Question: A $100 par value 10 year bond provides 5% semiannual coupons. The yield rate is 4% convertible semiannually. What is the flat price (i.e., the

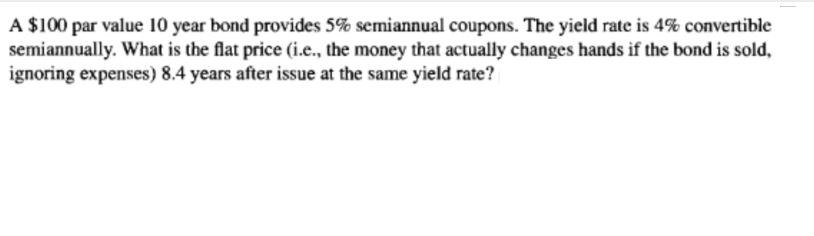

A $100 par value 10 year bond provides 5% semiannual coupons. The yield rate is 4% convertible semiannually. What is the flat price (i.e., the money that actually changes hands if the bond is sold, ignoring expenses) 8.4 years after issue at the same yield rate? A $100 par value 10 year bond provides 5% semiannual coupons. The yield rate is 4% convertible semiannually. What is the flat price (i.e., the money that actually changes hands if the bond is sold, ignoring expenses) 8.4 years after issue at the same yield rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock