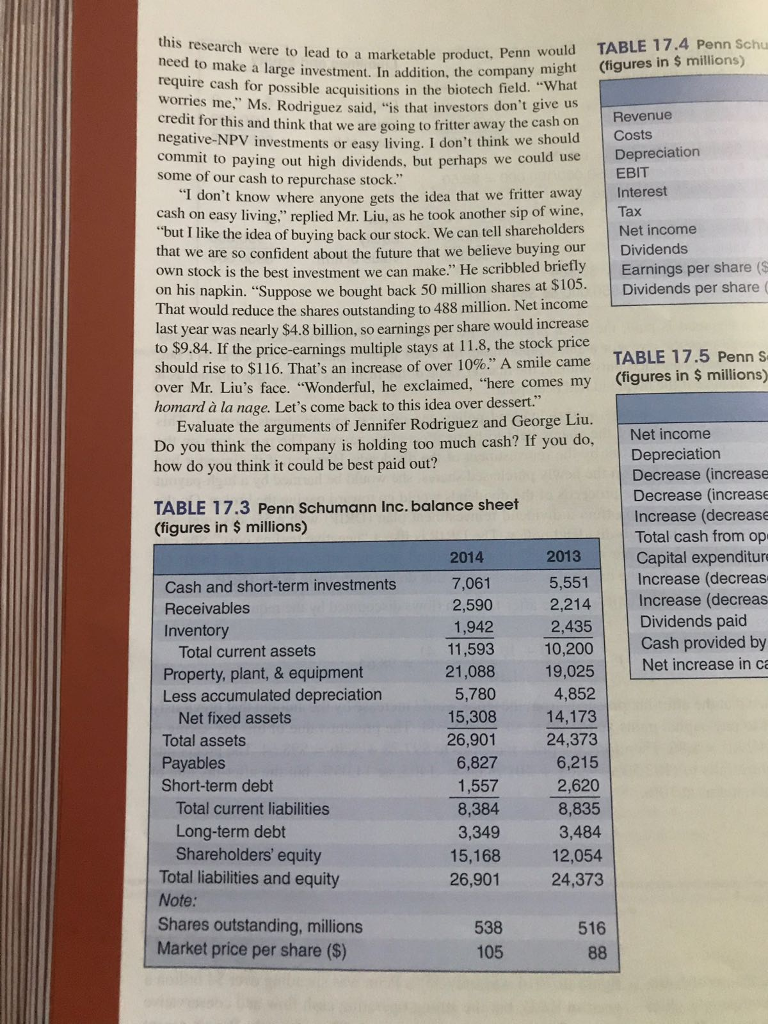

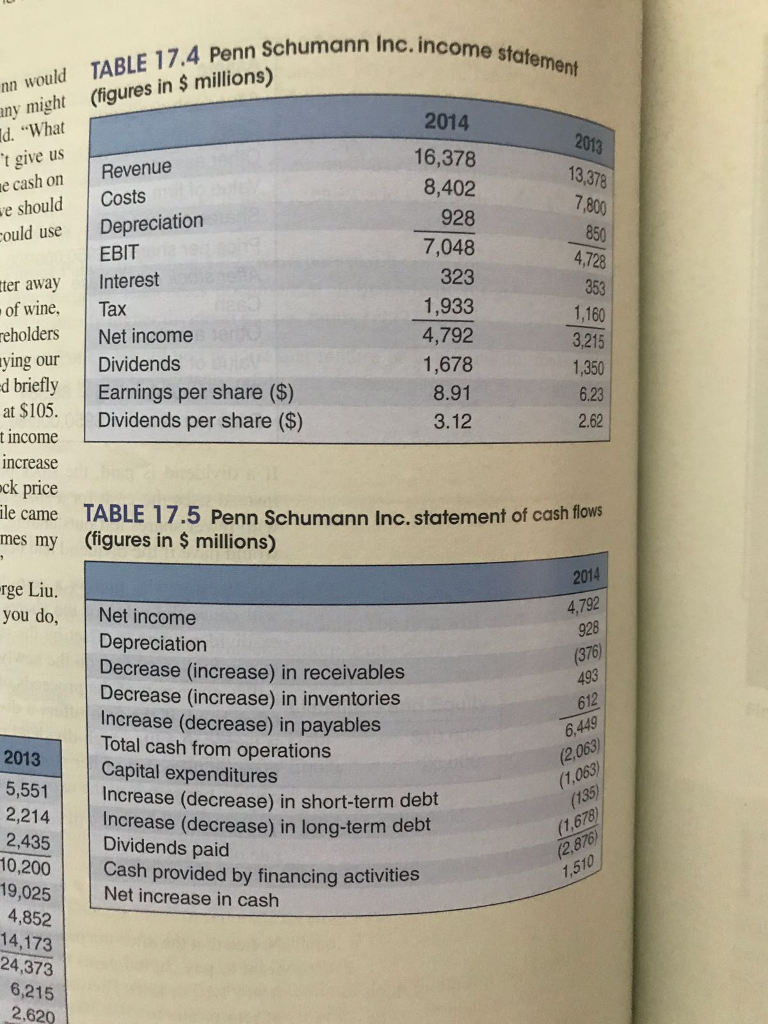

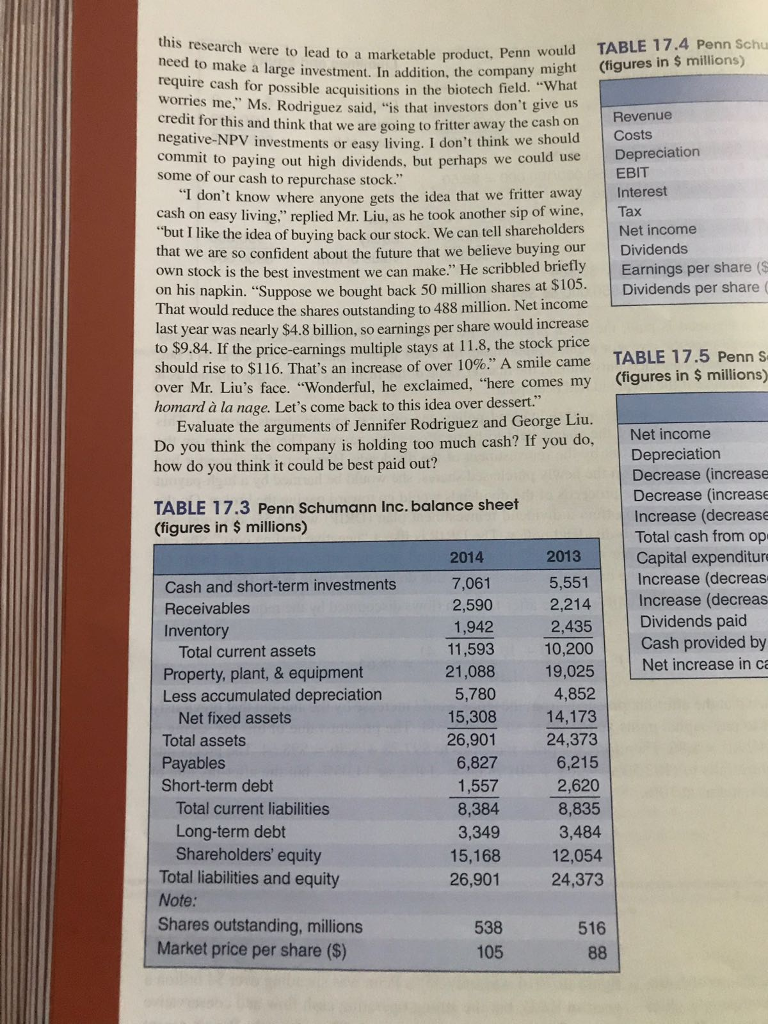

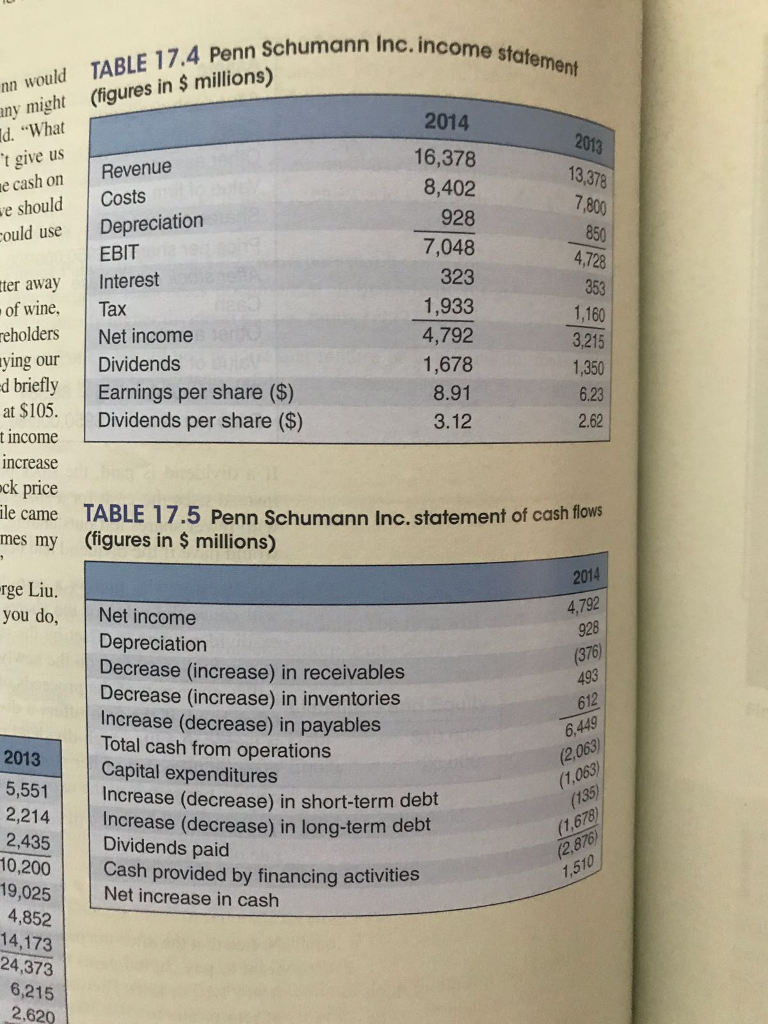

98.64 1.10 No tice that the after-tax proceeds from the stock would increase by the amount that previously went to pay capital gains taxes, .20 x $4.72 = $.944. The present value of this tax saving is S.944/1.10 $.86. Therefore, the price increases to $97.78$.86 $98.64. The pretax rate of return falls to (102.50-98.64+ 10/98.64-.1405, or 14.05%, but the after-tax rate of return remains at 10%. MINICASE George Liu, the CEO of Penn Schumann, was a creature of habit, figure in 2014 was only 35%. Penn was spending over $4 billion a Every month he and Jennifer Rodriguez, the company's chief year on R&D, but the strong operating cash flow and conservative financial officer, met for lunch and an informal chat at Pierre's. dividend policy had resulted in a buildup of cash. Penn's recent Nothing was ever discussed until George had finished his favorite income statements, balance sheets, and cash-flow statements are escalope de foie gras chaude. At their last meeting in March he summarized in Tables 17.3 to 17.5. had then toyed thoughtfully with his glass of Chateau Haut-Brion The problem, as Mr. Liu explained, was that Penn's dividend Blanc before suddenly asking. "What do you think we should be policy was more conservative than that of its main competitors. doing about our payout policy?" "Share prices depend on dividends," he said. "If we raise our divi- dend, we'll raise our share price, and that's the name of the game." y. It had an enviable list of highly profitable drugs, many Ms. Rodriguez suggested that the real issue was how much cash the of patent protection. Earnings company wanted to hold. The current cash holding was more than Penn Schumann was a large and successful pharmaceutical of which had 5 or more further years in the latest 4 years had increased rapidly, but it was difficult to see adequate for the company's immediate needs. that such rates of growth could continue. The company had tradi- the research staff had been analyzing a number of new compounds out about 40% of earnings as dividends, though the with promising applications in the treatment of liver diseases. If tionally paid