9-36) Please help to solve all 3 parts . Questions are listed in the attachment

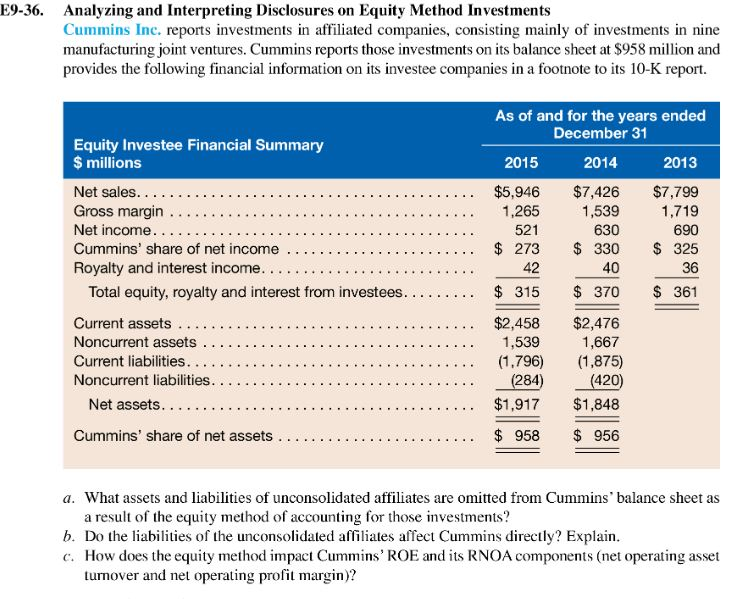

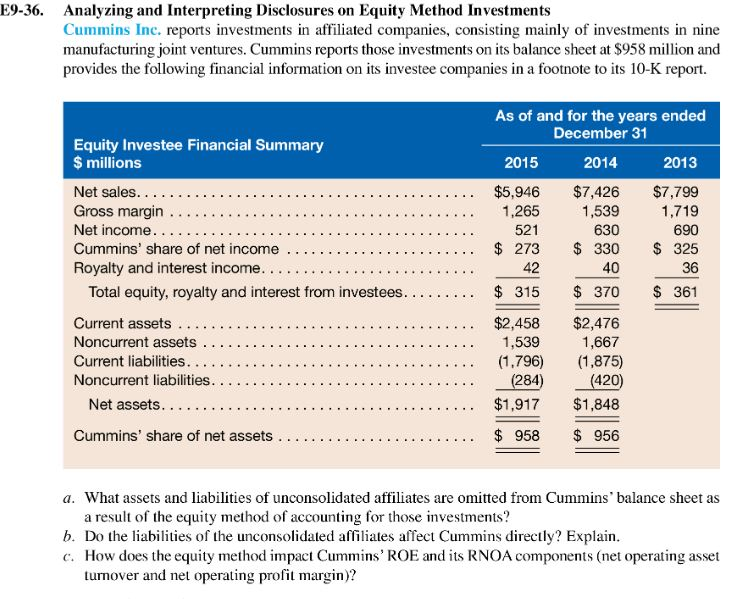

E9-36. Analyzing and Interpreting Disclosures on Equity Method Investments Cummins Inc. reports investments in affiliated companies, consisting mainly of investments in nine manufacturing joint ventures, Cummins reports those investments on its balance sheet at $958 million and provides the following financial information on its investee companies in a footnote to its 10-K report. Equity Investee Financial Summary $ millions As of and for the years ended December 31 2015 2014 2013 Net sales. ............ Gross margin .................... Net income............... Cummins' share of net income .............. Royalty and interest income Total equity, royalty and interest from investees......... $5,946 1,265 521 $ 273 ... 42 $ 315 $7,426 1,539 630 $ 330 40 $ 370 $7,799 1,719 690 $ 325 36 $361 Current assets ....... Noncurrent assets ... Current liabilities. ... Noncurrent liabilities. ... Net assets......... $2,458 1,539 (1.796) (284) $1,917 $ 958 $2,476 1,667 (1,875) (420) $1,848 . . . Cummins' share of net assets $ 956 . a. What assets and liabilities of unconsolidated affiliates are omitted from Cummins balance sheet as a result of the equity method of accounting for those investments? b. Do the liabilities of the unconsolidated affiliates affect Cummins directly? Explain. c. How does the equity method impact Cummins' ROE and its RNOA components (net operating asset turnover and net operating profit margin)? E9-36. Analyzing and Interpreting Disclosures on Equity Method Investments Cummins Inc. reports investments in affiliated companies, consisting mainly of investments in nine manufacturing joint ventures, Cummins reports those investments on its balance sheet at $958 million and provides the following financial information on its investee companies in a footnote to its 10-K report. Equity Investee Financial Summary $ millions As of and for the years ended December 31 2015 2014 2013 Net sales. ............ Gross margin .................... Net income............... Cummins' share of net income .............. Royalty and interest income Total equity, royalty and interest from investees......... $5,946 1,265 521 $ 273 ... 42 $ 315 $7,426 1,539 630 $ 330 40 $ 370 $7,799 1,719 690 $ 325 36 $361 Current assets ....... Noncurrent assets ... Current liabilities. ... Noncurrent liabilities. ... Net assets......... $2,458 1,539 (1.796) (284) $1,917 $ 958 $2,476 1,667 (1,875) (420) $1,848 . . . Cummins' share of net assets $ 956 . a. What assets and liabilities of unconsolidated affiliates are omitted from Cummins balance sheet as a result of the equity method of accounting for those investments? b. Do the liabilities of the unconsolidated affiliates affect Cummins directly? Explain. c. How does the equity method impact Cummins' ROE and its RNOA components (net operating asset turnover and net operating profit margin)