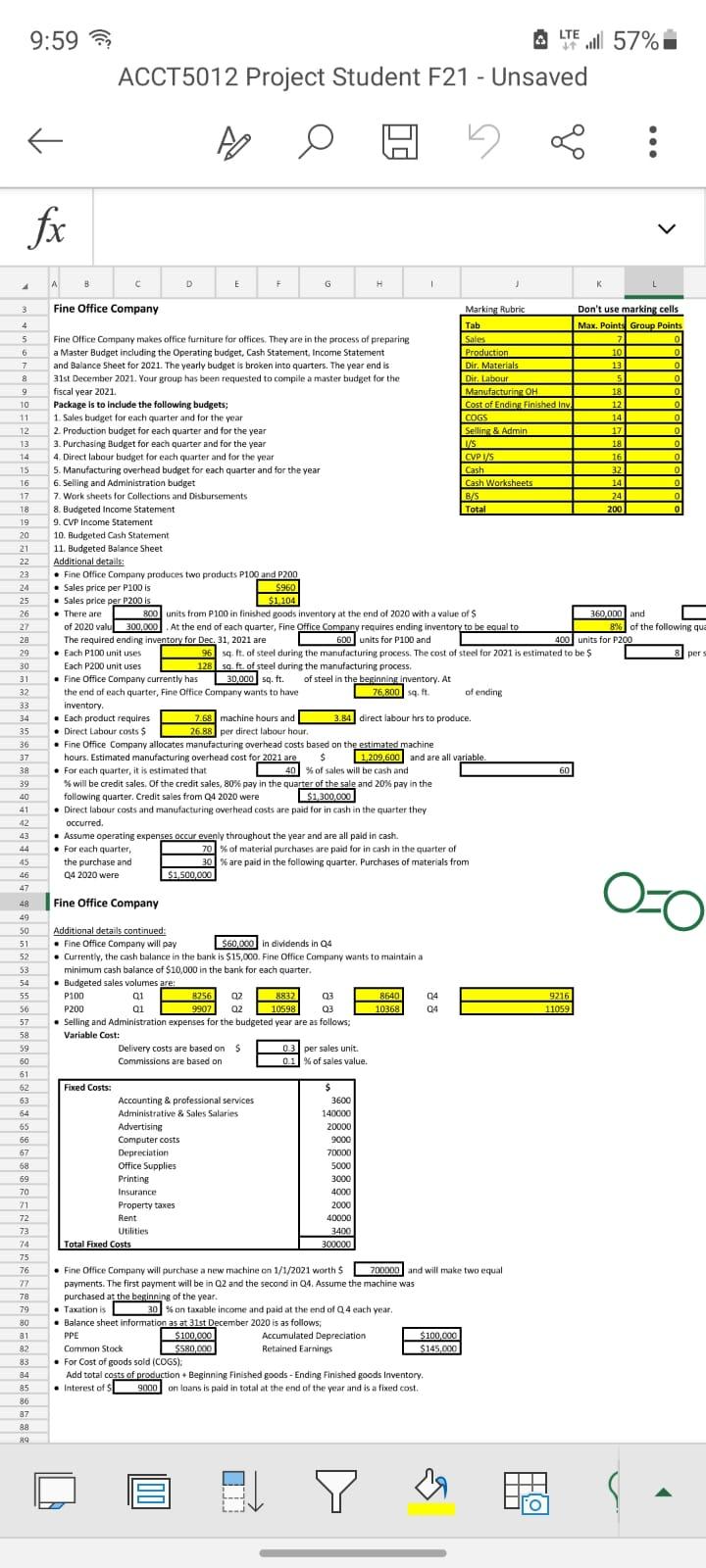

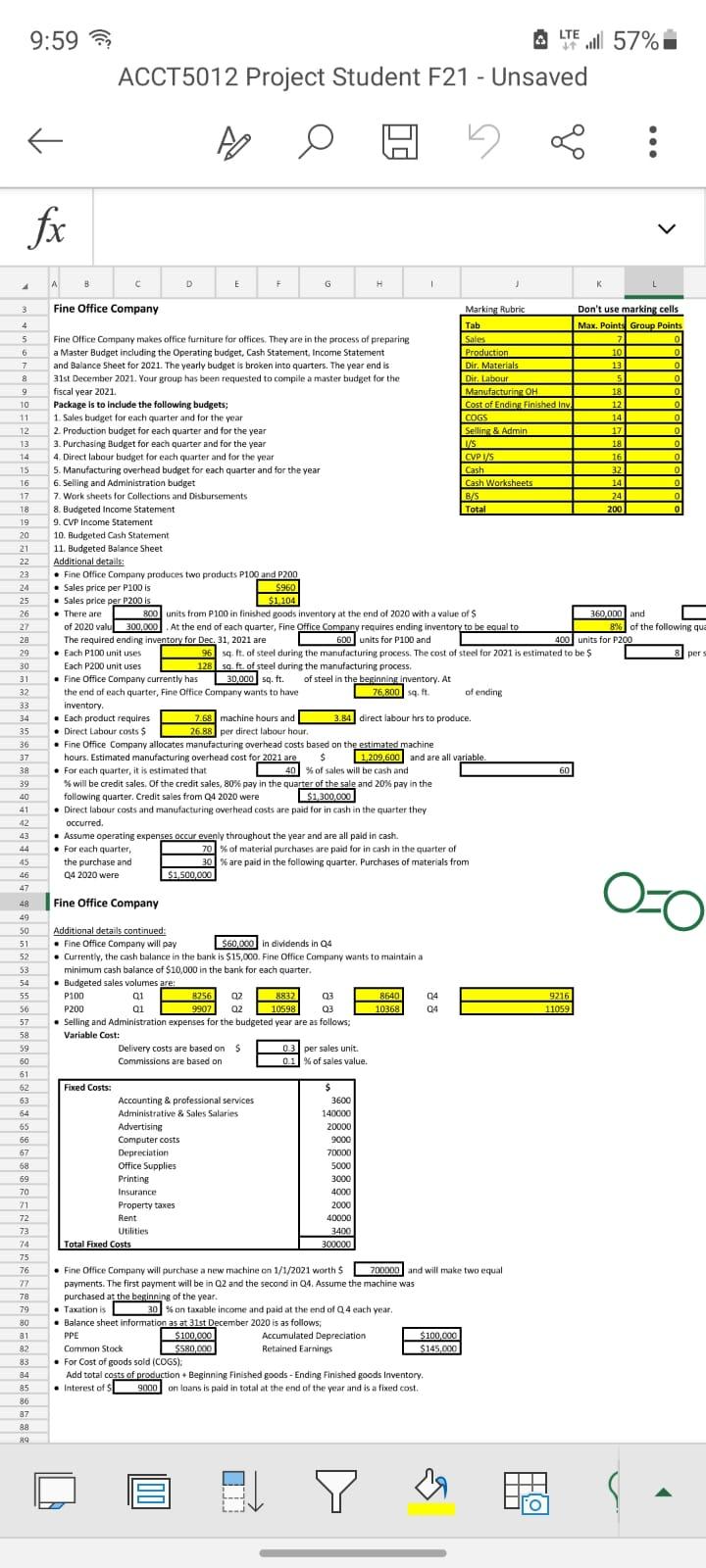

9:59 LTE 57% % ACCT5012 Project Student F21 - Unsaved A 5 : fx L 4 c D D E F G H I K L 3 4 5 6 7 7 8 Dir. Labour 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 20 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 Fine Office Company Marking Rubric Don't use marking cells Tab Max. Point Group Points Fine Office Company makes office furniture for offices. They are in the process of preparing Sales 7 a Master Budget including the Operating budget, Cash Statement. Income Statement Production 10 0 and Balance Sheet for 2021. The yearly budget is broken into quarters. The year end is Dir. Materials 13 0 31st December 2021. Your group has been requested to compile a master budget for the 5 5 0 fiscal year 2021 Manufacturing OH 18 0 Package is to include the following budgets; Cost of Endina Finished Inv. 12 O 1. Sales budget for each quarter and for the year COGS 14 0 2 Production budget for each quarter and for the year Selline & Admin 17 0 3. Purchasing Budget for each quarter and for the year I/S 18 4. Direct labour budget for each quarter and for the year CVP IS 16 0 5. Manufacturing overhead budget for each quarter and for the year Cash 32 0 6. Selling and Administration budget Cash Worksheets 14 7. Worksheets for Collections and Disbursements B/S 24 0 8. Budgeted Income Statement Total 200 0 9. CVP Income Statement 10. Budgeted Cash Statement 11. Budgeted Balance Sheet Additional details: Fine Office Company produces two products P100 and 2200 Sales price per P100 is 5960 Sales price per P200 is $1. 104 . There are 800 units from P100 in finished goods inventory at the end of 2020 with a value of $ 160,000 and of 2020 valu 300,000 At the end of each quarter, Fine Office Company requires ending inventory to be equal to 8% of the following qua The required ending inventory for Dec. 31, 2021 are 600 units for P100 and 400 units for P200 Each P100 unit uses 96 sq. ft. of steel during the manufacturing process. The cost of steel for 2021 is estimated to be $ pers Each P200 unit uses 128 sq ft of steel during the manufacturing process Fine Office Company currently has 30,000 sq. ft. of steel in the beginnint inventory. At the end of each quarter, Fine Office Company wants to have 76,800 sq.ft of ending Inventory. Each product requires 7.68 machine hours and 3.84 direct labour hrs to produce. Direct Labour costs $ 26 88 per direct labour hour Fine Office Company allocates manufacturing overhead costs based on the estimated machine hours. Estimated manufacturing overhead cost for 2021 are. $ 1.209,600 and are all variable. For each quarter, it is estimated that . 40 % of sales will be cash and 60 % will be credit sales. Of the credit sales, 80% pay in the quarter of the sale and 20% pay in the following quarter. Credit sales from Q4 2020 were $1.300.000 Direct labour costs and manufacturing overhead costs are paid for in cash in the quarter they occurred. Assume operating expenses occur evenly throughout the year and are all paid in cash. For each quarter 70% of material purchases are paid for in cash in the quarter of the purchase and % are paid in the following quarter. Purchases of materials from 24 2020 were $1,500,000 Oo Fine Office Company Additional details continued Fine Office Company will pay 560,000 in dividends in Q4 . Currently, the cash balance in the bank is $15,000. Fine Office Company wants to maintain a minimum cash balance of $10,000 in the bank for each quarter. Budgeted sales volumes are P100 01 825 02 8832 Q3 8640 Q4 P200 Q1 9907 Q2 10598 Q3 10368 04 . Selling and Administration expenses for the budgeted year are as follows: : Variable Cost: Delivery costs are based on 5 03 per sales unit. Commissions are based on 0.1% of sales value. 9216 11059 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 34 85 86 87 88 HO Fixed Costs: Accounting & professional services Administrative & Sales Salaries Advertising Computer costs Depreciation Office Supplies Printing Insurance Property taxes Rent Utilities Total Fixed Costs $ 3600 140000 20000 9000 70000 5000 3000 4000 2000 40000 3400 300000 . Fine Office Company will purchase a new machine on 1/1/2021 worth $ 700000 and will make two equal payments. The first payment will be in Q2 and the second in 04. Assume the machine was purchased at the beginning of the year. Taxation is 30% on taxable income and paid at the end of Q4 each year Balance sheet information as at 31st December 2020 is as follows PPE $100,000 Accumulated Depreciation $100,000 Common Stock 5580,000 Retained Earnings $145,000 For Cost of goods sold (COGS). Add total costs of production + Beginning Finished goods - Ending Finished goods Inventory . Interest of 9000 on loans is paid in total at the end of the year and is a fixed cost. a ? 