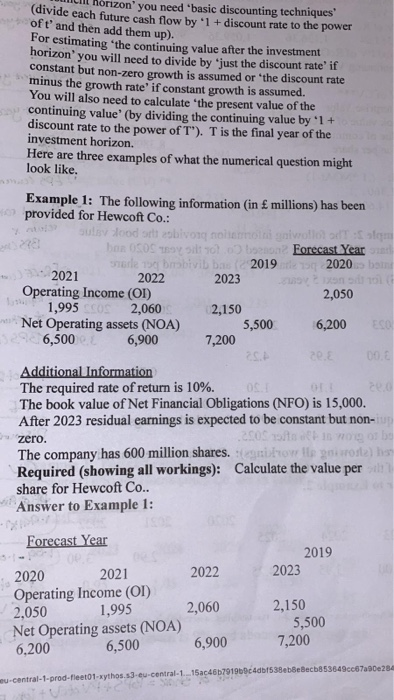

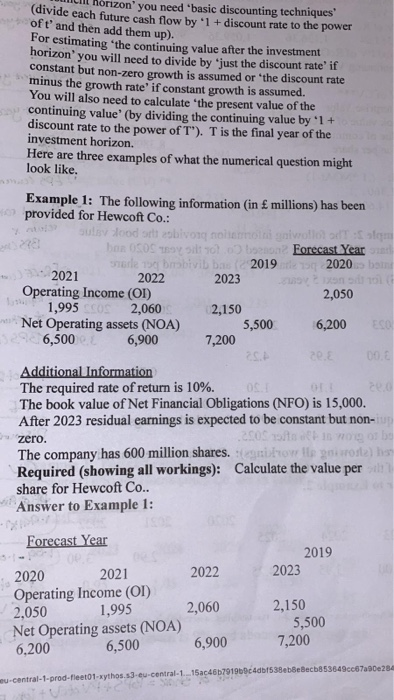

divide by just minne tout non-zero w ill horizon' you need basic discounting techniques (divide each future cash flow by 1 + discount rate to the power of t' and then add them up). For estimating the continuing value after the investment horizon' you will need to divide by just the discount rate if constant but non-zero growth is assumed or the discount rate minus the growth rate' if constant growth is assumed. You will also need to calculate the present value of the continuing value' (by dividing the continuing value by 'I + discount rate to the power of T'). T is the final year of the investment horizon. Here are three examples of what the numerical question might look like. 5,500 Example 1: The following information (in millions) has been provided for Hewcoft Co.: Sulev lood sobivog rolignivoll n bon OSOS 7.0 ozon Forecast Year Store og brobivib bas 2019 2020 batt 2021 2022 2023 5 Operating Income (OI) 2,050 1,995 COS2,060 2,150 Net Operating assets (NOA) 6,200 ESO 6,500 6,900 7,200 20E 00. Additional Information The required rate of return is 10%. O 20.0 The book value of Net Financial Obligations (NFO) is 15,000. After 2023 residual earnings is expected to be constant but non- zero. COS O O bo The company has 600 million shares how to getrosta en Required (showing all workings): Calculate the value per share for Hewcoft Co.. Answer to Example 1: Forecast Year 2019 2023 2020 2021 2022 Operating Income (OI) 2,050 1,995 2,060 Net Operating assets (NOA) 6.200 6,500 6,900 2,150 5,500 7,200 central-1-prod-feet01-xythos.s3-eu-central-1...15ac46b791900c4dbt538eebecb853646667000284 - divide by just minne tout non-zero w ill horizon' you need basic discounting techniques (divide each future cash flow by 1 + discount rate to the power of t' and then add them up). For estimating the continuing value after the investment horizon' you will need to divide by just the discount rate if constant but non-zero growth is assumed or the discount rate minus the growth rate' if constant growth is assumed. You will also need to calculate the present value of the continuing value' (by dividing the continuing value by 'I + discount rate to the power of T'). T is the final year of the investment horizon. Here are three examples of what the numerical question might look like. 5,500 Example 1: The following information (in millions) has been provided for Hewcoft Co.: Sulev lood sobivog rolignivoll n bon OSOS 7.0 ozon Forecast Year Store og brobivib bas 2019 2020 batt 2021 2022 2023 5 Operating Income (OI) 2,050 1,995 COS2,060 2,150 Net Operating assets (NOA) 6,200 ESO 6,500 6,900 7,200 20E 00. Additional Information The required rate of return is 10%. O 20.0 The book value of Net Financial Obligations (NFO) is 15,000. After 2023 residual earnings is expected to be constant but non- zero. COS O O bo The company has 600 million shares how to getrosta en Required (showing all workings): Calculate the value per share for Hewcoft Co.. Answer to Example 1: Forecast Year 2019 2023 2020 2021 2022 Operating Income (OI) 2,050 1,995 2,060 Net Operating assets (NOA) 6.200 6,500 6,900 2,150 5,500 7,200 central-1-prod-feet01-xythos.s3-eu-central-1...15ac46b791900c4dbt538eebecb853646667000284