Question

A $100,000 bond payable is issued on June 1. Year One for 104. The bond pays annual cash interest of 12 percent per year

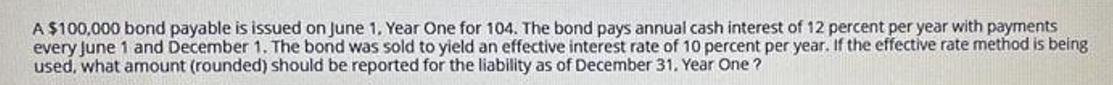

A $100,000 bond payable is issued on June 1. Year One for 104. The bond pays annual cash interest of 12 percent per year with payments every June 1 and December 1. The bond was sold to yield an effective interest rate of 10 percent per year. If the effective rate method is being used, what amount (rounded) should be reported for the liability as of December 31. Year One ?

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Date Interest payment 12 Interest expense 10 Amortiz...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management for Public Health and Not for Profit Organizations

Authors: Steven A. Finkler, Thad Calabrese

4th edition

133060411, 132805669, 9780133060416, 978-0132805667

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App