Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) (10 points) Given the junk bond status of US Steel, the yield to maturity calculation may be too optimistic. Assume that there is a

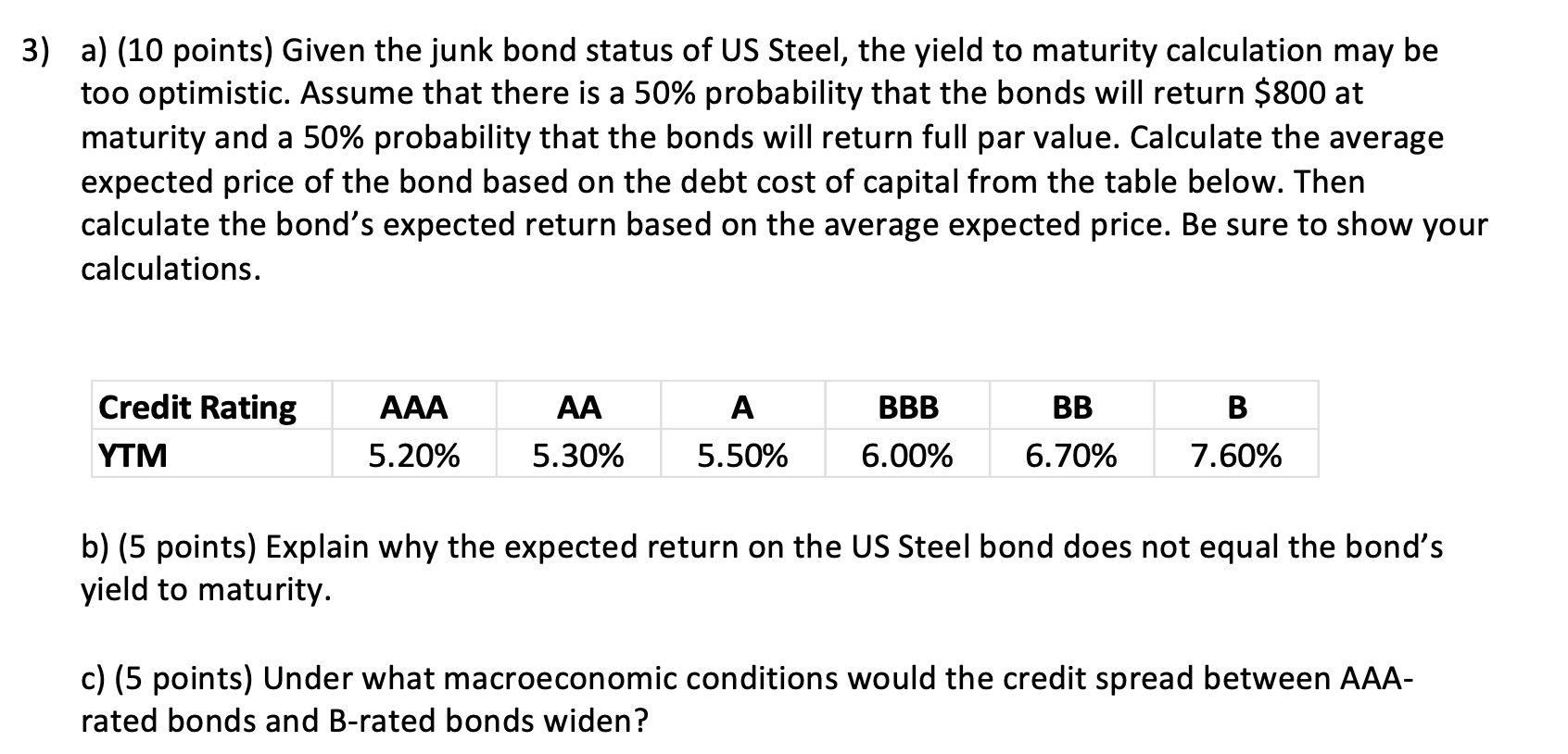

a) (10 points) Given the junk bond status of US Steel, the yield to maturity calculation may be too optimistic. Assume that there is a 50% probability that the bonds will return $800 at maturity and a 50% probability that the bonds will return full par value. Calculate the average expected price of the bond based on the debt cost of capital from the table below. Then calculate the bond's expected return based on the average expected price. Be sure to show your calculations. b) (5 points) Explain why the expected return on the US Steel bond does not equal the bond's yield to maturity. c) (5 points) Under what macroeconomic conditions would the credit spread between AAArated bonds and B-rated bonds widen? a) (10 points) Given the junk bond status of US Steel, the yield to maturity calculation may be too optimistic. Assume that there is a 50% probability that the bonds will return $800 at maturity and a 50% probability that the bonds will return full par value. Calculate the average expected price of the bond based on the debt cost of capital from the table below. Then calculate the bond's expected return based on the average expected price. Be sure to show your calculations. b) (5 points) Explain why the expected return on the US Steel bond does not equal the bond's yield to maturity. c) (5 points) Under what macroeconomic conditions would the credit spread between AAArated bonds and B-rated bonds widen

a) (10 points) Given the junk bond status of US Steel, the yield to maturity calculation may be too optimistic. Assume that there is a 50% probability that the bonds will return $800 at maturity and a 50% probability that the bonds will return full par value. Calculate the average expected price of the bond based on the debt cost of capital from the table below. Then calculate the bond's expected return based on the average expected price. Be sure to show your calculations. b) (5 points) Explain why the expected return on the US Steel bond does not equal the bond's yield to maturity. c) (5 points) Under what macroeconomic conditions would the credit spread between AAArated bonds and B-rated bonds widen? a) (10 points) Given the junk bond status of US Steel, the yield to maturity calculation may be too optimistic. Assume that there is a 50% probability that the bonds will return $800 at maturity and a 50% probability that the bonds will return full par value. Calculate the average expected price of the bond based on the debt cost of capital from the table below. Then calculate the bond's expected return based on the average expected price. Be sure to show your calculations. b) (5 points) Explain why the expected return on the US Steel bond does not equal the bond's yield to maturity. c) (5 points) Under what macroeconomic conditions would the credit spread between AAArated bonds and B-rated bonds widen Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started