09 A 9:59 LTE 57% % ACCT5012 Project Student F21 - Unsaved A 5 : fx L 4 c D D E F G H I K L 3 4 5 6 7 7 8 Dir. Labour 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 20 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 Fine Office Company Marking Rubric Don't use marking cells Tab Max. Point Group Points Fine Office Company makes office furniture for offices. They are in the process of preparing Sales 7 a Master Budget including the Operating budget, Cash Statement. Income Statement Production 10 0 and Balance Sheet for 2021. The yearly budget is broken into quarters. The year end is Dir. Materials 13 0 31st December 2021. Your group has been requested to compile a master budget for the 5 5 0 fiscal year 2021 Manufacturing OH 18 0 Package is to include the following budgets; Cost of Endina Finished Inv. 12 O 1. Sales budget for each quarter and for the year COGS 14 0 2 Production budget for each quarter and for the year Selline & Admin 17 0 3. Purchasing Budget for each quarter and for the year I/S 18 4. Direct labour budget for each quarter and for the year CVP IS 16 0 5. Manufacturing overhead budget for each quarter and for the year Cash 32 0 6. Selling and Administration budget Cash Worksheets 14 7. Worksheets for Collections and Disbursements B/S 24 0 8. Budgeted Income Statement Total 200 0 9. CVP Income Statement 10. Budgeted Cash Statement 11. Budgeted Balance Sheet Additional details: Fine Office Company produces two products P100 and 2200 Sales price per P100 is 5960 Sales price per P200 is $1. 104 . There are 800 units from P100 in finished goods inventory at the end of 2020 with a value of $ 160,000 and of 2020 valu 300,000 At the end of each quarter, Fine Office Company requires ending inventory to be equal to 8% of the following qua The required ending inventory for Dec. 31, 2021 are 600 units for P100 and 400 units for P200 Each P100 unit uses 96 sq. ft. of steel during the manufacturing process. The cost of steel for 2021 is estimated to be $ pers Each P200 unit uses 128 sq ft of steel during the manufacturing process Fine Office Company currently has 30,000 sq. ft. of steel in the beginnint inventory. At the end of each quarter, Fine Office Company wants to have 76,800 sq.ft of ending Inventory. Each product requires 7.68 machine hours and 3.84 direct labour hrs to produce. Direct Labour costs $ 26 88 per direct labour hour Fine Office Company allocates manufacturing overhead costs based on the estimated machine hours. Estimated manufacturing overhead cost for 2021 are. $ 1.209,600 and are all variable. For each quarter, it is estimated that . 