Answered step by step

Verified Expert Solution

Question

1 Approved Answer

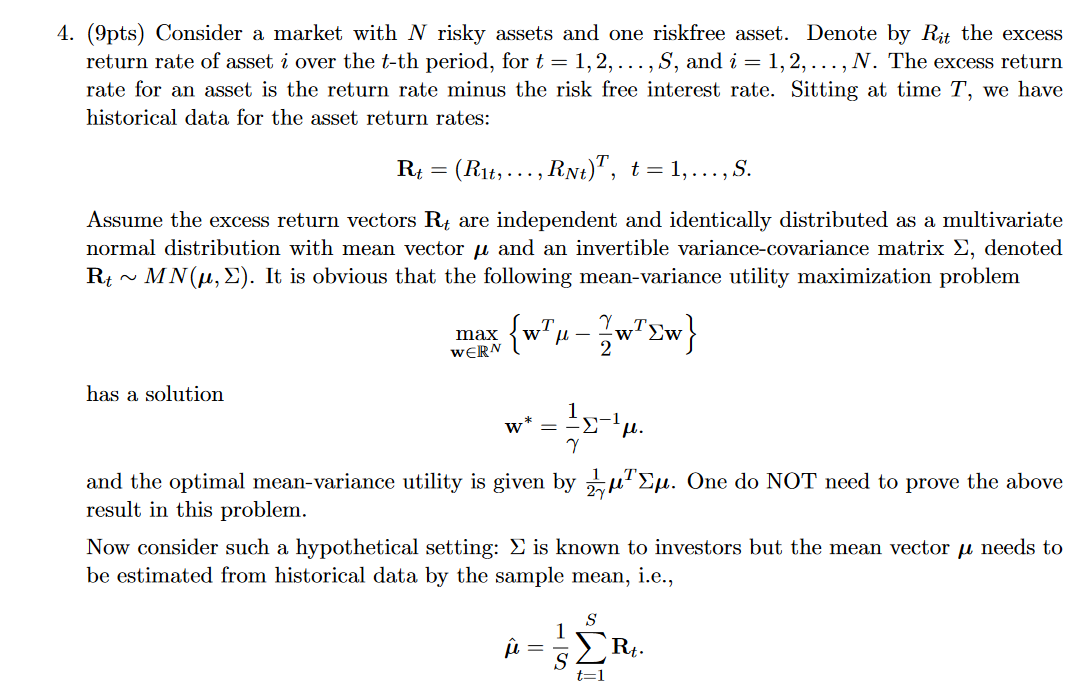

(9pts) Consider a market with N risky assets and one riskfree asset. Denote by Rit the excess return rate of asset i over the t-th

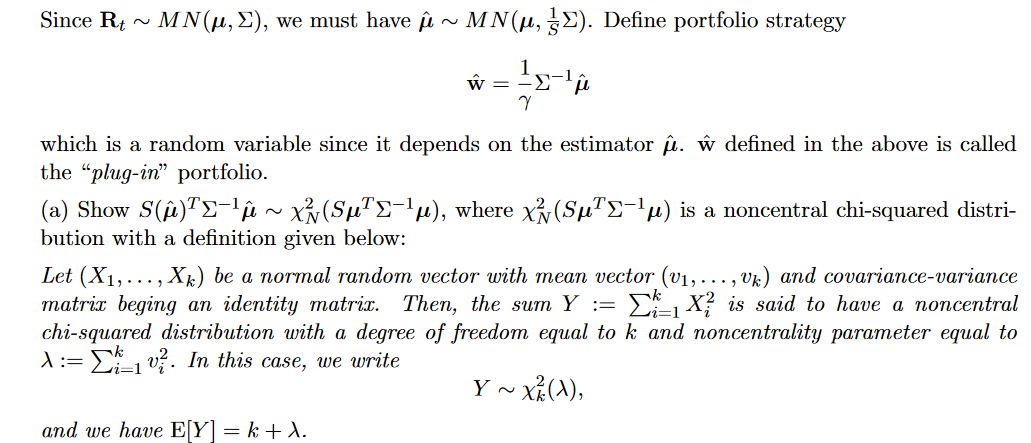

(9pts) Consider a market with N risky assets and one riskfree asset. Denote by Rit the excess return rate of asset i over the t-th period, for t=1,2,,S, and i=1,2,,N. The excess return rate for an asset is the return rate minus the risk free interest rate. Sitting at time T, we have historical data for the asset return rates: Rt=(R1t,,RNt)T,t=1,,S. Assume the excess return vectors Rt are independent and identically distributed as a multivariate normal distribution with mean vector and an invertible variance-covariance matrix , denoted RtMN(,). It is obvious that the following mean-variance utility maximization problem maxwRN{wT2wTw} has a solution w=11. and the optimal mean-variance utility is given by 21T. One do NOT need to prove the above result in this problem. Now consider such a hypothetical setting: is known to investors but the mean vector needs to be estimated from historical data by the sample mean, i.e., ^=S1t=1SRt Since RtMN(,), we must have ^MN(,S1). Define portfolio strategy w^=11^ which is a random variable since it depends on the estimator ^. w^ defined in the above is called the "plug-in" portfolio. (a) Show S(^)T1^N2(ST1), where N2(ST1) is a noncentral chi-squared distribution with a definition given below: Let (X1,,Xk) be a normal random vector with mean vector (v1,,vk) and covariance-variance matrix beging an identity matrix. Then, the sum Y:=i=1kXi2 is said to have a noncentral chi-squared distribution with a degree of freedom equal to k and noncentrality parameter equal to :=i=1kvi2. In this case, we write Yk2() and we have E[Y]=k+

(9pts) Consider a market with N risky assets and one riskfree asset. Denote by Rit the excess return rate of asset i over the t-th period, for t=1,2,,S, and i=1,2,,N. The excess return rate for an asset is the return rate minus the risk free interest rate. Sitting at time T, we have historical data for the asset return rates: Rt=(R1t,,RNt)T,t=1,,S. Assume the excess return vectors Rt are independent and identically distributed as a multivariate normal distribution with mean vector and an invertible variance-covariance matrix , denoted RtMN(,). It is obvious that the following mean-variance utility maximization problem maxwRN{wT2wTw} has a solution w=11. and the optimal mean-variance utility is given by 21T. One do NOT need to prove the above result in this problem. Now consider such a hypothetical setting: is known to investors but the mean vector needs to be estimated from historical data by the sample mean, i.e., ^=S1t=1SRt Since RtMN(,), we must have ^MN(,S1). Define portfolio strategy w^=11^ which is a random variable since it depends on the estimator ^. w^ defined in the above is called the "plug-in" portfolio. (a) Show S(^)T1^N2(ST1), where N2(ST1) is a noncentral chi-squared distribution with a definition given below: Let (X1,,Xk) be a normal random vector with mean vector (v1,,vk) and covariance-variance matrix beging an identity matrix. Then, the sum Y:=i=1kXi2 is said to have a noncentral chi-squared distribution with a degree of freedom equal to k and noncentrality parameter equal to :=i=1kvi2. In this case, we write Yk2() and we have E[Y]=k+

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started