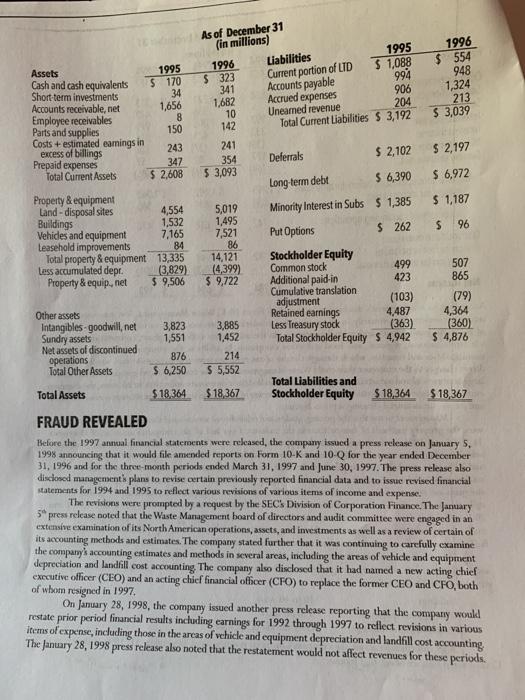

Question: 994 1996 $ 554 948 1,324 213 $ 3,039 Assets Cash and cash equivalents Short term investments Accounts receivable, net Employee receivables Parts and supplies

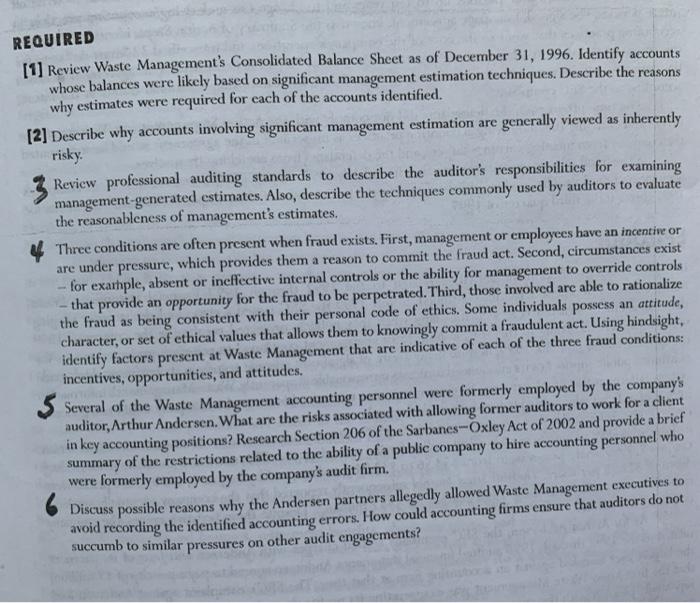

994 1996 $ 554 948 1,324 213 $ 3,039 Assets Cash and cash equivalents Short term investments Accounts receivable, net Employee receivables Parts and supplies Costs + estimated earnings in excess of billings Prepaid expenses Total Current Assets 1995 $ 170 34 1,656 8 150 243 347 $ 2,608 $ 2,197 $ 6,972 $ 1,187 As of December 31 (in millions) 1995 1996 Liabilities $ 1,088 Current portion of LTD $ 323 341 Accounts payable 906 1,682 Accrued expenses 10 Uneared revenue 204 142 Total Current Liabilities $ 3,192 241 354 Deferrals $ 2,102 5 3,093 Long-term debt $ 6,390 5,019 Minority Interest in Subs $ 1,385 1,495 7,521 $ 262 86 14,121 Stockholder Equity 14,399) Common stock 499 $ 9,722 Additional paid in 423 Cumulative translation adjustment (103) Retained earnings 4,487 3,885 Less Treasury stock (363) 1.452 Total Stockholder Equity $ 4,942 214 $ 5,552 Total Liabilities and $18,367 Stockholder Equity $ 18,364 $ 96 Property & equipment Land - disposal sites 4,554 Buildings 1,532 Vehides and equipment 7,165 Leasehold improvements 84 Total property & equipment 13,335 Less accumulated depr. (3,829) Property & equip.net $ 9,506 Put Options 507 865 (79) 4,364 (360) $ 4,876 Other assets Intangibles-goodwill, net Sundry assets Net assets of discontinued operations Total Other Assets 3,823 1,551 876 $ 6,250 Total Assets $18,364 $ 18,367 FRAUD REVEALED Before the 1997 annual financial statements were released, the company issued a press release on January 5, 1998 announcing that it would file amended reports on Form 10-K and 10-Q for the year ended December 31, 1996 and for the three month periods ended March 31, 1997 and June 30, 1997. The press release also disclosed management plans to revise certain previously reported financial data and to issue revised financial statements for 1994 and 1995 to reflect various revisions of various items of income and expense. The revisions were prompted by a request by the SECS Division of Corporation Finance. The January 59 press release noted that the Waste Management board of directors and audit committee were engaged in an extensive examination of its North American operations, assets, and investments as well as a review of certain of its accounting methods and estimates. The company stated further that it was continuing to carefully examine the company's accounting estimates and methods in several areas, including the areas of vehicle and equipment depreciation and landfill cost accounting. The company also disclosed that it had named a new acting chief executive officer (CEO) and an acting chief financial officer (CFO) to replace the former CEO and CFO, both of whom resigned in 1997, On January 28, 1998, the company issued another press release reporting that the restate prior period financial results including earnings for 1992 through 1997 to reflect revisions in various items of expense, including those in the areas of vehicle and equipment depreciation and landfill cost accounting The January 28, 1998 press release also noted that the restatement would not affect revenues for these periods. company would REQUIRED [1] Review Waste Management's Consolidated Balance Sheet as of December 31, 1996. Identify accounts whose balances were likely based on significant management estimation techniques. Describe the reasons why estimates were required for each of the accounts identified. [2] Describe why accounts involving significant management estimation are generally viewed as inherently risky Review professional auditing standards to describe the auditor's responsibilities for examining management-generated estimates. Also, describe the techniques commonly used by auditors to evaluate the reasonableness of management's estimates. 4 Three conditions are often present when fraud exists. First, management or employees have an incentive or are under pressure, which provides them a reason to commit the fraud act. Second, circumstances exist for exarhple, absent or ineffective internal controls or the ability for management to override controls that provide an opportunity for the fraud to be perpetrated. Third, those involved are able to rationalize the fraud as being consistent with their personal code of ethics. Some individuals possess an attitude, character, or set of ethical values that allows them to knowingly commit a fraudulent act. Using hindsight, identify factors present at Waste Management that are indicative of each of the three fraud conditions: incentives, opportunities, and attitudes. Several of the Waste Management accounting personnel were formerly employed by the company's auditor, Arthur Andersen. What are the risks associated with allowing former auditors to work for a client in key accounting positions? Research Section 206 of the Sarbanes-Oxley Act of 2002 and provide a brief summary of the restrictions related to the ability of a public company to hire accounting personnel who were formerly employed by the company's audit firm. Discuss possible reasons why the Andersen partners allegedly allowed Waste Management executives to avoid recording the identified accounting errors . How could accounting firms ensure that auditors do not succumb to similar pressures on other audit engagements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts