Question: (Solving a comprehenelve problem) Use the end-oryear stock price data in the popup window. , to answer the following questions for the Harris and Pinwheel

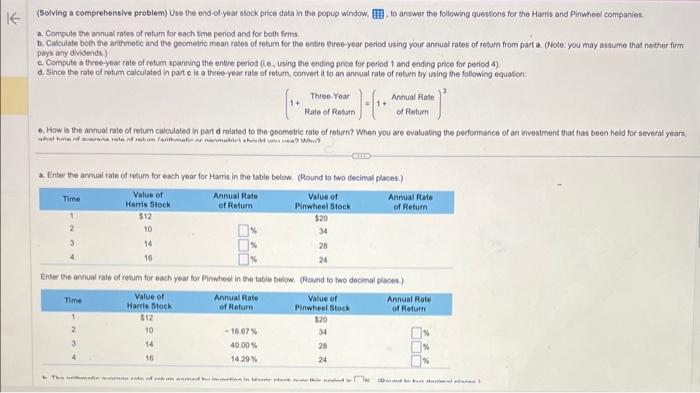

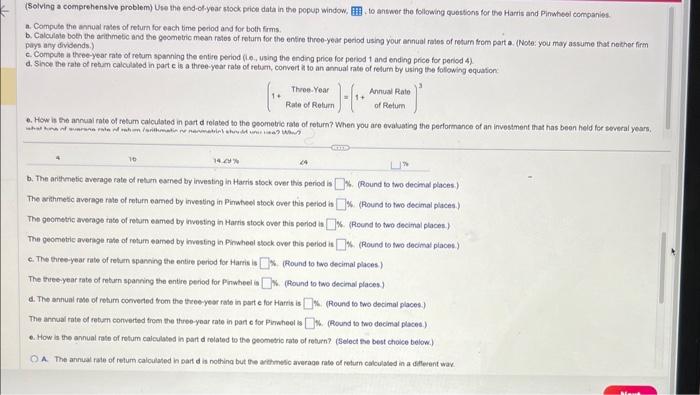

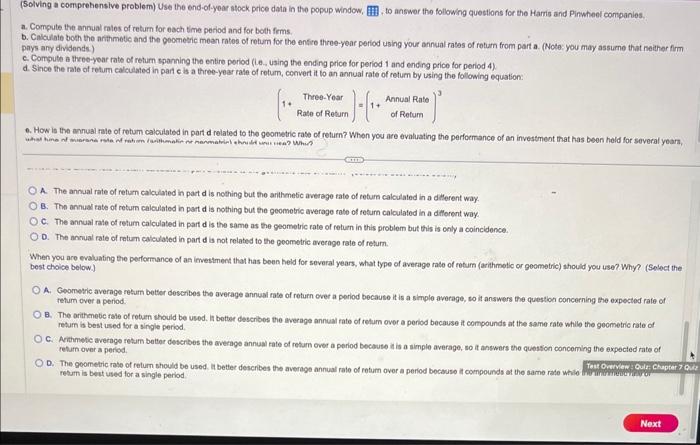

(Solving a comprehenelve problem) Use the end-oryear stock price data in the popup window. , to answer the following questions for the Harris and Pinwheel companies. a. Compuile the annual rates of roturn for each tme period and for both frms. b. Colculate both the anthmetc and the geometric mean ratos of retum for the entie three-yeat period using your antual rates of rotum from port a. (Note: you may assume that neither firm pays ary dmidends.) c. Compute a thee-yeac rate of retum spanning the entie period (i.e. using the ending price for period 1 and ending price for period 4 ). d. Since the rate of retum calculated in part c is a three-year rate of rotum, convert it to an annual rate of roturn by using the following equa5ch: 6. How is the annual rate of return calculated in part d rolated to the geometric rate of return? When you dre evaluating the performance of an itivestment that has been heid for soveral yoars, a. Enter the ancual rate of retum foc each year for Harris in the tible below. (Round to two decimal places.) (Solving a comprehensive problem) Use the end-olyear stock price data in the popup window, to antwor the following questions for the Harris and Pinsteol corrganies. a. Compute the annual rases of return for each time period and for both firms. b. Calculele both the acithmebe and the geometric mean rates of return for the entire throe-year period using your annual rales of retum from part a. (Note: you may assume that neither firm pays any dividends.) c. Compuite an throe-year rate of retum spanining the entire period (i.e., using the ending price for period 1 and ending price for period 4 ). d. Shoe the rate of rehum calculaled in part c is a three-year rate of teburn, convert in to an annual rate of relum by using the following equafion: 6. How is the annual rate of return calculated in part d felated to the goometric rale of return? When you are divaluating the perlormance of an investment that has been held for tereral years, b. The arithmetic average rate of retum eaned by irvesting in Harris stock aver this period is 14. (Round to two decimal peaces.) The arithmesc average rate of return eamed by investing in Piritieel atock over this petiod is 4. (Round to tieo decimal plices.) The peometric average inte of retum esmed by investing in Harris stock over this poriod is K. (Round to two decimal places.) The geometric avenge rate of return earned by inesting in Pinwheel stock over this petiod is 14. (Round to wo decimat places.) c. The three-year rate of return spanning the entire period for Hartis is \&8. (Round to two decimal places) The tree-year rate of meturn spanring the entire period for Priwbeel is K. (Round to two decinal places) d. The annual rase of retum convened trom the theeeyear rale in part e for Harris is 14. (Round to two decimal places.) 6. How is the annual rase of retum caiculated in part d related te the geometrio rate of retirn? (Select he best choice below.) A. The annual rate of retum calcilated h sart d it nothing but the aremmesc averaoe rate of return calculaled in a dflevent wav. (Solving a comprehensive problem) Use the end-of-yoar atock price data in a. Compute the annual rales of return for each time period and for both fems. a. Compute the annual rales of return for each time period and for both fems. b. Calculaie both the anthmetic and the goometic mean ratos of retum for the enfice throe-year period using your annual rates of rotam from part a. (Note: you may assurne that neither firm b. Cacultito both the pays any dividends.) c. Compute a throe-year rate of return spanning the entire poriod (Le., using the ending price for period 1 and ending price for period 4 ). d. Since the rale of retum calculated in part c is a three-year rate of retum, convert it to an annual rate of retum by using the following equation: to answer the following questions for the Harris and Pinwheel companies. (1+Three-YoarRateofRetum)=(1+ArnualRateofRetum)3 6. How is the annual rate of rotum caloriated in part d related to the geometric rate of return? When you are evaluating the perfocmance of an investment that has been held for several yoarn, A. The annual rate of return calculated in pact d is nothing but the arithenetic average tate of return calculated in a ditlerent way. B. The annual rate of return calculated in part d is nothing but the geomotric average tate of teturn calculated in a ditlorent way. c. The annual rale of retum calculated in part dis the same as the geometric rate of return in this problem but this is only a coincidence. D. The ancual rate of raturn calculated in part d is not related to the peometric avernge rate of retum. When you are evaluating the performance of as imestment that has been held for several years, what type of average rate of rotum (arithmotic or geometric) should you use? Why? (Select the best choice below.] A. Geometric average retum better describes the average annual rate of return evet a period because it is a simple average, to it answers the question concerning the expected rate of retum over a period. B. The arithenete rate of roturn should be used. It bettee describes the average annual rate of retum over a period because it compounds at the same rate while the geometrie rate of return is best used for a single period. C. Arithmete average retum better describes the average annual rate of resum over a period becaute it is a simple average, so it answers the question conceming the expected rate of ceturn over a period. retum is bect used for a single period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts