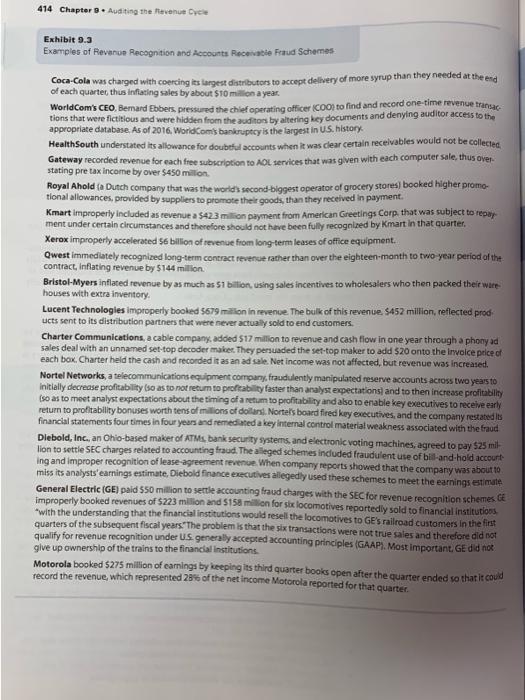

9-7 LO 3 Refer to Exhibit 9.3 and to the Focus on Fraud features "Channel Stuffing at ArthroCare-The Importance of Professional Skepticism" and "Assisted Living Concepts (ALC) Revenue Cycle Fraud and the Improper Professional Conduct of Grant Thornton's Audit Partners." What methods do companies use to fraudulently inflate revenue? How can auditors use professional skepticism to help identify these fraud schemes? 414 Chapter 3 - Auditing the Havenue dice Exhibit 9.3 Examples of Revenue Recognition and accounts Receivable Fraud Schemes: Coca-Cola was charged with coercing its largest distributors to accept delivery of more syrup than they needed at the end of each quarter, thus inflating sales by about $10 milion a year World Com's CEO Bemard Ebbers, pressured the chief operating officer (coo) to find and record one-time revenue transac tions that were fictitious and were hidden from the auditors by altering key documents and denying auditor access to the appropriate database. As of 2016. Worldcom bankruptcy is the largest in US history HealthSouth understated its allowance for doubtful accounts when it was clear certain receivables would not be collected Gateway recorded revenue for each free subscription to AOL services that was given with each computer sale, thus over stating pre tax income by over $450 million Royal Ahold a Dutch company that was the world's second biggest operator of grocery stores) booked higher promo- tional allowances, provided by suppliers to promote their goods, than they received in payment. Kmart improperly included as revenue a 5423 milion payment from American Greetings Corp that was subject to repay ment under certain circumstances and therefore should not have been fully recognized by Kmart in that quarter. Xerox improperly accelerated 56 billion of revenue from long-term leases of office equipment Qwest immediately recognized long-term contract sevenue rather than over the eighteen-month to two year period of the contract, inflating revenue by $144 milion Bristol-Myers inflated revenue by as much as 51 billion, using sales incentives to wholesalers who then packed their were houses with extra inventory Lucent Technologles improperly booked 5679 million in revenue. The bulk of this revenue $452 million, reflected prod ucts sent to its distribution partners that were never actually sold to end customers. Charter Communications, a cable company added 517 million to revenue and cash flow in one year through a phony ad sales deal with an unnamed set-top decoder makes. They persuaded the set-top maker to add 520 onto the involce price of each box. Charter held the cash and recorded it as an ad sale. Net income was not affected, but revenue was increased Nortel Networks, a telecommunication equipment company fraudulently manipulated reserve accounts across two years to initially decrease profitability (so as to not return to profitability faster than analyse expectations and to the increase profitability Iso as to meet analyst expectations about the timing of a retum to profitability and also to enable key executives to receive early return to profitability bonuses worth tens of millions of dollars Nortels board fired key executives, and the company restated is financial statements four times in four years and remediated a key internal control material weakness associated with the fraud Diebold, Inc., an Ohio-based maker of ATMs, bank security systems and electronic voting machines, agreed to pay 525 mil- lion to settle SEC charges related to accounting fraud. The alleged schemes included fraudulent use of bill and hold account ing and improper recognition of lease-agreement revenue when company reports showed that the company was about to miss its analysts earnings estimate, Diebold finance executives allegedly used these schemes to meet the earnings estimate General Electric (GE) paid 550 million to settle accounting fraud charges with the SEC for revenue recognition schemes GE improperly booked revenues of $223 million and 5158 million for six locomotives reportedly sold to financial institutions with the understanding that the financial institutions would resell the locomotives to GE's railroad customers in the first quarters of the subsequent fiscal years. The problem is that the six transactions were not true sales and therefore did not qualify for revenue recognition under US generally accepted accounting principles (GAAP). Most important. Ge did not give up ownership of the trains to the financial Institutions Motorola booked $275 million of earnings by keeping its third quarter books open after the quarter ended so that it could record the revenue, which represented 23% of the net income Motorola reported for that quarter