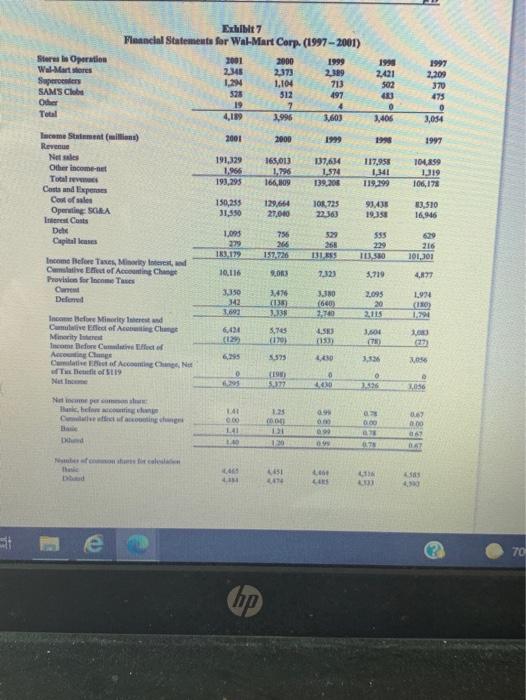

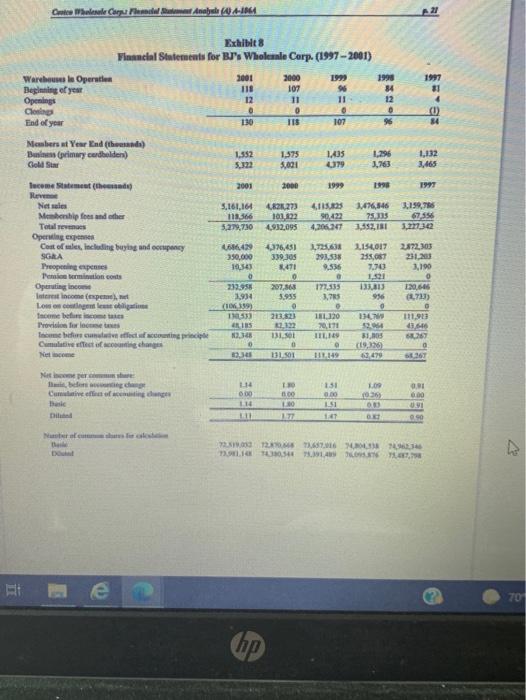

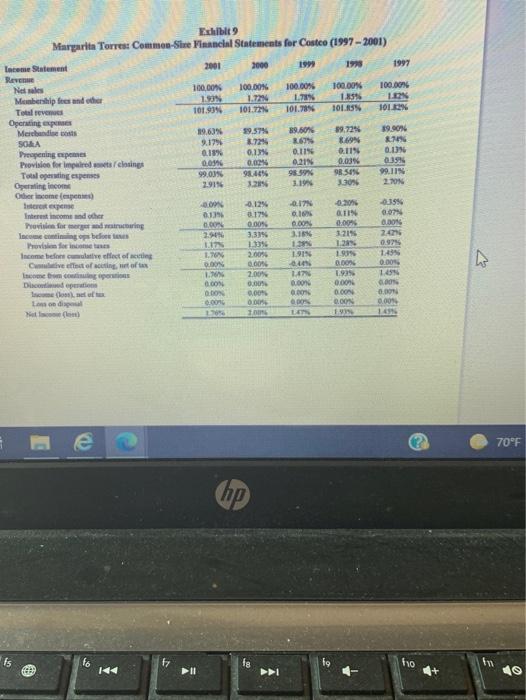

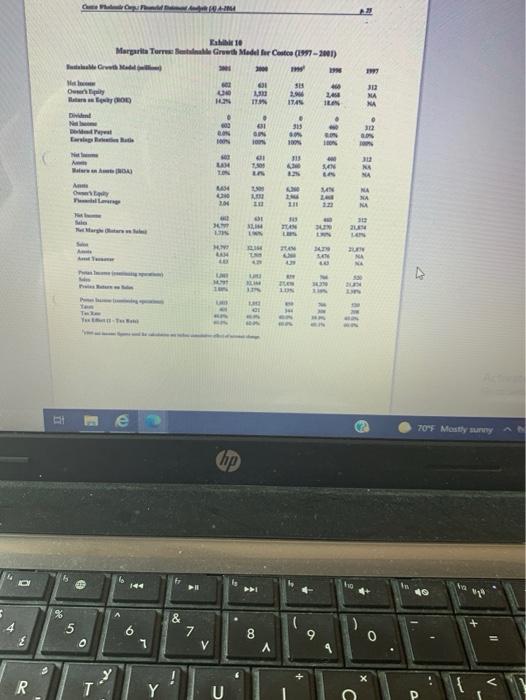

-9656/mod resource/content/O/COSTCW0A por - I Page Highlight frase fo US + AN Read soud v Draw COSTCO WHOLESALE CORPORATION FINANCIAL STATEMENT ANALYSIS (A) INTRODUCTION Margarita Torres first purchased ars in Cole Wholesale Corporation in 1997 part of her personal Investment portfolio. Between 1997 and 2002, she added slightly to her holdings from time to time when the company sold stock for what she felt was able valution, and up to that time she did not well any of her san. Having watched Costco grow from 265 warehouses 10 365 worldwide from sales revenus of $21.3 billion to $34.1 billion, she wondered what factors led to successful growth. She also was to determine whether the factors would hold consistent going forward At this point, Costco Was be of a special breed of relen eller wholesale clubs. Unlike other retailers, wholesale clube required ut customer porche a memberships in order to shop at their stores. Cosice operated chain of warehouses that sold food and merchandise large discounts to member customers. The company was able to maintain low mbylling items in bulk, keeping operating pees to mind turning investory over rapidly Costco's closest competitions were SAM'S Club division of Wal-Mart) and is Wholesale which both operated a wholesale clubs. Other competitors included general discounts (ach Wal-Mart), retail (such as grey orech (uch Safeway specially discounten (ich Best Buy). Torres first considered svesting is Costce be she be ww member. She was impromed by the company's low pod noticed la partir du her local Costco always crowded. She decided to reach the company ward ways, with the report. She discovered with dous growth potential, wrong operational efficiency, and added on Mock wing tableros Now, in July 2002, vi predsed well from her lavesten, he decided it was time to update her analysis and determine whether they will opening efficiently Chham 0.1 Wal-Mart also expanded its product offerings. Wees vold clothing, health and boy products, prescriptions, electronic, sporting poda, mind toys. In 191), Wal-Mart opened its fint SAM's wholesale club to compete with Price Club In 1987, Wal-Mart opened his first Supercenter, which included a full-tdproouyor song with the complete product line of a traditional Wal-Mart More. By 2000, Wal-Mart was also selling is product line through Walmart.com During this era of Wal-Mart expansion, another type of discounter developed specializing in the sake of only one category of product, such as clectronics, hardware, or fluwe Dubbed "category killers, the companies looked to beat discounters at their own game by achieving even greater efficiencies of sale. Although not all specially discounters gained ting see several conted to dominate their respective categories, including Home Depot, Circuit City. and Walgreens Discounters a specialty discounters had been very successful Maling sales from department ore. As a rewoli, general merchandises from Sears to JC Penney have been forond to reinvent themselves in order to stay in business. Whether they would need, however, was still in question. Montgomery Ward, a once-formidable competitor to Sees, was forced to shut down its stores in 2000 after 12 years of operations Wholesale Club The early 1980s saw the introduction of a new trend in real-the wholesale clubs Wholesale clubs we based on the premises discounters offer the best value to shoppers. They delivered that valo, bowever, in a different way. Pint, customers purchased mal membership in order to shop in the wores. Second, the clube carried a very limited selection of goods, generally 4,000 SKUs compared to 10,000 SKUs almost grocery or Where discounters and specialty discounters carried abroad product line, chule generally carried one or two brands in each cay, Third, the club soldiers in bulk. By limiting the selection of goods and selling in bulk, clubs were able to negotial discounts from venders and pass on these discounts to customers in the form of lower prices. These two factors alre allowed cloin totum inventory over for Fourth, the chilis koopmating expenses to a minimum. Low operating expenses are essential in order for me to maintain profitability, became they worked on very low gross murgins Clubs achieved low operating expenses by running their stress warehousestyle facilities and by reducing stocking con Wholesale clubs wental revenue and en growth of 12-15 percent during the 1990s compared to 5.6 percent malgrowth for generation Wholesale clubs expanded matically with limited. They pine trimis de and Mexion, borrowth wafective in Europe, South America, and Ald. Although prices of holesales were to starters, there were my challenge is growing intonally, including difference is pragu, com for con il lett for women regalai dinenientaries ( tanti ) Oullee Retailers Activate Windows Os 70F Mostly sunny du ENG Controle Guru Pendentement de 4.18 Costco Strategy In 2001, Costco was the largest wholesale club in the industry with sales of $34 billion. The company, however, was smaller than SAM'S in number of warehouses (365 for Costco va 528 for SAM'S). Contoo differentiated itself from SAM'S by targeting a wealthier clientele of small business owners and middle class shoppers (see Exhibit 4). Costoo, through its history with Price Club, took great pride in having invented and developed the club warehouse concept. The company demonstrated its value to customers by refusing to mark products more than 14 percent over the distributor's price. By comparison, a typical retailer marked up products 25 percent to 40 percent. Although selling items in bulk allowed for many operating efficiencies, management's main focus was on delivering the lowest per unit price on the products it nold. For example, a 100 flounice container of Tide liquid detergent would sell at a general retailer for $8.99, or $0.0899 per flounce. At Wal-Mart, a 100 ounce container sold for $744, or $0.0744 per flounce. Costco sold the same detergent in a 300 fl. ounce container at a price of $17.99, or $0.06 fl. per ounce. Costco was able to sell it such a low per unit cost precisely because of its bulk packaging. The size of the container, however, was not maximized in order to compel consumers to purchase more goods. Costco had a policy of not increasing the size of a container unless it resulted in a lower per unit cost. That is, they would not sell Tide detergent in containers greater than 300 n. ounces unless the resulting price was less than $0.06 per flounce. They believed that lowering the unit price of goods was what allowed them to deliver value to the customer. Selling through Costco was a mixed blessing for product manufacturers. On the one hand, Costos offered a broad distribution channel that brought increased revenues. In addit Costco only purchased a handful of SKUs from its vendors. This allowed manufacturer greatly reduce production costs. For example, when Costo ordered toilet paper from Kimberly Clark, it ordered one color, one print, and one ply. This allowed Kimberly Clark to set up the production line only once and run continuous butches of the same product, lowering per unit production costs. On the other hand, because Costco was a powerful purchaser, it could demand that production savings be passed on to itself in the form of lower prices. As a roult, the manufacturer would se increased revenue, but increases in profits would be limited. Costco passed these savings on to its own costomers. The result was lower profits throughout the supply chain Costco created value for the customer through these saving. This