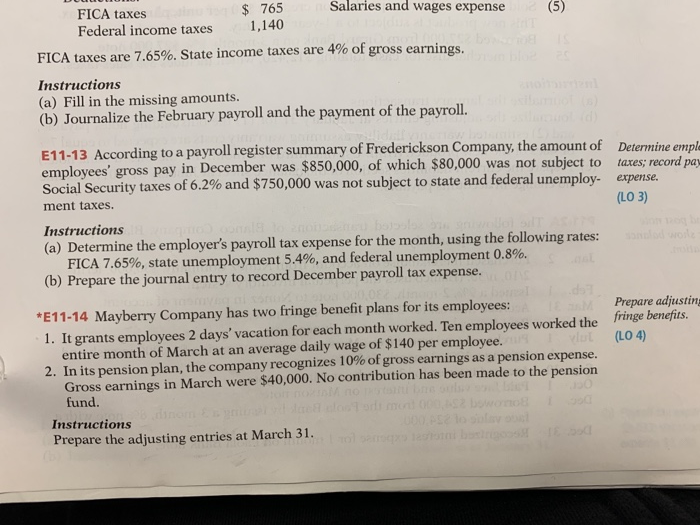

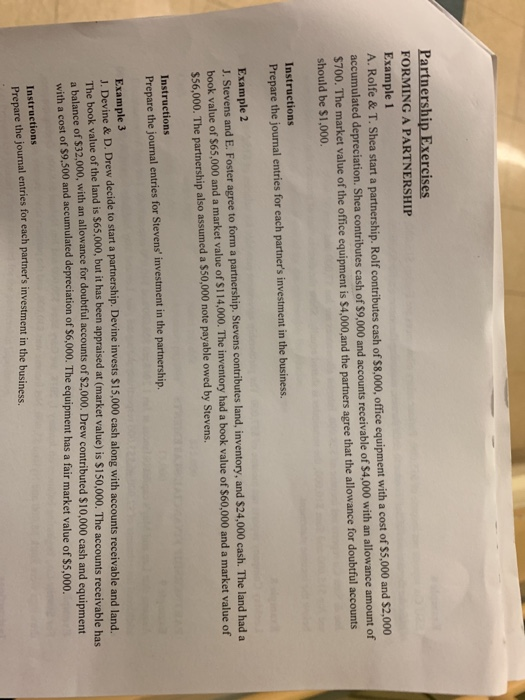

(5) FICA taxes $ 765 Salaries and wages expense Federal income taxes 1,140 FICA taxes are 7.65%. State income taxes are 4% of gross earnings. Instructions (a) Fill in the missing amounts. (b) Journalize the February payroll and the payment of the payroll. E11-13 According to a payroll register summary of Frederickson Company, the amount of Determine empe employees' gross pay in December was $850,000, of which $80,000 was not subject to taxes, record pa Social Security taxes of 6.2% and $750,000 was not subject to state and federal unemploy- expense. ment taxes. (LO 3) Instructions (a) Determine the employer's payroll tax expense for the month, using the following rates: FICA 7.65%, state unemployment 5.4%, and federal unemployment 0.8%. (b) Prepare the journal entry to record December payroll tax expense. *E11-14 Mayberry Company has two fringe benefit plans for its employees: Prepare adjustin 1. It grants employees 2 days' vacation for each month worked. Ten employees worked the fringe benefits. entire month of March at an average daily wage of $140 per employee. (LO4) 2. In its pension plan, the company recognizes 10% of gross earnings as a pension expense. Gross earnings in March were $40,000. No contribution has been made to the pension fund. Instructions Prepare the adjusting entries at March 31. Partnership Exercises FORMING A PARTNERSHIP Example 1 A. Rolfe & T. Shea start a partnership. Rolf contributes cash of $8.000, office equipment with a cost of $5,000 and $2,000 accumulated depreciation. Shea contributes cash of $9,000 and accounts receivable of $4,000 with an allowance amount of $700. The market value of the office equipment is $4,000, and the partners agree that the allowance for doubtful accounts should be $1,000 Instructions Prepare the journal entries for each partner's investment in the business. Example 2 J. Stevens and E. Foster agree to form a partnership. Stevens contributes land, inventory, and $24.000 cash. The land had a book value of $65,000 and a market value of $114,000. The inventory had a book value of $60,000 and a market value of $56,000. The partnership also assumed a $50,000 note payable owed by Stevens Instructions Prepare the journal entries for Stevens' investment in the partnership Example 3 D e D. Drew decide to start a partnership. Devine invests $15,000 cash along with accounts receivable and land The book value of the land is $65,000, but it has been appraised at market value) is $150,000. The accounts receivable has $32.000, with an allowance for doubtful accounts of $2,000. Drew contributed $10,000 cash and equipment $9.500 and accumulated depreciation of 30,000. The equipment has a fair market value of $3.000. Instructions Prepare the journal enines for each partners investment in the business