Question

A 10-year, capital-indexed bond linked to the Consumer Price Index (CPI) is issued with an annual coupon rate of 6% and a par (face)

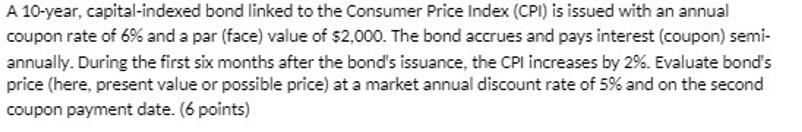

A 10-year, capital-indexed bond linked to the Consumer Price Index (CPI) is issued with an annual coupon rate of 6% and a par (face) value of $2,000. The bond accrues and pays interest (coupon) semi- annually. During the first six months after the bond's issuance, the CPI increases by 2%. Evaluate bond's price (here, present value or possible price) at a market annual discount rate of 5% and on the second coupon payment date. (6 points)

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Par Value 2000 Coupon Rate 6 Discount Rate 5 CPI increase 2 Step 1 Cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Statistics A Decision Making Approach

Authors: David F. Groebner, Patrick W. Shannon, Phillip C. Fry

9th Edition

013302184X, 978-0133021844

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App