drove the value of its membership and allowed Costco to raise fees over time. In 1986, Coco's membership fee was $25. By 2002, i was $45. The more savings Costco was able to pass on to customers, the more it would be able to increase its membership fee over time. Costo also delivered value to customers by expanding its selection of name brand products and by adding ancillary services Costco offered whitems as Levi's jeans, Polo bed comforters and Compaq computers. Through its proprietary band, Kirkland, the company offered everything from cheese and to cream to cook wee and ytami. Kirkland products were developed wherever Costco recognized and for high quality, low cost items that did not exist in the market in addition, Costcode photo developesent service pharmacies wation and tire changing stations in many of its store. The company also increased its fresh food department added high-end wines and jeweley is an improve the woods of it (hp) The answer er 1994 diges Build of 1 2001, SAMS L an ninh, de ledes BC by bong SAMSwing 2000 These www eyes Most SMS diety where locale, SANS ha webcoming en The Club bewed South W. With www how wwwww face, which con Dule 3000 ASANS ayland 4 win DallComed hotos wirely When 's WeChat Car was Med May 2007 do the Sa te wees as we Collectie pode werden heda Cos www110.000 TE000SL.000 www AB ga shop The www Cu www SAM'S. I love che V. Other So www Blade uan ctivation i e 70F Mostly sunny A4 ENG Porvoo hp ) - + 2 OD Page view A Read aloud V Draw Highlight Erase mk kal otty, toma, apathanai daya in the modo particolaringolo As the viewerwe could be product of the following me to Fings Rento Divide you ale Rang 10-Notice's Egy Ir a computed all of the divided you to www noto wa ped out more of an added in te for imateath its laila is est le for every week inity Sep 2. La The ROEG be the fact of the full i dobrany maalai business 15 persone capital and bow 10pt financiallerge WinROL Fatherstin *Tiancial Legity At the sum of planplayed the late in the w of the well predibility will no di been fee to shareholdes und dereitos Resep the la RA (ROA) - Not A Ilydowe Coco's Roethe, Tom wwwanden levende how the whey' Yawwal Marger A comprometer do od Wicher mange gode pri The first it weer will Solaris Tweed come which we bow pret was por dollar of Areeyer- Mariame www + D Page view A Read aloud Draw NHIa (0444 EMME Retailed Wholesale Tradea Pretage of GDP 1950 1960 1970 1900 1990 Grow do 241 415 DOI 2,708 5.546 product, he Ratul wwele 41 64 121 07 184 trade, the Tell A whole 17 19 15% 10% 1 trade, as of GDP 2000 9,873 1560 16 U.S. Theory, 1912 1911 Per Capital 1940 . 1956 1.192 Godt produto 1990 23,215 2000 M.194 12.276 10205 4.101 19.614 300 216 2591 17.13 23.79 Detlepel. Inc Pral 12 ci 3.166 2,11 15. 3014 e 70F Mostly sur hip Camera and Alb (4-JA AIT Exhibit Financial Statements for Sears, Roebuck (1997-2001) 3001 867 1990 1991 Store Full-time Specialty Total 2000 16 2151 21 1999 338 2153 2011 345 2198 306 103 2697 3530 2135 Income Stations) 2001 2000 1999 1998 1997 Revens Merchandwrvos Credit financial proiectare Terve 35.000 1235 41,078 3666 47 40.927 36,728 40 4. DTI 36,704 4618 1322 3671 4933 41,2% 24,721 2,607 11 27.212 LI 871 Cod Expo Cost of buying Selling and ministe Provimet Proin for previously red rece Deprecation and on Special charges Terally Opening Oder icons, 26.122 22 1.344 572 165 1413 542 39.900 LIT es 27,257 IS 27 10 1.23 39 548 24779 12 1.392 0 735 1,400 373 39.33 1994 146 al 11.750 352 19.469 1 23 20 6 . 1.223 447 21 735 1723 31 19 2419 904 Tomboy Is Mintys Net Income wyling Net 1,453 912 30 LIR 0 24 le 1,45 Net 2. 24 ER 10 3. Number 13 . 