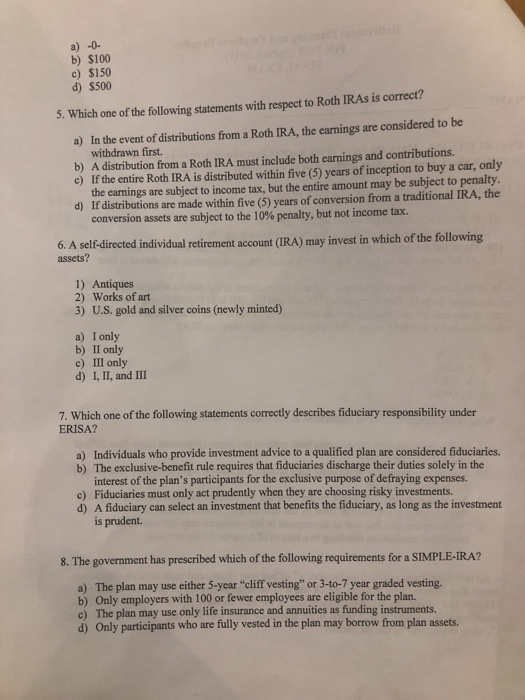

a) -0- b) $100 c) $150 d) S500 5. Which one of the following statements with respect to Roth IRAs is correct? a) In the event of distributions from a Roth IRA, the earnings are considered to be withdrawn first. b) A distribution from a Roth IRA must include both earnings and contributions. c) If the entire Roth IRA is distributed within five (5) years of inception to buy a car, only the earnings are subject to income tax, but the entire amount may be subject to penalty. d) If distributions are made within five (5) years of conversion from a traditional IRA, the conversion assets are subject to the 10% penalty, but not income tax. 6. A self-directed individual retirement account (RA) may invest in which of the following assets? 1) Antiques 2) Works of art 3) U.S. gold and silver coins (newly minted) a) I only b) II only c) III only d) I, II, and III 7. Which one of the following statements correctly describes fiduciary responsibility under ERISA? Individuals who provide investment advice to a qualified plan are considered fiduciaries. The exclusive-benefit rule requires that fiduciaries discharge their duties solely in the interest of the plan's participants for the exclusive purpose of defraying expenses Fiduciaries must only act prudently when they are choosing risky investments. A fiduciary can select an investment that benefits the fiduciary, as long as the investment is prudent. a) b) c) d) 8. The government has prescribed which of the following requirements for a SIMPLE-IRA? a) The plan may use either 5-year "cliff vesting" or 3-to-7 year graded vesting. b) Only employers with 100 or fewer employees are eligible for the plan. c) The plan may use only life insurance and annuities as funding instruments d) Only participants who are fully vested in the plan may borrow from plan assets. a) -0- b) $100 c) $150 d) S500 5. Which one of the following statements with respect to Roth IRAs is correct? a) In the event of distributions from a Roth IRA, the earnings are considered to be withdrawn first. b) A distribution from a Roth IRA must include both earnings and contributions. c) If the entire Roth IRA is distributed within five (5) years of inception to buy a car, only the earnings are subject to income tax, but the entire amount may be subject to penalty. d) If distributions are made within five (5) years of conversion from a traditional IRA, the conversion assets are subject to the 10% penalty, but not income tax. 6. A self-directed individual retirement account (RA) may invest in which of the following assets? 1) Antiques 2) Works of art 3) U.S. gold and silver coins (newly minted) a) I only b) II only c) III only d) I, II, and III 7. Which one of the following statements correctly describes fiduciary responsibility under ERISA? Individuals who provide investment advice to a qualified plan are considered fiduciaries. The exclusive-benefit rule requires that fiduciaries discharge their duties solely in the interest of the plan's participants for the exclusive purpose of defraying expenses Fiduciaries must only act prudently when they are choosing risky investments. A fiduciary can select an investment that benefits the fiduciary, as long as the investment is prudent. a) b) c) d) 8. The government has prescribed which of the following requirements for a SIMPLE-IRA? a) The plan may use either 5-year "cliff vesting" or 3-to-7 year graded vesting. b) Only employers with 100 or fewer employees are eligible for the plan. c) The plan may use only life insurance and annuities as funding instruments d) Only participants who are fully vested in the plan may borrow from plan assets