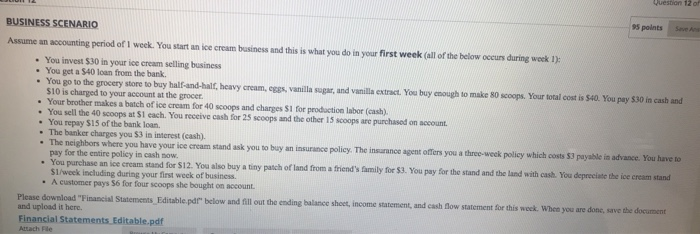

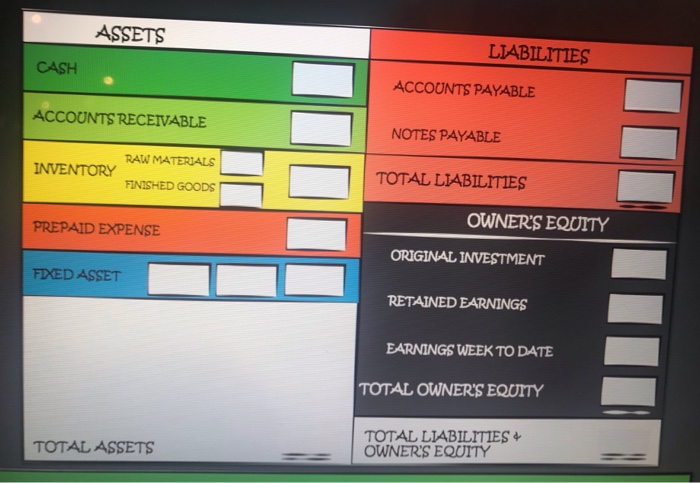

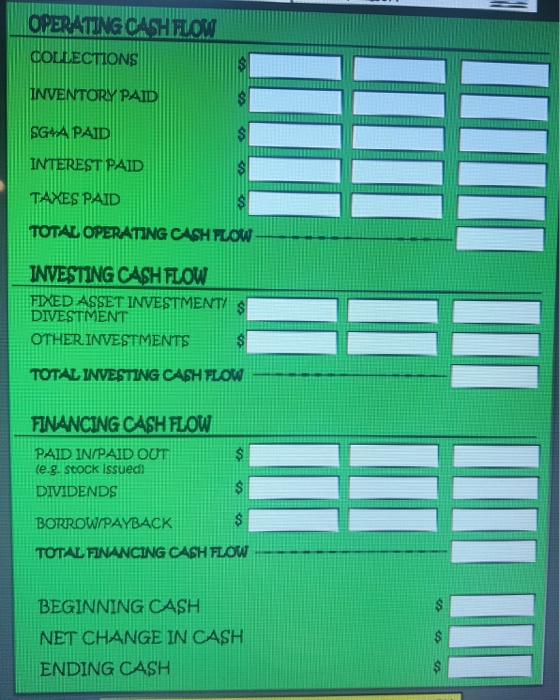

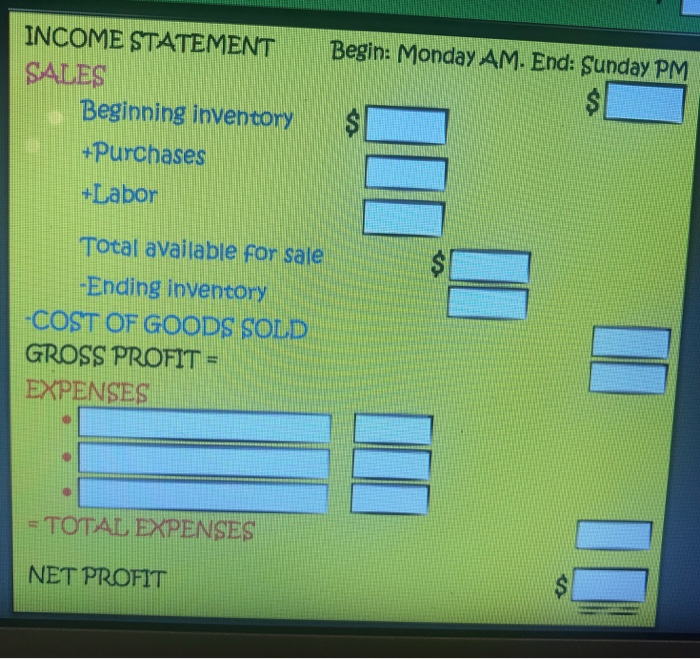

95 points BUSINESS SCENARIO Assume an accounting period of I week. You start an ice cream business and this is what you do in your first week (all of the below occurs during week 1): You invest in your ice cream selling business . You get a 540 loan from the bank You go to the grocery store to buy half-and-half, heavy cream, eges, vanilla sugar, and vanilla extract. You buy enough to make 80 scoops. Your total cost is $40. You pay $30 in cash and 510 is charged to your account at the grocer Your brother makes a batch of ice cream for 40 scoops and charges Sl for production labor (cash). You sell the 40 scoops at St each. You receive cash for 25 scoops and the other 15 Scoops are purchased on account. You repay S15 of the bank loan. - The bunker charges you $3 in interest (cash). The neighbors where you have your ice cream stand ask you to buy an insurance policy. The insurance agent offers you a three-week policy which costs 53 payable in advance. You have to pay for the entire policy in cash now . You purchase an ice cream stand for $12. You also buy a tiny patch of land from a friend's family for $3. You pay for the stand and the land with cash. You depreciate the ice cream stand Sweck including during your first week of business A customer pays $6 for four scoops she bought on account Please download "Financial Statements Editable.pdf below and fill out the ending balance sheet, income statement, and cash flow statement for this week. When you are done, save the document and upload it here. Financial Statements Editable.pdf ASSETS LIABILITIES CASH ACCOUNTS PAYABLE ACCOUNTS RECEIVABLE NOTES PAYABLE INVENTORY RAW MATERIALS FINISHED GOODS TOTAL LIABILITIES PREPAID EXPENSE OWNER'S EQUITY ORIGINAL INVESTMENT FIXED ASSET SSET RETAINED EARNINGS EARNINGS WEEK TO DATE TOTAL OWNER'S EQUITY TOTAL ASSETS TOTAL LIABILITIES OWNER'S EQUITY OPERATING CASH FLOW COLLECTIONS INVENTORY PAID SGUA PAID INTEREST PAID TAXES PAID TOTAL OPERATING CASH FLOW INVESTING CASH FLOW FIXED ASSET INVESTMENTY DIVESTMENT OTHER. INVESTMENTS TOTAL INVESTING CASH FLOW FINANCING CASH FLOW PAID IN/PAID OUT (e.g. stock issued) DIVIDENDS BORROW/PAYBACK TOTAL FINANCING CASH FLOW $ BEGINNING CASH NET CHANGE IN CASH ENDING CASH LILIT Begin: Monday AM. End: Sunday PM INCOME STATEMENT SALES Beginning inventory +Purchases +Labor Total available for sale -Ending inventory -COST OF GOODS SOLD GROSS PROFIT = EXPENSES = TOTAL EXPENSES NET PROFIT