33 2792 1977 WE DO T 70F Mol hp Exhibit 7 Flancial Statements for Wal-Mart Corp. (1997-2001) 1999 2,389 Sterlin Operation Wal-Marters Superles SAM'S Club Other Total 2001 2,345 LIN 528 19 4,199 2000 2373 1,104 312 2 1996 1997 2,209 370 713 497 4 1990 2421 502 3 0 3,405 3603 0 3,054 2001 2000 1999 1998 1997 104,859 191,329 1,966 193,295 165,013 1.796 166,109 137.634 1.524 139.705 117,955 1.341 119,199 1319 106,178 Income Stainment (is) Revenue Notes Other income To Casts and pas Cost of Opening SORA Interest Costs Det Capitals 150,235 31,550 129,664 27.000 JOR 725 22363 93.435 83,510 16.946 19,350 629 1,005 239 183,179 756 265 1572226 529 268 131.28 555 229 IL 30 216 101,301 10.116 9.03 7323 Income Before Tex Mint Interest, Castle Effect of Accounting Chang Provision for Income Tanes Can Defend 3.719 4.877 3350 142 3,692 2.414 (135) 3.338 33N0 (640 1.740 2,095 20 2125 1,974 (10) 1.29 6,434 (129) 5,75 1020 4.53 115) 3.60 (7) Incolore Minority read Come flet of Ang Chung Minority best Income Bon Coiffure Aanaa Cate of Accounting Net Bet of 19 Net In $_35 4230 3:56 20 19 5.377 0 44 3.926 56 Ne per Tha hau HHHV Vit Cew cooling 09 1.41 000 LI 02 0.00 1.25 OD 21 130 090 09 00 067 LAT 078 Nocal 4451 LES 40 70 op Gente elesale Carpi: Finala Automaat Analyule (10.A-1004 Exhibit 8 Financial Statements for BJ's Wholesale Corp. (1997-2001) Wareho la Operation Beginning of your Openings Closing End of year 2001 118 12 . 130 2000 107 11 0 TIS 1999 96 11 0 107 1998 84 12 0 96 1997 31 6 CO) 84 Mashers at Year End (thead) Burimary cardholders) Gold Sim 1.552 5.333 1.375 5.01 1435 U19 1.296 1.763 1,132 3,465 2001 2000 1999 1990 1997 5,161,164 13366 5,279,730 UZK. 273 101 102 4932,095 411.23 30,122 4.2002 14,545 75.333 3,352,181 3.1995 67.556 3.2302 Income Smet (head Rev Net Mopfes and other Total Operating en Cost of, including buying and company SGRA Preopeningen amminos Operating income Interest (expert Lorem aligai Income before Provision for lo Icebe cesting price Cumulative effect of the 376,451 339305 1.4TI 0 207,565 5.955 1,7338 29.338 2.535 2152017 235,08T 7.70 1.21 1333 956 849 350.000 10.30 0 232.95 1934 (1399) 11:53 ERIES 12.38 0 2, 3 172335 3,7 0 181. 120 20.111 10,1 272,303 231.20 3,190 O 120606 01733) 0 111.901 41.446 067 213.82 22 131.0 130W 52,054 31,103 (1936) 3479 131 501 149 5367 Ne per Cum effe og Basic Di 000 14 1.09 03 151 0.00 151 1 10 0.81 6.00 0.91 0.90 Natural 22.12.2016 13.11.1949, te 70 hp Exhibit Margarita Torres: Commen Sie Financial Statements for Costco (1997 - 2001) 2001 2000 1999 1990 1997 100.00 1.93N 101N 100.COM 1.72 101.72 100.00% 1.78% 101.78 100.00N 1.85 101 AS 100.00 1. 101. 19.6% 9.17 Lone Statement Rave News Membership fees and other Totale Operating expenses Mercado SOLA Propeningen Provision for impresclosings Total operating expenses Gewing income Other income pe Interest income and other how forming Income contigo for in Income becamate elect of iting Cheet of songs of tax Ibum on Discount Icon Las on disa 19.57% 3.725 0.1 0.00 98.4% 3.21% 89.50% 2679 011 021N 983 1.19 19.724 RON 0.11% 0.035 98.50% 3.30% 19.90 AN 0.13 39 99. IN 2.70 0.051 99.JS 2.9114 DOWN 11 . 2.97 1. 1. DON . -0.12% 0.17 0.00% 3.3.15 104 2.00% 0.00 2.00% 0.00% 0.00% 0.00 -0.17 0.10 C.COM 3.18 13 LIN 02 LIIN 2.00 3219 12 10 0.00% 155 0:07 0.00 20 0.97 145 0.00 1N 12 LAN 0.00 DON con 0.00 DOON 0.00 ON 0.001 16 70F hp 16 18 110 f 1 40 -100 22 Rabbit 10 Margarita Torre delle Growth Model for Costco (1997-2001) Tervet 2000 LA 109 We Only later we n 1.30 ITIN SU 29 ITAS 460 24 ILEN HUN NG LON MO w WE w NOUT ID HT 7.500 NO INDA NA NA NE WT 251 21 118 119 999 $1235641 NA NA NA BE DIT 111 1 143 TUN MET 2 LE H. BU VN UN NA LE TE WE UN E NA ID Yete w E e 70F Most hp O el % 5 9 & 7 V 8 3 0 7 1 RY ! U C P COSTCO A QUESTIONS: A. Has Costco become more or less efficient over time? B. What are the various ratios computed to analyze financial statements? C. Compute and analyze the trend analysis of the company, D. How it has financed its growth? E. What areas of improvement can you suggest for the future? Organize your analysis as Common size analysis, Sustainable