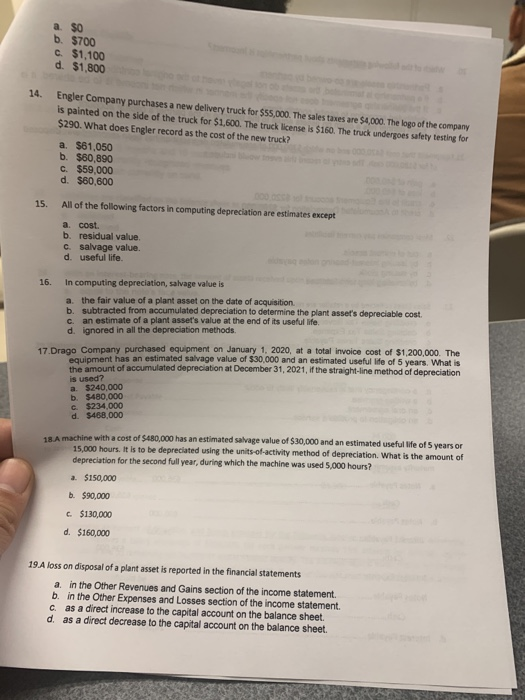

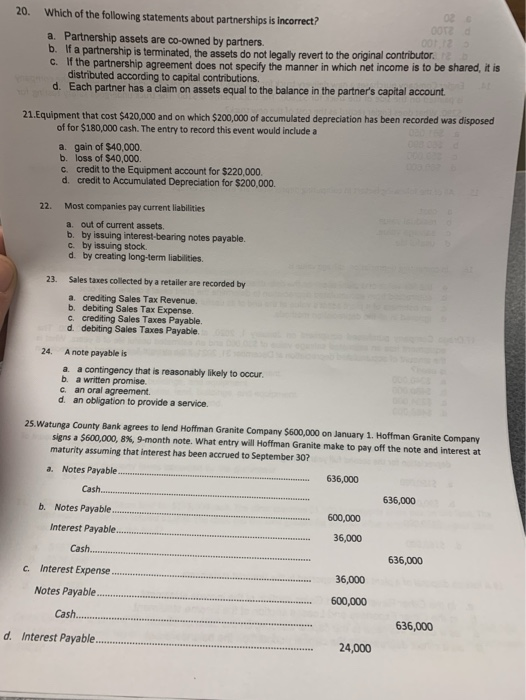

a. $0 b. $700 C $1,100 d. $1,800 14. Engler Company purchases a new delivery truck for $55.000 The sales taxes are $4,000. The logo of the company is painted on the side of the truck for $1,600. The truck license is $160. The truck undergoes safety testing for $290. What does Engler record as the cost of the new truck? a $61.050 b. $60,890 C. $59,000 d. $60.600 15. All of the following factors in computing depreciation are estimates except a cost. b. residual value c. salvage value d. useful life. 16. in computing depreciation, salvage value is a the fair value of a plant asset on the date of acquisition b. subtracted from accumulated depreciation to determine the plant asset's depreciable cost. an estimate of a plant asset's value at the end of its useful life d ignored in all the depreciation methods c 17 Drago Company purchased equipment on January 1, 2020, at a total invoice cost of $1.200.000. The equipment has an estimated salvage value of $30.000 and an estimated useful life of 5 years. What is the amount of accumulated depreciation at December 31, 2021, if the straight-line method of depreciation is used? a $240.000 b. $480,000 C $234.000 d 546.000 18. A machine with a cost of $480,000 has an estimated salvage value of $30,000 and an estimated useful life of 5 years or 15,000 hours. It is to be depreciated using the units-of-activity method of depreciation. What is the amount of depreciation for the second full year, during which the machine was used 5,000 hours? a. $150,000 b. $90,000 C. $130,000 d. $160,000 19.A loss on disposal of a plant asset is reported in the financial statements a in the Other Revenues and Gains section of the income statement b. in the Other Expenses and Losses section of the income statement c as a direct increase to the capital account on the balance sheet. d as a direct decrease to the capital account on the balance sheet. 20. Which of the following statements about partnerships is incorrect? DOTZ a. Partnership assets are co-owned by partners. b. If a partnership is terminated the assets do not legally revert to the original contributor C. If the partnership agreement does not specify the manner in which net income is to be shared, it is distributed according to capital contributions d. Each partner has a claim on assets equal to the balance in the partner's capital account. 21.Equipment that cost $420,000 and on which $200,000 of accumulated depreciation has been recorded was disposed of for $180,000 cash. The entry to record this event would include a a. gain of $40,000. b. loss of $40,000. C. credit to the Equipment account for $220,000 d. credit to Accumulated Depreciation for $200,000 Most companies pay current liabilities a out of current assets b. by Issuing interest-bearing notes payable. C by issuing stock. d. by creating long-term liabilities Sales taxes collected by a retailer are recorded by c a crediting Sales Tax Revenue. b debiting Sales Tax Expense crediting Sales Taxes Payable. d. debiting Sales Taxes Payable 24. b c d A note payable is a. a contingency that is reasonably likely to occur. a written promise an oral agreement. an obligation to provide a service. 25. Watunga County Bank agrees to lend Hoffman Granite Company $600,000 on January 1. Hoffman Granite Company signs a $600,000, 8%, 9-month note. What entry will Hoffman Granite make to pay off the note and interest at maturity assuming that interest has been accrued to September 30? a. Notes Payable....... 636,000 Cash.................. 636,000 b. Notes Payable.... 600,000 Interest Payable. 36,000 Cash.... 636,000 c. Interest Expense...... 36,000 Notes Payable......................... 600,000 Cash......................... 636,000 d. Interest Payable.................. 24,000