Answered step by step

Verified Expert Solution

Question

1 Approved Answer

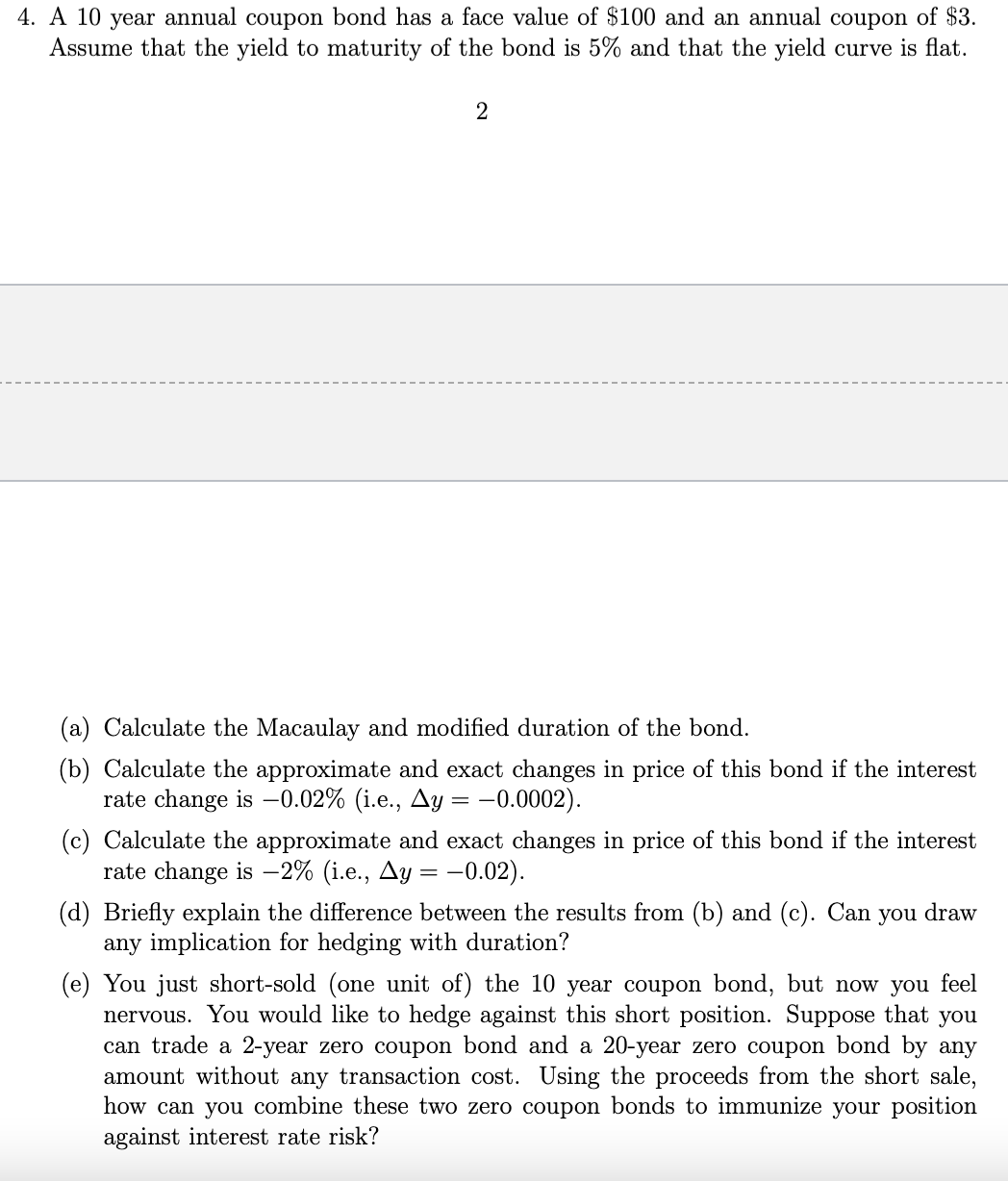

A 1 0 year annual coupon bond has a face value of $ 1 0 0 and an annual coupon of $ 3 . Assume

A year annual coupon bond has a face value of $ and an annual coupon of $

Assume that the yield to maturity of the bond is and that the yield curve is flat.

a Calculate the Macaulay and modified duration of the bond.

b Calculate the approximate and exact changes in price of this bond if the interest

rate change is iey

c Calculate the approximate and exact changes in price of this bond if the interest

rate change is iey

d Briefly explain the difference between the results from b and c Can you draw

any implication for hedging with duration?

e You just shortsold one unit of the year coupon bond, but now you feel

nervous. You would like to hedge against this short position. Suppose that you

can trade a year zero coupon bond and a year zero coupon bond by any

amount without any transaction cost. Using the proceeds from the short sale,

how can you combine these two zero coupon bonds to immunize your position

against interest rate risk?A year annual coupon bond has a face value of $ and an annual coupon of $

Assume that the yield to maturity of the bond is and that the yield curve is flat.

a Calculate the Macaulay and modified duration of the bond.

b Calculate the approximate and exact changes in price of this bond if the interest

rate change is ie

c Calculate the approximate and exact changes in price of this bond if the interest

rate change is ie

d Briefly explain the difference between the results from b and c Can you draw

any implication for hedging with duration?

e You just shortsold one unit of the year coupon bond, but now you feel

nervous. You would like to hedge against this short position. Suppose that you

can trade a year zero coupon bond and a year zero coupon bond by any

amount without any transaction cost. Using the proceeds from the short sale,

how can you combine these two zero coupon bonds to immunize your position

against interest rate risk?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started