growth models, and benchmarking ratio (industry benchmark). e 70F Mostly sunny & ENG -9656/mod resource/content/O/COSTCW0A por - I Page Highlight frase fo US + AN Read soud v Draw COSTCO WHOLESALE CORPORATION FINANCIAL STATEMENT ANALYSIS (A) INTRODUCTION Margarita Torres first purchased ars in Cole Wholesale Corporation in 1997 part of her personal Investment portfolio. Between 1997 and 2002, she added slightly to her holdings from time to time when the company sold stock for what she felt was able valution, and up to that time she did not well any of her san. Having watched Costco grow from 265 warehouses 10 365 worldwide from sales revenus of $21.3 billion to $34.1 billion, she wondered what factors led to successful growth. She also was to determine whether the factors would hold consistent going forward At this point, Costco Was be of a special breed of relen eller wholesale clubs. Unlike other retailers, wholesale clube required ut customer porche a memberships in order to shop at their stores. Cosice operated chain of warehouses that sold food and merchandise large discounts to member customers. The company was able to maintain low mbylling items in bulk, keeping operating pees to mind turning investory over rapidly Costco's closest competitions were SAM'S Club division of Wal-Mart) and is Wholesale which both operated a wholesale clubs. Other competitors included general discounts (ach Wal-Mart), retail (such as grey orech (uch Safeway specially discounten (ich Best Buy). Torres first considered svesting is Costce be she be ww member. She was impromed by the company's low pod noticed la partir du her local Costco always crowded. She decided to reach the company ward ways, with the report. She discovered with dous growth potential, wrong operational efficiency, and added on Mock wing tableros Now, in July 2002, vi predsed well from her lavesten, he decided it was time to update her analysis and determine whether they will opening efficiently Chham 0.1 Wal-Mart also expanded its product offerings. Wees vold clothing, health and boy products, prescriptions, electronic, sporting poda, mind toys. In 191), Wal-Mart opened its fint SAM's wholesale club to compete with Price Club In 1987, Wal-Mart opened his first Supercenter, which included a full-tdproouyor song with the complete product line of a traditional Wal-Mart More. By 2000, Wal-Mart was also selling is product line through Walmart.com During this era of Wal-Mart expansion, another type of discounter developed specializing in the sake of only one category of product, such as clectronics, hardware, or fluwe Dubbed "category killers, the companies looked to beat discounters at their own game by achieving even greater efficiencies of sale. Although not all specially discounters gained ting see several conted to dominate their respective categories, including Home Depot, Circuit City. and Walgreens Discounters a specialty discounters had been very successful Maling sales from department ore. As a rewoli, general merchandises from Sears to JC Penney have been forond to reinvent themselves in order to stay in business. Whether they would need, however, was still in question. Montgomery Ward, a once-formidable competitor to Sees, was forced to shut down its stores in 2000 after 12 years of operations Wholesale Club The early 1980s saw the introduction of a new trend in real-the wholesale clubs Wholesale clubs we based on the premises discounters offer the best value to shoppers. They delivered that valo, bowever, in a different way. Pint, customers purchased mal membership in order to shop in the wores. Second, the clube carried a very limited selection of goods, generally 4,000 SKUs compared to 10,000 SKUs almost grocery or Where discounters and specialty discounters carried abroad product line, chule generally carried one or two brands in each cay, Third, the