Answered step by step

Verified Expert Solution

Question

1 Approved Answer

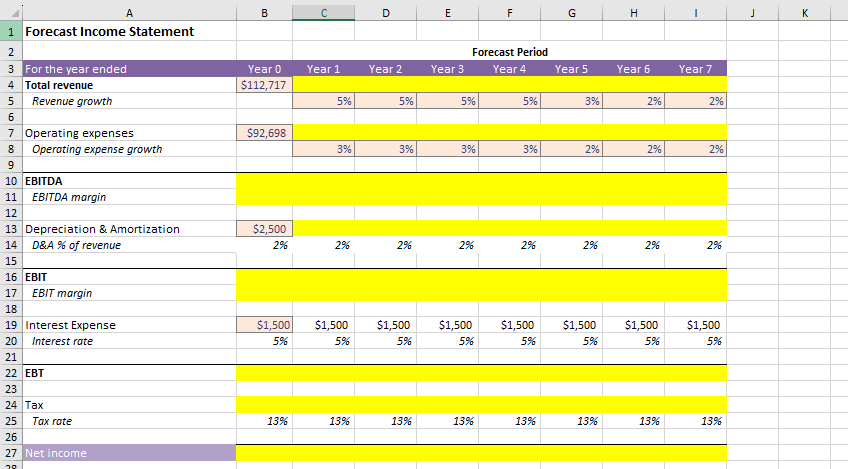

A 1 Forecast Income Statement 2 3 For the year ended 4 Total revenue 5 Revenue growth 6 7 Operating expenses 8 Operating expense

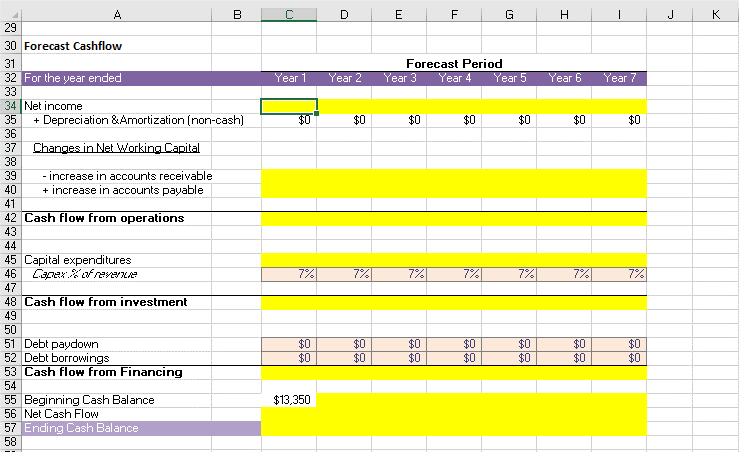

A 1 Forecast Income Statement 2 3 For the year ended 4 Total revenue 5 Revenue growth 6 7 Operating expenses 8 Operating expense growth 9 10 EBITDA B D E F G H Forecast Period Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 $112,717 5% 5% 5% 5% 3% 2% 2% $92,698 3% 3% 3% 3% 2% 2% 2% 11 EBITDA margin 12 13 Depreciation & Amortization 14 D&A % of revenue $2,500 2% 2% 2% 2% 2% 2% 2% 2% 15 16 EBIT 17 EBIT margin 18 19 Interest Expense 20 Interest rate $1,500 5% $1,500 5% $1,500 5% $1,500 5% $1,500 5% $1,500 5% $1,500 5% $1,500 5% 21 22 EBT 23 24 Tax 25 Tax rate 13% 13% 13% 13% 13% 13% 13% 13% 26 27 Net income 78 J K A B C D E F G H J K 29 30 Forecast Cashflow 32 For the year ended 33 34 Net income + 36 885888886889+ 39 Changes in Net Working Capital - increase in accounts receivable + increase in accounts payable 42 Cash flow from operations Forecast Period Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Depreciation & Amortization (non-cash) $0 $0 $0 $0 $0 $0 $0 45 Capital expenditures Capex of revenue 46 47 48 Cash flow from investment 49 50 51 Debt paydown 52 Debt borrowings 53 Cash flow from Financing 54 55 Beginning Cash Balance 56 Net Cash Flow 57 Ending Cash Balance 58 7% 7% 7% 7% 7% 7% 7% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $13,350

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started