Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a $100,000 investment yields an annual return of $11,730.82 the first year; thereafter, annual returns increase at an annual rate of 6%. Based on a

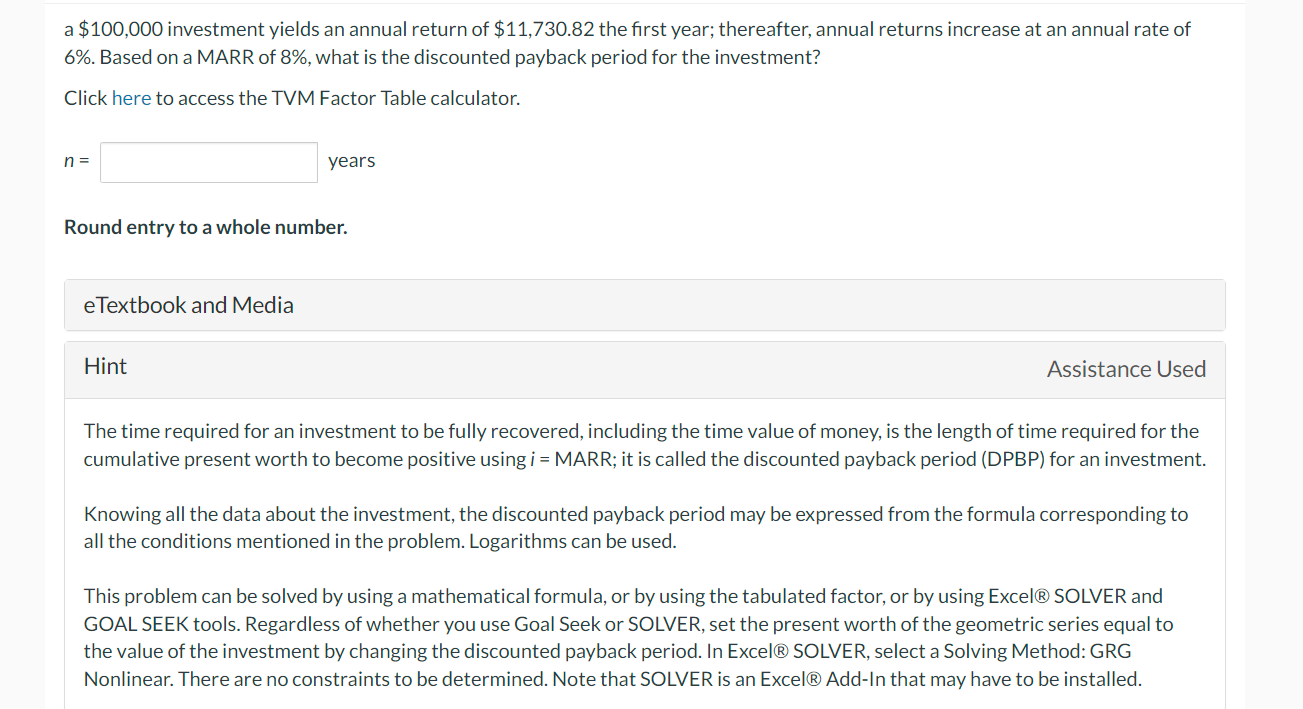

a $100,000 investment yields an annual return of $11,730.82 the first year; thereafter, annual returns increase at an annual rate of 6%. Based on a MARR of 8%, what is the discounted payback period for the investment? Click here to access the TVM Factor Table calculator. n= years Round entry to a whole number. eTextbook and Media Hint Assistance Used The time required for an investment to be fully recovered, including the time value of money, is the length of time required for the cumulative present worth to become positive using i= MARR; it is called the discounted payback period (DPBP) for an investment. Knowing all the data about the investment, the discounted payback period may be expressed from the formula corresponding to all the conditions mentioned in the problem. Logarithms can be used. This problem can be solved by using a mathematical formula, or by using the tabulated factor, or by using Excel ( SOLVER and GOAL SEEK tools. Regardless of whether you use Goal Seek or SOLVER, set the present worth of the geometric series equal to Nonlinear. There are no constraints to be determined. Note that SOLVER is an Excel ( Add-In that may have to be installed

a $100,000 investment yields an annual return of $11,730.82 the first year; thereafter, annual returns increase at an annual rate of 6%. Based on a MARR of 8%, what is the discounted payback period for the investment? Click here to access the TVM Factor Table calculator. n= years Round entry to a whole number. eTextbook and Media Hint Assistance Used The time required for an investment to be fully recovered, including the time value of money, is the length of time required for the cumulative present worth to become positive using i= MARR; it is called the discounted payback period (DPBP) for an investment. Knowing all the data about the investment, the discounted payback period may be expressed from the formula corresponding to all the conditions mentioned in the problem. Logarithms can be used. This problem can be solved by using a mathematical formula, or by using the tabulated factor, or by using Excel ( SOLVER and GOAL SEEK tools. Regardless of whether you use Goal Seek or SOLVER, set the present worth of the geometric series equal to Nonlinear. There are no constraints to be determined. Note that SOLVER is an Excel ( Add-In that may have to be installed Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started