Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A 10-year bond with face value of TZS. 1,000 and redeemable at par was issued with a coupon rate of 7% payable annually. The

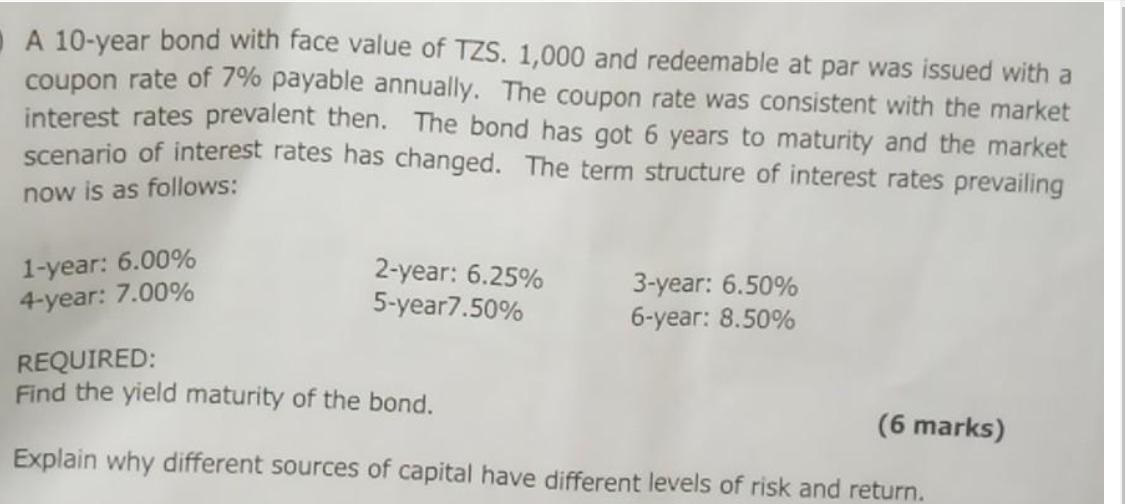

A 10-year bond with face value of TZS. 1,000 and redeemable at par was issued with a coupon rate of 7% payable annually. The coupon rate was consistent with the market interest rates prevalent then. The bond has got 6 years to maturity and the market scenario of interest rates has changed. The term structure of interest rates prevailing now is as follows: 1-year: 6.00% 4-year: 7.00% 2-year: 6.25% 5-year7.50% 3-year: 6.50% 6-year: 8.50% REQUIRED: Find the yield maturity of the bond. (6 marks) Explain why different sources of capital have different levels of risk and return.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To find the yield to maturity YTM of the bond we need to calculate the present value of its cash flows including both coupon payments and the redemption value at maturity Given Face value of the bond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started