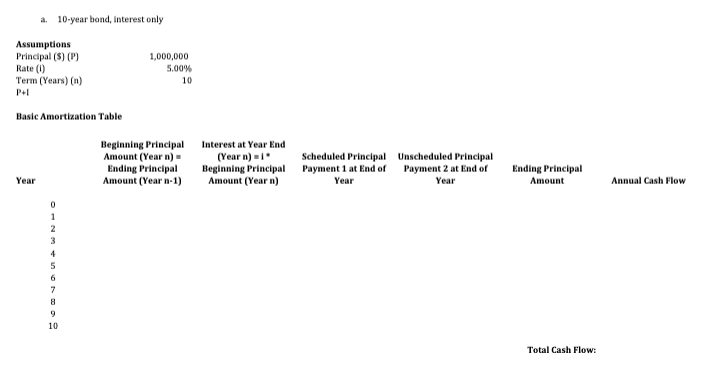

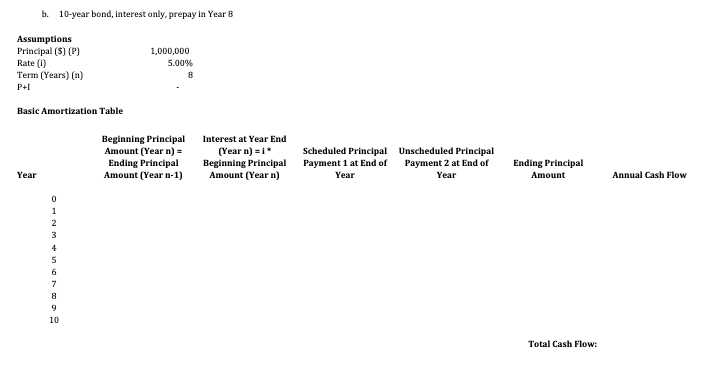

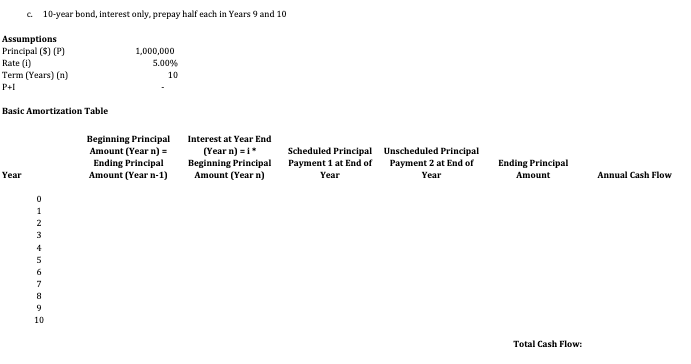

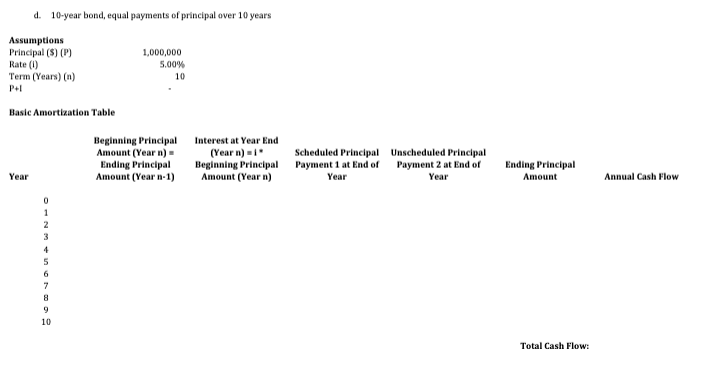

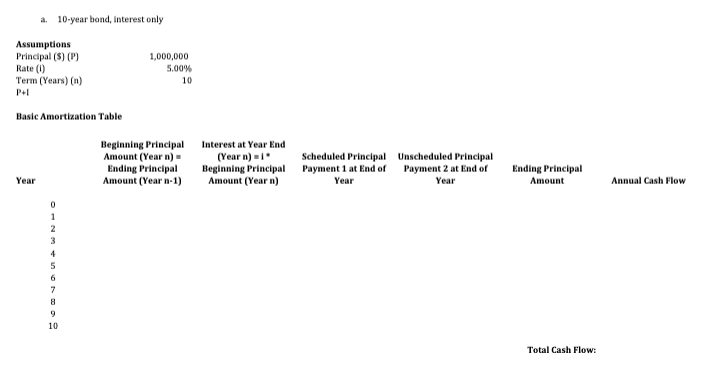

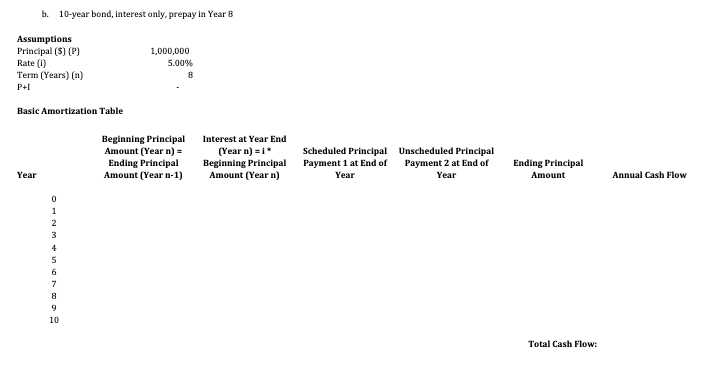

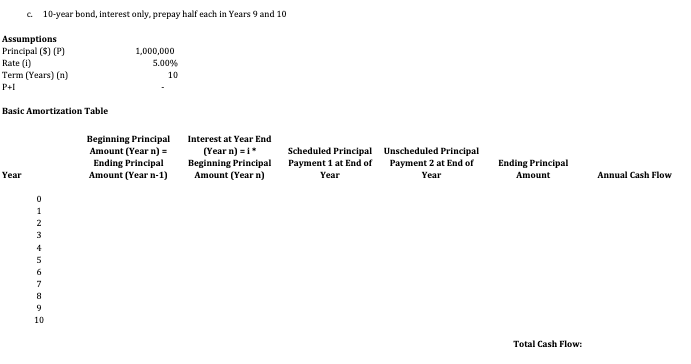

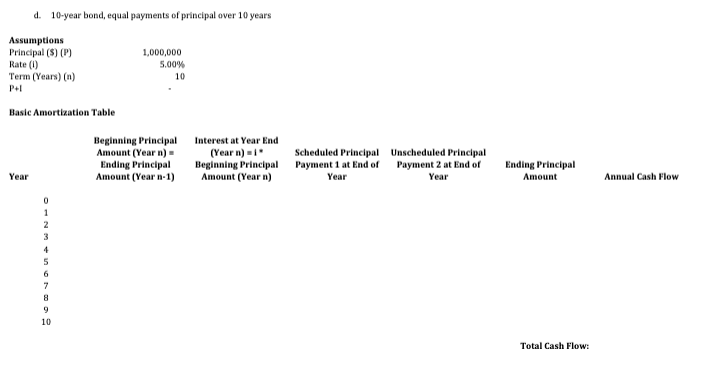

a. 10-year bond, interest only Assumptions Principal (5) (P) 1,000,000 Rate (1) 5.00% Term (Years) (1) 10 PEL Basic Amortization Table Beginning Principal Amount (Year n) - Ending Principal Year Amount (Year 6-1) Interest at Year End (Year n)-1 Beginning Principal Amount (Year) Scheduled Principal Unscheduled Principal Payment 1 at End of Payment 2 at End of Year Year Ending Principal Amount Annual Cash Flow 0 1 2 OOOWN 8 9 10 Total Cash Flow: b. 10-year bond, interest only, prepay in Year 8 Assumptions Principal (S) (P) Rate (i) Term (Years) (n) P+ 1,000,000 5.00% 8 Basic Amortization Table Beginning Principal Amount (Year n) = Ending Principal Amount (Year n-1) Interest at Year End (Year n)-1 Beginning Principal Amount (Year n) Scheduled Principal Unscheduled Principal Payment 1 at End of Payment 2 at End of Year Year Ending Principal Amount Year Annual Cash Flow BOOWNO 5 10 Total Cash Flow: c. 10-year bond, Interest only, prepay half each in Years 9 and 10 Assumptions Principal (8) (P) Rate (0) Term (Years) (n) P+1 1,000,000 5.00% 10 Basic Amortization Table Beginning Principal Amount (Year n) = Ending Principal Amount (Year n-1) Interest at Year End (Year n) = 1 Beginning Principal Amount (Year n) Scheduled Principal Unscheduled Principal Payment 1 at End of Payment 2 at End of Year Year Ending Principal Amount Year Annual Cash Flow 0 OOOWN- 10 Total Cash Flow: d. 10-year bond, equal payments of principal over 10 years Assumptions Principal (8) (P) Rate (6) Term (Years) (n) P+1 1,000,000 5.00% 10 Basic Amortization Table Beginning Principal Amount (Year n)- Ending Principal Amount (Year n-1) Interest at Year End (Year n)-1 Beginning Principal Amount (Year n) Scheduled Principal Unscheduled Principal Payment 1 at End of Payment 2 at End of Year Year Ending Principal Amount Year Annual Cash Flow 0 1 2 4 5 6 7 8 9 10 Total Cash Flow: a. 10-year bond, interest only Assumptions Principal (5) (P) 1,000,000 Rate (1) 5.00% Term (Years) (1) 10 PEL Basic Amortization Table Beginning Principal Amount (Year n) - Ending Principal Year Amount (Year 6-1) Interest at Year End (Year n)-1 Beginning Principal Amount (Year) Scheduled Principal Unscheduled Principal Payment 1 at End of Payment 2 at End of Year Year Ending Principal Amount Annual Cash Flow 0 1 2 OOOWN 8 9 10 Total Cash Flow: b. 10-year bond, interest only, prepay in Year 8 Assumptions Principal (S) (P) Rate (i) Term (Years) (n) P+ 1,000,000 5.00% 8 Basic Amortization Table Beginning Principal Amount (Year n) = Ending Principal Amount (Year n-1) Interest at Year End (Year n)-1 Beginning Principal Amount (Year n) Scheduled Principal Unscheduled Principal Payment 1 at End of Payment 2 at End of Year Year Ending Principal Amount Year Annual Cash Flow BOOWNO 5 10 Total Cash Flow: c. 10-year bond, Interest only, prepay half each in Years 9 and 10 Assumptions Principal (8) (P) Rate (0) Term (Years) (n) P+1 1,000,000 5.00% 10 Basic Amortization Table Beginning Principal Amount (Year n) = Ending Principal Amount (Year n-1) Interest at Year End (Year n) = 1 Beginning Principal Amount (Year n) Scheduled Principal Unscheduled Principal Payment 1 at End of Payment 2 at End of Year Year Ending Principal Amount Year Annual Cash Flow 0 OOOWN- 10 Total Cash Flow: d. 10-year bond, equal payments of principal over 10 years Assumptions Principal (8) (P) Rate (6) Term (Years) (n) P+1 1,000,000 5.00% 10 Basic Amortization Table Beginning Principal Amount (Year n)- Ending Principal Amount (Year n-1) Interest at Year End (Year n)-1 Beginning Principal Amount (Year n) Scheduled Principal Unscheduled Principal Payment 1 at End of Payment 2 at End of Year Year Ending Principal Amount Year Annual Cash Flow 0 1 2 4 5 6 7 8 9 10 Total Cash Flow