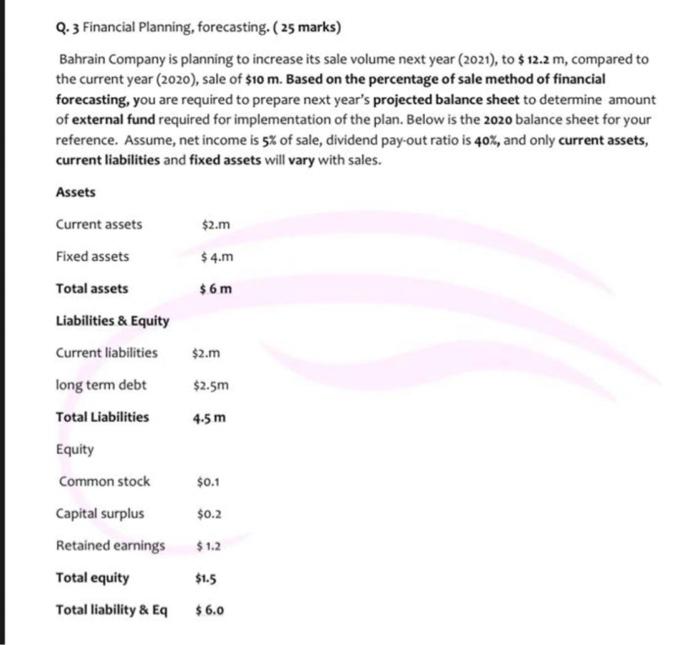

9.3 Financial ringforecasting ( ar) Bahrain Company is planning to resume rest year.cometto the current years to em Bed the percentage of francia forecasting you are required to prepared balance sheet me of external fund required for implementation of the plan Below the balance sheet for your reference. Asume, et income sted puedan current current abilities and feed sets will varytale Assets Current Feed 16m Liabilities & Equity Current longtem debit Total Equity Comment Capitaluri 10:3 Totality Totalt 560 Q. 3 Financial Planning, forecasting. ( 25 marks) Bahrain Company is planning to increase its sale volume next year (2021), to $ 12.2 m, compared to the current year (2020), sale of $10 m. Based on the percentage of sale method of financial forecasting, you are required to prepare next year's projected balance sheet to determine amount of external fund required for implementation of the plan. Below is the 2020 balance sheet for your reference. Assume, net income is 5% of sale, dividend pay-out ratio is 40%, and only current assets, current liabilities and fixed assets will vary with sales. Assets Current assets $2.m Fixed assets $4.m $6 m $2.m $2.5m Total assets Liabilities & Equity Current liabilities long term debt Total Liabilities Equity Common stock Capital surplus 4.5 m $0.1 $0.2 Retained earnings $1.2 Total equity $1.5 Total liability & Eq $ 6.0 9.3 Financial ringforecasting ( ar) Bahrain Company is planning to resume rest year.cometto the current years to em Bed the percentage of francia forecasting you are required to prepared balance sheet me of external fund required for implementation of the plan Below the balance sheet for your reference. Asume, et income sted puedan current current abilities and feed sets will varytale Assets Current Feed 16m Liabilities & Equity Current longtem debit Total Equity Comment Capitaluri 10:3 Totality Totalt 560 Q. 3 Financial Planning, forecasting. ( 25 marks) Bahrain Company is planning to increase its sale volume next year (2021), to $ 12.2 m, compared to the current year (2020), sale of $10 m. Based on the percentage of sale method of financial forecasting, you are required to prepare next year's projected balance sheet to determine amount of external fund required for implementation of the plan. Below is the 2020 balance sheet for your reference. Assume, net income is 5% of sale, dividend pay-out ratio is 40%, and only current assets, current liabilities and fixed assets will vary with sales. Assets Current assets $2.m Fixed assets $4.m $6 m $2.m $2.5m Total assets Liabilities & Equity Current liabilities long term debt Total Liabilities Equity Common stock Capital surplus 4.5 m $0.1 $0.2 Retained earnings $1.2 Total equity $1.5 Total liability & Eq $ 6.0