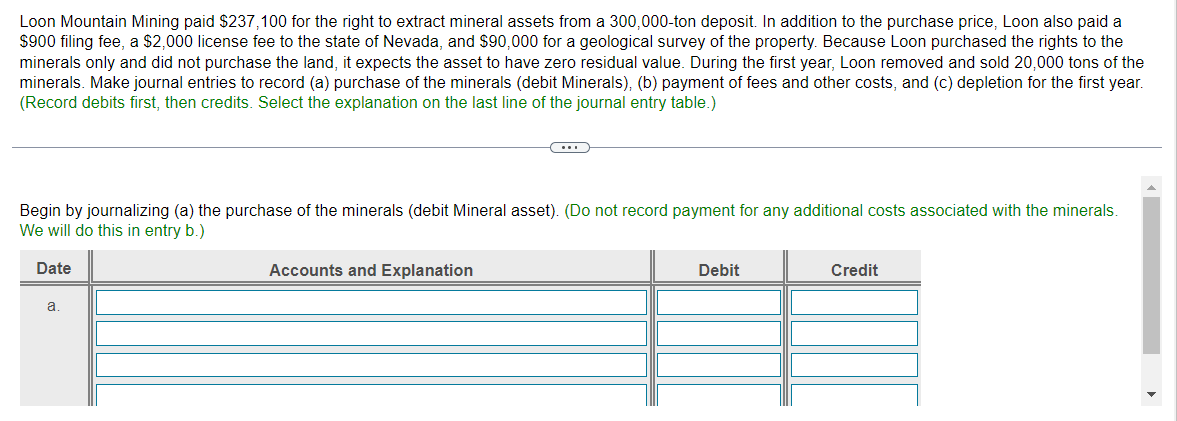

Loon Mountain Mining paid $237,100 for the right to extract mineral assets from a 300,000 -ton deposit. In addition to the purchase price, Loon also paid a $900 filing fee, a $2,000 license fee to the state of Nevada, and $90,000 for a geological survey of the property. Because Loon purchased the rights to the minerals only and did not purchase the land, it expects the asset to have zero residual value. During the first year, Loon removed and sold 20,000 tons of the minerals. Make journal entries to record (a) purchase of the minerals (debit Minerals), (b) payment of fees and other costs, and (c) depletion for the first year. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing (a) the purchase of the minerals (debit Mineral asset). (Do not record payment for any additional costs associated with the minerals. We will do this in entry b.)

Loon Mountain Mining paid $237,100 for the right to extract mineral assets from a 300,000 -ton deposit. In addition to the purchase price, Loon also paid a $900 filing fee, a $2,000 license fee to the state of Nevada, and $90,000 for a geological survey of the property. Because Loon purchased the rights to the minerals only and did not purchase the land, it expects the asset to have zero residual value. During the first year, Loon removed and sold 20,000 tons of the minerals. Make journal entries to record (a) purchase of the minerals (debit Minerals), (b) payment of fees and other costs, and (c) depletion for the first year. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing (a) the purchase of the minerals (debit Mineral asset). (Do not record payment for any additional costs associated with the minerals. We will do this in entry b.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started