Answered step by step

Verified Expert Solution

Question

1 Approved Answer

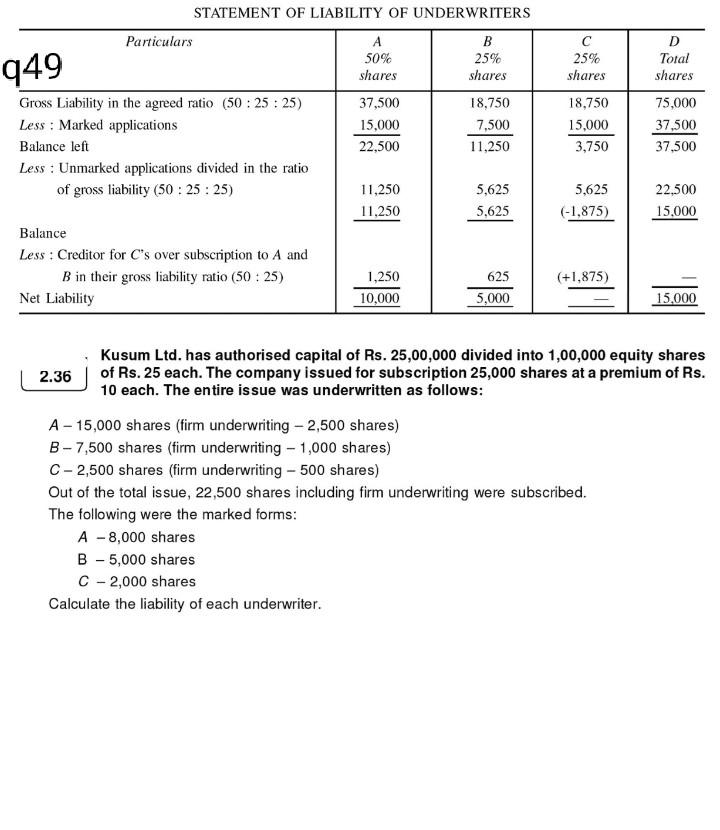

949 25% shares D Total shares 18,750 15.000 3,750 75,000 37,500 37,500 STATEMENT OF LIABILITY OF UNDERWRITERS Particulars A B 50% 25% shares shares Gross

949 25% shares D Total shares 18,750 15.000 3,750 75,000 37,500 37,500 STATEMENT OF LIABILITY OF UNDERWRITERS Particulars A B 50% 25% shares shares Gross Liability in the agreed ratio (50:25 : 25) 37,500 18,750 Less : Marked applications 15,000 7,500 Balance left 22,500 11,250 Less : Unmarked applications divided in the ratio of gross liability (50:25:25) 11,250 5,625 11.250 Balance Less : Creditor for C's over subscription to A and B in their gross liability ratio (50:25) 1,250 625 Net Liability 10,000 5,000 5,625 (-1,875) 22,500 15,000 5.625 (+1,875) 15,000 2.36 Kusum Ltd. has authorised capital of Rs. 25,00,000 divided into 1,00,000 equity shares of Rs. 25 each. The company issued for subscription 25,000 shares at a premium of Rs. 10 each. The entire issue was underwritten as follows: A - 15,000 shares (firm underwriting - 2,500 shares) B - 7,500 shares (firm underwriting - 1,000 shares) C - 2,500 shares (firm underwriting - 500 shares) Out of the total issue, 22,500 shares including firm underwriting were subscribed. The following were the marked forms: A - 8,000 shares B - 5,000 shares C - 2,000 shares Calculate the liability of each underwriter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started