Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A $1,000 face value bond with a quoted price of 97 is selling for a. $1,000. b. $970. c. $907. d. $97. The total cost

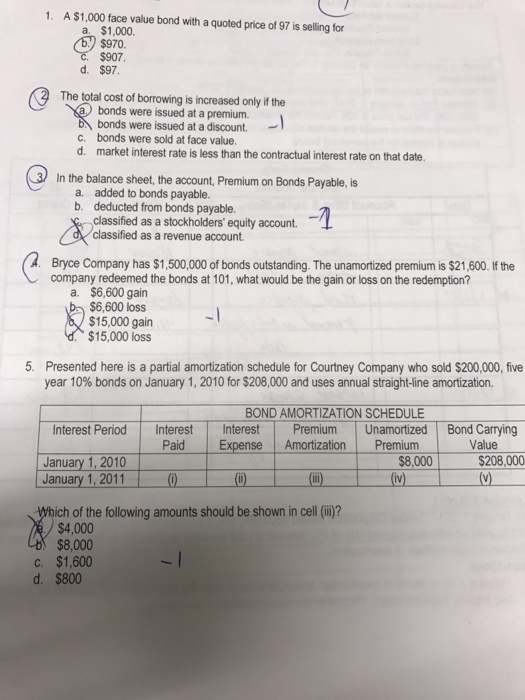

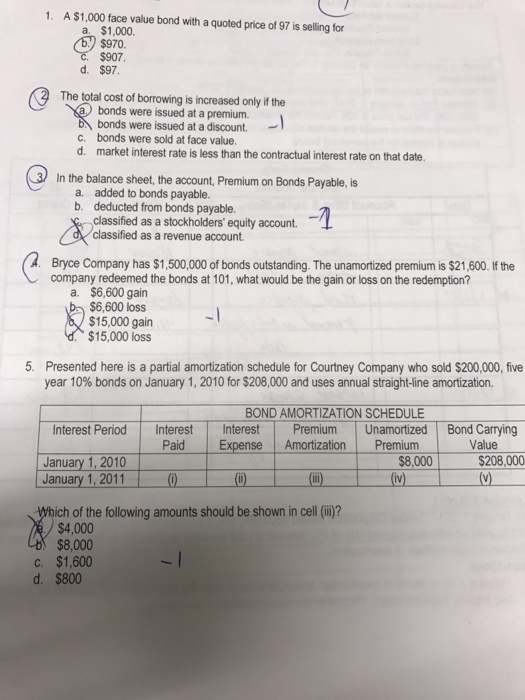

A $1,000 face value bond with a quoted price of 97 is selling for a. $1,000. b. $970. c. $907. d. $97. The total cost of borrowing is increased only if the a. bonds were issued at a premium. b. bonds were issued at a discount. c. bonds were sold at face value. d. market interest rate is less than the contractual interest rate on that date. In the balance sheet, the account, Premium on Bonds Payable, is a. added to bonds payable. b. deducted from bonds payable. c. classified as a stockholders' equity account. d. classified as a revenue account. Bryce Company has $1, 500,000 of bonds outstanding. The unamortized premium is $21, 600. lf the company redeemed the bonds at 101, what would be the gain or loss on the redemption? a. $6, 600 gain b. $6, 600 loss c. $15,000 gain d. $15,000 loss Presented here is a partial amortization schedule for Courtney Company who sold $200,000, five year 10% bonds on January 1, 2010 for $208,000 and uses annual straight-line amortization. Which of the following amounts should be shown in cell (iii)? a. $4,000 b. $8,000 c. $1, 600 d. $800

A $1,000 face value bond with a quoted price of 97 is selling for a. $1,000. b. $970. c. $907. d. $97. The total cost of borrowing is increased only if the a. bonds were issued at a premium. b. bonds were issued at a discount. c. bonds were sold at face value. d. market interest rate is less than the contractual interest rate on that date. In the balance sheet, the account, Premium on Bonds Payable, is a. added to bonds payable. b. deducted from bonds payable. c. classified as a stockholders' equity account. d. classified as a revenue account. Bryce Company has $1, 500,000 of bonds outstanding. The unamortized premium is $21, 600. lf the company redeemed the bonds at 101, what would be the gain or loss on the redemption? a. $6, 600 gain b. $6, 600 loss c. $15,000 gain d. $15,000 loss Presented here is a partial amortization schedule for Courtney Company who sold $200,000, five year 10% bonds on January 1, 2010 for $208,000 and uses annual straight-line amortization. Which of the following amounts should be shown in cell (iii)? a. $4,000 b. $8,000 c. $1, 600 d. $800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started