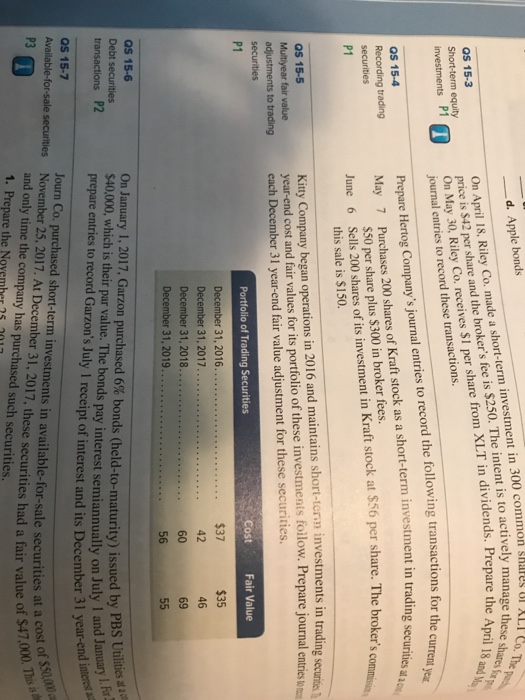

-d. Apple bonds nt in 300 common shares ol AL QS 15-3 Short-term equity investments P1 On April 18, Riley Co. made a short-term investment in 300 comm the broker's fee is $250. The intent is to actively manage these price is $42 per share and journal entries to record these transactions. Prepare Hertog Company's journal entries to record the following transactions for the May 7 Purchases 200 shares of Kraft stock as a short-term investment in tradin June 6 Sells 200 shares of its investment in Kraft stock at $56 per share. The b ley Co. receives SI per share from XL.T in dividends. Preparees shares o pril 18 ad QS 15-4 Recording trading P1 $50 per share plus $300 in broker fees. this sale is $150. broker's commisin QS 15-5 Multiyear fair value adjustments to trading securities P1 Kitty Company began operations in 2016 and maintains short-tcrn investments in trading year-end cost and fair values for its portfolio of these investments foilow. Prepare journal entrieste each December 31 year-end fair value adjustment for these securities. Portfolio of Trading Securities Cost Fair Value December 31, 2017 $37 42 $35 as 15-6 Debt securities transactions P2 On January 1, 2017, Garzon purchased 6% bonds (held-to-maturity) issued by $40,000, which is their par value. The bonds pay interest semiannually on July l prepare entries to record Garzon's July 1 receipt of interest and its December 31 year 56 Qs 15-7 Available-for-sale securties November 25, 2017. At December 31, 2017, these securities had a fair value of $47N0 PBS Utilities 1 and January Journ Co. purchased short-term investments in available-for-sale securities at a cos Fr interest a P3 and only time the company has purchased such securities 1. Prepare the Novemher 017 -d. Apple bonds nt in 300 common shares ol AL QS 15-3 Short-term equity investments P1 On April 18, Riley Co. made a short-term investment in 300 comm the broker's fee is $250. The intent is to actively manage these price is $42 per share and journal entries to record these transactions. Prepare Hertog Company's journal entries to record the following transactions for the May 7 Purchases 200 shares of Kraft stock as a short-term investment in tradin June 6 Sells 200 shares of its investment in Kraft stock at $56 per share. The b ley Co. receives SI per share from XL.T in dividends. Preparees shares o pril 18 ad QS 15-4 Recording trading P1 $50 per share plus $300 in broker fees. this sale is $150. broker's commisin QS 15-5 Multiyear fair value adjustments to trading securities P1 Kitty Company began operations in 2016 and maintains short-tcrn investments in trading year-end cost and fair values for its portfolio of these investments foilow. Prepare journal entrieste each December 31 year-end fair value adjustment for these securities. Portfolio of Trading Securities Cost Fair Value December 31, 2017 $37 42 $35 as 15-6 Debt securities transactions P2 On January 1, 2017, Garzon purchased 6% bonds (held-to-maturity) issued by $40,000, which is their par value. The bonds pay interest semiannually on July l prepare entries to record Garzon's July 1 receipt of interest and its December 31 year 56 Qs 15-7 Available-for-sale securties November 25, 2017. At December 31, 2017, these securities had a fair value of $47N0 PBS Utilities 1 and January Journ Co. purchased short-term investments in available-for-sale securities at a cos Fr interest a P3 and only time the company has purchased such securities 1. Prepare the Novemher 017