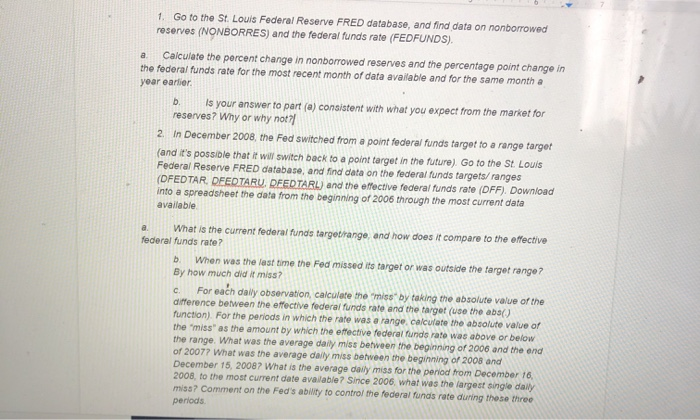

a 1. Go to the St. Louis Federal Reserve FRED database, and find data on nonborrowed reserves (NONBORRES) and the federal funds rate (FEDFUNDS). Calculate the percent change in nonborrowed reserves and the percentage point change in the federal funds rate for the most recent month of data available and for the same month a year earlier. b. Is your answer to part (a) consistent with what you expect from the market for reserves? Why or why not? 2 in December 2008, the Fed switched from a point federal funds target to a range farger (and it's possible that it will switch back to a point target in the future). Go to the St. Louis Federal Reserve FRED database, and find data on the federal funds targets/ranges (DFEDTAR DFEDTARU, DFEDTARL) and the effective federal funds rate (DFF). Download into a spreadsheet the data from the beginning of 2006 through the most current data available a What is the current federal funds targetirange, and how does it compare to the effective federal funds rate? b When was the last time the Fed missed its target or was outside the target rango? By how much did it miss? c For each daily observation, calculate the miss" by taking the absolute value of the difference between the effective federal funds rate and the target (use the abs() function). For the periods in which the rate was a range calculate the absolute value of the 'miss' as the amount by which the effective federal funds rate was above or below the range. What was the average daily miss between the beginning of 2006 and the end of 2007? What was the average daily miss between the beginning of 2008 and December 15, 2008? What is the average daily miss for the period from December 16, 2008 to the most current date available? Since 2006 what was the largest single daily miss? Comment on the Fed's ability to control the federal funds rate during these three periods a 1. Go to the St. Louis Federal Reserve FRED database, and find data on nonborrowed reserves (NONBORRES) and the federal funds rate (FEDFUNDS). Calculate the percent change in nonborrowed reserves and the percentage point change in the federal funds rate for the most recent month of data available and for the same month a year earlier. b. Is your answer to part (a) consistent with what you expect from the market for reserves? Why or why not? 2 in December 2008, the Fed switched from a point federal funds target to a range farger (and it's possible that it will switch back to a point target in the future). Go to the St. Louis Federal Reserve FRED database, and find data on the federal funds targets/ranges (DFEDTAR DFEDTARU, DFEDTARL) and the effective federal funds rate (DFF). Download into a spreadsheet the data from the beginning of 2006 through the most current data available a What is the current federal funds targetirange, and how does it compare to the effective federal funds rate? b When was the last time the Fed missed its target or was outside the target rango? By how much did it miss? c For each daily observation, calculate the miss" by taking the absolute value of the difference between the effective federal funds rate and the target (use the abs() function). For the periods in which the rate was a range calculate the absolute value of the 'miss' as the amount by which the effective federal funds rate was above or below the range. What was the average daily miss between the beginning of 2006 and the end of 2007? What was the average daily miss between the beginning of 2008 and December 15, 2008? What is the average daily miss for the period from December 16, 2008 to the most current date available? Since 2006 what was the largest single daily miss? Comment on the Fed's ability to control the federal funds rate during these three periods