40 % of sales will be cash and 60 % will be credit sales. Of the credit sales, 80% pay in the quarter of the sale and 20% pay in the following quarter. Credit sales from Q4 2020 were $1.300.000 Direct labour costs and manufacturing overhead costs are paid for in cash in the quarter they occurred. Assume operating expenses occur evenly throughout the year and are all paid in cash. For each quarter 70% of material purchases are paid for in cash in the quarter of the purchase and % are paid in the following quarter. Purchases of materials from 24 2020 were $1,500,000 Oo Fine Office Company Additional details continued Fine Office Company will pay 560,000 in dividends in Q4 . Currently, the cash balance in the bank is $15,000. Fine Office Company wants to maintain a minimum cash balance of $10,000 in the bank for each quarter. Budgeted sales volumes are P100 01 825 02 8832 Q3 8640 Q4 P200 Q1 9907 Q2 10598 Q3 10368 04 . Selling and Administration expenses for the budgeted year are as follows: : Variable Cost: Delivery costs are based on 5 03 per sales unit. Commissions are based on 0.1% of sales value. 9216 11059 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 34 85 86 87 88 HO Fixed Costs: Accounting & professional services Administrative & Sales Salaries Advertising Computer costs Depreciation Office Supplies Printing Insurance Property taxes Rent Utilities Total Fixed Costs $ 3600 140000 20000 9000 70000 5000 3000 4000 2000 40000 3400 300000 . Fine Office Company will purchase a new machine on 1/1/2021 worth $ 700000 and will make two equal payments. The first payment will be in Q2 and the second in 04. Assume the machine was purchased at the beginning of the year. Taxation is 30% on taxable income and paid at the end of Q4 each year Balance sheet information as at 31st December 2020 is as follows PPE $100,000 Accumulated Depreciation $100,000 Common Stock 5580,000 Retained Earnings $145,000 For Cost of goods sold (COGS). Add total costs of production + Beginning Finished goods - Ending Finished goods Inventory . Interest of 9000 on loans is paid in total at the end of the year and is a fixed cost. a ? 09 A