club soldiers in bulk. By limiting the selection of goods and selling in bulk, clubs were able to negotial discounts from venders and pass on these discounts to customers in the form of lower prices. These two factors alre allowed cloin totum inventory over for Fourth, the chilis koopmating expenses to a minimum. Low operating expenses are essential in order for me to maintain profitability, became they worked on very low gross murgins Clubs achieved low operating expenses by running their stress warehousestyle facilities and by reducing stocking con Wholesale clubs wental revenue and en growth of 12-15 percent during the 1990s compared to 5.6 percent malgrowth for generation Wholesale clubs expanded matically with limited. They pine trimis de and Mexion, borrowth wafective in Europe, South America, and Ald. Although prices of holesales were to starters, there were my challenge is growing intonally, including difference is pragu, com for con il lett for women regalai dinenientaries ( tanti ) Oullee Retailers Activate Windows Os 70F Mostly sunny du ENG Controle Guru Pendentement de 4.18 Costco Strategy In 2001, Costco was the largest wholesale club in the industry with sales of $34 billion. The company, however, was smaller than SAM'S in number of warehouses (365 for Costco va 528 for SAM'S). Contoo differentiated itself from SAM'S by targeting a wealthier clientele of small business owners and middle class shoppers (see Exhibit 4). Costoo, through its history with Price Club, took great pride in having invented and developed the club warehouse concept. The company demonstrated its value to customers by refusing to mark products more than 14 percent over the distributor's price. By comparison, a typical retailer marked up products 25 percent to 40 percent. Although selling items in bulk allowed for many operating efficiencies, management's main focus was on delivering the lowest per unit price on the products it nold. For example, a 100 flounice container of Tide liquid detergent would sell at a general retailer for $8.99, or $0.0899 per flounce. At Wal-Mart, a 100 ounce container sold for $744, or $0.0744 per flounce. Costco sold the same detergent in a 300 fl. ounce container at a price of $17.99, or $0.06 fl. per ounce. Costco was able to sell it such a low per unit cost precisely because of its bulk packaging. The size of the container, however, was not maximized in order to compel consumers to purchase more goods. Costco had a policy of not increasing the size of a container unless it resulted in a lower per unit cost. That is, they would not sell Tide detergent in containers greater than 300 n. ounces unless the resulting price was less than $0.06 per flounce. They believed that lowering the unit price of goods was what allowed them to deliver value to the customer. Selling through Costco was a mixed blessing for product manufacturers. On the one hand, Costos offered a broad distribution channel that brought increased revenues. In addit Costco only purchased a handful of SKUs from its vendors. This allowed manufacturer greatly reduce production costs. For example, when Costo ordered toilet paper from Kimberly Clark, it ordered one color, one print, and one ply. This allowed Kimberly Clark to set up the production line only once and run continuous butches of the same product, lowering per unit production costs. On the other hand, because Costco was a powerful purchaser, it could demand that production savings be passed on to itself in the form of lower prices. As a roult, the manufacturer would se increased revenue, but increases in profits would be limited. Costco passed these savings on to its own costomers. The result was lower profits throughout the supply chain Costco created value for the customer through these saving. This drove the value of its membership and allowed Costco to raise fees over time. In 