Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9-32. VARIABLE COSTING VERSUS ABSORPTION COSTING. The Stenback Company uses an absorption-costing system based on standard costs. Variable manufacturing cost consists of direct material

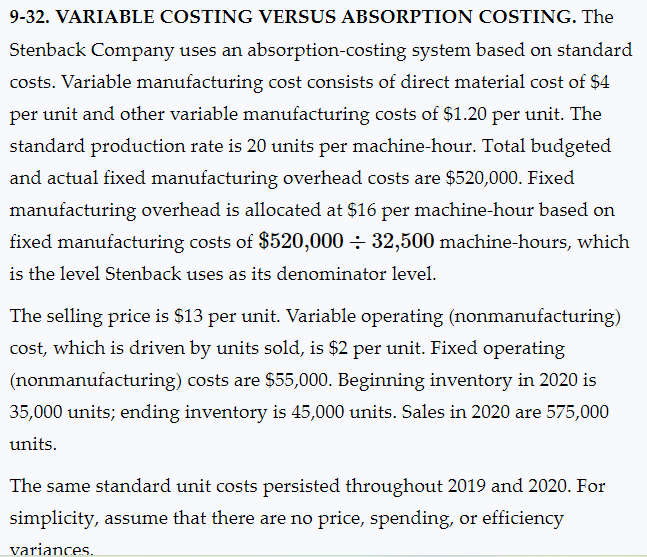

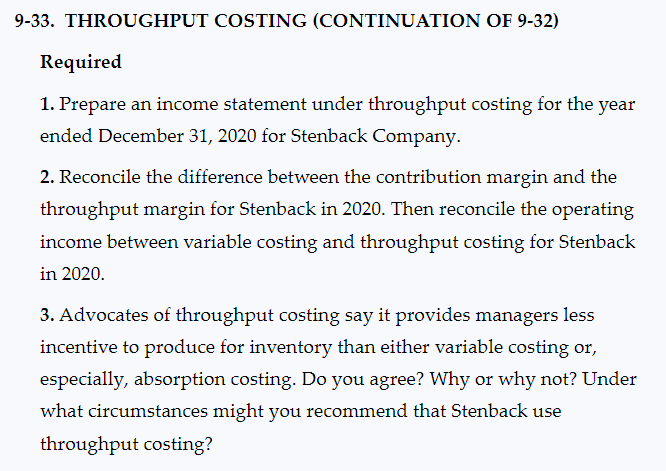

9-32. VARIABLE COSTING VERSUS ABSORPTION COSTING. The Stenback Company uses an absorption-costing system based on standard costs. Variable manufacturing cost consists of direct material cost of $4 per unit and other variable manufacturing costs of $1.20 per unit. The standard production rate is 20 units per machine-hour. Total budgeted and actual fixed manufacturing overhead costs are $520,000. Fixed manufacturing overhead is allocated at $16 per machine-hour based on fixed manufacturing costs of $520,000 32,500 machine-hours, which is the level Stenback uses as its denominator level. The selling price is $13 per unit. Variable operating (nonmanufacturing) cost, which is driven by units sold, is $2 per unit. Fixed operating (nonmanufacturing) costs are $55,000. Beginning inventory in 2020 is 35,000 units; ending inventory is 45,000 units. Sales in 2020 are 575,000 units. The same standard unit costs persisted throughout 2019 and 2020. For simplicity, assume that there are no price, spending, or efficiency variances.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started