Answered step by step

Verified Expert Solution

Question

1 Approved Answer

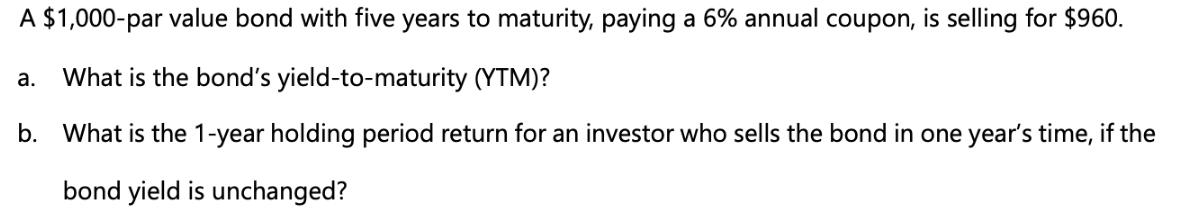

A $1,000-par value bond with five years to maturity, paying a 6% annual coupon, is selling for $960. a. What is the bond's yield-to-maturity

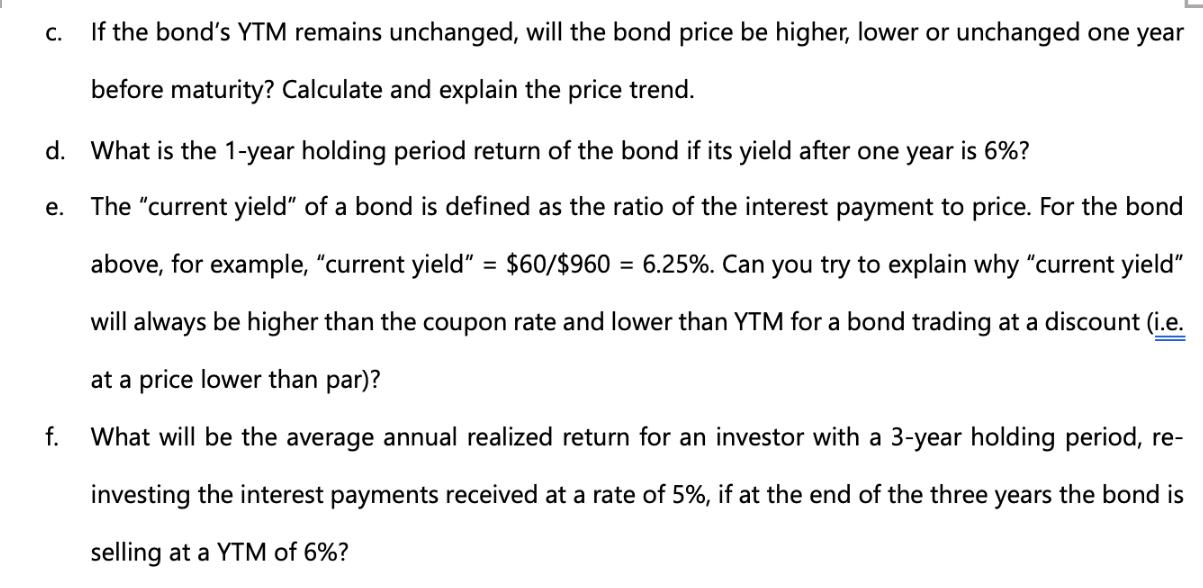

A $1,000-par value bond with five years to maturity, paying a 6% annual coupon, is selling for $960. a. What is the bond's yield-to-maturity (YTM)? b. What is the 1-year holding period return for an investor who sells the bond in one year's time, if the bond yield is unchanged? C. If the bond's YTM remains unchanged, will the bond price be higher, lower or unchanged one year before maturity? Calculate and explain the price trend. d. What is the 1-year holding period return of the bond if its yield after one year is 6%? e. The "current yield" of a bond is defined as the ratio of the interest payment to price. For the bond above, for example, "current yield" = $60/$960 = 6.25%. Can you try to explain why "current yield" will always be higher than the coupon rate and lower than YTM for a bond trading at a discount (i.e. at a price lower than par)? What will be the average annual realized return for an investor with a 3-year holding period, re- investing the interest payments received at a rate of 5%, if at the end of the three years the bond is selling at a YTM of 6%? f.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To find the bonds yieldtomaturity YTM we need to calculate the internal rate of return IRR that makes the present value of the bonds cash flows equal to its face value We can use the formul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started