1986, Coco's membership fee was $25. By 2002, i was $45. The more savings Costco was able to pass on to customers, the more it would be able to increase its membership fee over time. Costo also delivered value to customers by expanding its selection of name brand products and by adding ancillary services Costco offered whitems as Levi's jeans, Polo bed comforters and Compaq computers. Through its proprietary band, Kirkland, the company offered everything from cheese and to cream to cook wee and ytami. Kirkland products were developed wherever Costco recognized and for high quality, low cost items that did not exist in the market in addition, Costcode photo developesent service pharmacies wation and tire changing stations in many of its store. The company also increased its fresh food department added high-end wines and jeweley is an improve the woods of it (hp) The answer er 1994 diges Build of 1 2001, SAMS L an ninh, de ledes BC by bong SAMSwing 2000 These www eyes Most SMS diety where locale, SANS ha webcoming en The Club bewed South W. With www how wwwww face, which con Dule 3000 ASANS ayland 4 win DallComed hotos wirely When 's WeChat Car was Med May 2007 do the Sa te wees as we Collectie pode werden heda Cos www110.000 TE000SL.000 www AB ga shop The www Cu www SAM'S. I love che V. Other So www Blade uan ctivation i e 70F Mostly sunny A4 ENG Porvoo hp ) - + 2 OD Page view A Read aloud V Draw Highlight Erase mk kal otty, toma, apathanai daya in the modo particolaringolo As the viewerwe could be product of the following me to Fings Rento Divide you ale Rang 10-Notice's Egy Ir a computed all of the divided you to www noto wa ped out more of an added in te for imateath its laila is est le for every week inity Sep 2. La The ROEG be the fact of the full i dobrany maalai business 15 persone capital and bow 10pt financiallerge WinROL Fatherstin *Tiancial Legity At the sum of planplayed the late in the w of the well predibility will no di been fee to shareholdes und dereitos Resep the la RA (ROA) - Not A Ilydowe Coco's Roethe, Tom wwwanden levende how the whey' Yawwal Marger A comprometer do od Wicher mange gode pri The first it weer will Solaris Tweed come which we bow pret was por dollar of Areeyer- Mariame www + D Page view A Read aloud Draw NHIa (0444 EMME Retailed Wholesale Tradea Pretage of GDP 1950 1960 1970 1900 1990 Grow do 241 415 DOI 2,708 5.546 product, he Ratul wwele 41 64 121 07 184 trade, the Tell A whole 17 19 15% 10% 1 trade, as of GDP 2000 9,873 1560 16 U.S. Theory, 1912 1911 Per Capital 1940 . 1956 1.192 Godt produto 1990 23,215 2000 M.194 12.276 10205 4.101 19.614 300 216 2591 17.13 23.79 Detlepel. Inc Pral 12 ci 3.166 2,11 15. 3014 e 70F Mostly sur hip Camera and Alb (4-JA AIT Exhibit Financial Statements for Sears, Roebuck (1997-2001) 3001 867 1990 1991 Store Full-time Specialty Total 2000 16 2151 21 1999 338 2153 2011 345 2198 306 103 2697 3530 2135 Income Stations) 2001 2000 1999 1998 1997 Revens Merchandwrvos Credit financial proiectare Terve 35.000 1235 41,078 3666 47 40.927 36,728 40 4. DTI 36,704 4618 1322 3671 4933 41,2% 24,721 2,607 11 27.212 LI 871 Cod Expo Cost of buying Selling and ministe Provimet Proin for previously red rece Deprecation and on Special charges Terally Opening Oder icons, 26.122 22 1.344 572 165 1413 542 39.900 LIT es 27,257 IS 27 10 1.23 39 548 24779 12 1.392 0 735 1,400 373 39.33 1994 146 al 11.750 352 19.469 1 23 20 6 . 1.223 447 21 735 1723 31 19 2419 904 Tomboy Is Mintys Net Income wyling Net 1,453 912 30 LIR 0 24 le 1,45 Net 2. 24 ER 10 3. Number 13 . 33 2792 1977 WE DO T 70F Mol hp Exhibit 7 Flancial Statements for Wal-Mart Corp. (1997-2001) 1999 2,389 Sterlin Operation Wal-Marters Superles SAM'S Club Other Total 2001 2,345 LIN 528 19 4,199 2000 2373 1,104 312 2 1996 1997 2,209 370 713 497 4 1990 2421 502 3 0 3,405 3603 0 3,054 2001 2000 1999 1998 1997 104,859 191,329 1,966 193,295 165,013 1.796 166,109 137.634 1.524 139.705 117,955 1.341 119,199 1319 106,178 Income Stainment (is) Revenue Notes Other income To Casts and pas Cost of Opening SORA Interest Costs Det Capitals 150,235 31,550 129,664 27.000 JOR 725 22363 93.435 83,510 16.946 19,350 629 1,005 239 183,179 756 265 1572226 529 268 131.28 555 229 IL 30 216 101,301 10.116 9.03 7323 Income Before Tex Mint Interest, Castle Effect of Accounting Chang Provision for Income Tanes Can Defend 3.719 4.877 3350 142 3,692 2.414 (135) 3.338 33N0 (640 1.740 2,095 20 2125 1,974 (10) 1.29 6,434 (129) 5,75 1020 4.53 115) 3.60 (7) Incolore Minority read Come flet of Ang Chung Minority best Income Bon Coiffure Aanaa Cate of Accounting Net Bet of 19 Net In $_35 4230 3:56 20 19 5.377 0 44 3.926 56 Ne per Tha hau HHHV Vit Cew cooling 09 1.41 000 LI 02 0.00 1.25 OD 21 130 090 09 00 067 LAT 078 Nocal 4451 LES 40 70 op Gente elesale Carpi: Finala Automaat Analyule (10.A-1004 Exhibit 8 Financial Statements for BJ's Wholesale Corp. (1997-2001) Wareho la Operation Beginning of your Openings Closing End of year 2001 118 12 . 130 2000 107 11 0 TIS 1999 96 11 0 107 1998 84 12 0 96 1997 31 6 CO) 84 Mashers at Year End (thead) Burimary cardholders) Gold Sim 1.552 5.333 1.375 5.01 1435 U19 1.296 1.763 1,132 3,465 2001 2000 1999 1990 1997 5,161,164 13366 5,279,730 UZK. 273 101 102 4932,095 411.23 30,122 4.2002 14,545 75.333 3,352,181 3.1995 67.556 3.2302 Income Smet (head Rev Net Mopfes and other Total Operating en Cost of, including buying and company SGRA Preopeningen amminos Operating income Interest (expert Lorem aligai Income before Provision for lo Icebe cesting price Cumulative effect of the 376,451 339305 1.4TI 0 207,565 5.955 1,7338 29.338 2.535 2152017 235,08T 7.70 1.21 1333 956 849 350.000 10.30 0 232.95 1934 (1399) 11:53 ERIES 12.38 0 2, 3 172335 3,7 0 181. 120 20.111 10,1 272,303 231.20 3,190 O 120606 01733) 0 111.901 41.446 067 213.82 22 131.0 130W 52,054 31,103 (1936) 3479 131 501 149 5367 Ne per Cum effe og Basic Di 000 14 1.09 03 151 0.00 151 1 10 0.81 6.00 0.91 0.90 Natural 22.12.2016 13.11.1949, te 70 hp Exhibit Margarita Torres: Commen Sie Financial Statements for Costco (1997 - 2001) 2001 2000 1999 1990 1997 100.00 1.93N 101N 100.COM 1.72 101.72 100.00% 1.78% 101.78 100.00N 1.85 101 AS 100.00 1. 101. 19.6% 9.17 Lone Statement Rave News Membership fees and other Totale Operating expenses Mercado SOLA Propeningen Provision for impresclosings Total operating expenses Gewing income Other income pe Interest income and other how forming Income contigo for in Income becamate elect of iting Cheet of songs of tax Ibum on Discount Icon Las on disa 19.57% 3.725 0.1 0.00 98.4% 3.21% 89.50% 2679 011 021N 983 1.19 19.724 RON 0.11% 0.035 98.50% 3.30% 19.90 AN 0.13 39 99. IN 2.70 0.051 99.JS 2.9114 DOWN 11 . 2.97 1. 1. DON . -0.12% 0.17 0.00% 3.3.15 104 2.00% 0.00 2.00% 0.00% 0.00% 0.00 -0.17 0.10 C.COM 3.18 13 LIN 02 LIIN 2.00 3219 12 10 0.00% 155 0:07 0.00 20 0.97 145 0.00 1N 12 LAN 0.00 DON con 0.00 DOON 0.00 ON 0.001 16 70F hp 16 18 110 f 1 40 -100 22 Rabbit 10 Margarita Torre delle Growth Model for Costco (1997-2001) Tervet 2000 LA 109 We Only later we n 1.30 ITIN SU 29 ITAS 460 24 ILEN HUN NG LON MO w WE w NOUT ID HT 7.500 NO INDA NA NA NE WT 251 21 118 119 999 $1235641 NA NA NA BE DIT 111 1 143 TUN MET 2 LE H. BU VN UN NA LE TE WE UN E NA ID Yete w E e 70F Most hp O el % 5 9 & 7 V 8 3 0 7 1 RY ! U C P COSTCO A QUESTIONS: A. Has Costco become more or less efficient over time? B. What are the various ratios computed to analyze financial statements? C. Compute and analyze the trend analysis of the company, D. How it has financed its growth? E. What areas of improvement can you suggest for the future? Organize your analysis as Common size analysis, Sustainable growth models, and benchmarking ratio (industry benchmark). e 70F Mostly sunny & ENG