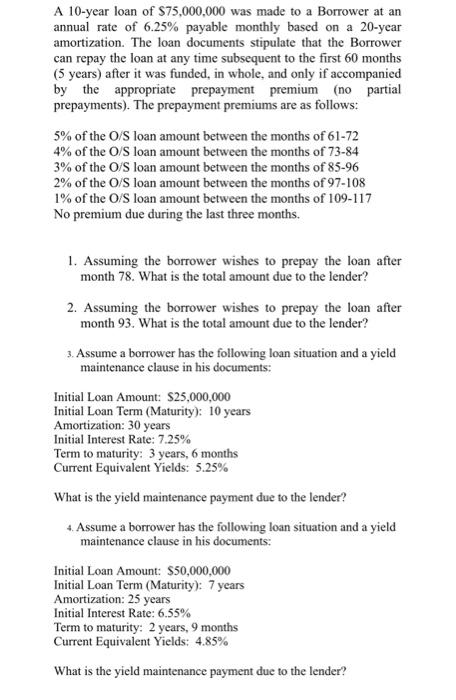

A 10-year loan of $75,000,000 was made to a Borrower at an annual rate of 6.25% payable monthly based on a 20 -year amortization. The loan documents stipulate that the Borrower can repay the loan at any time subsequent to the first 60 months (5 years) after it was funded, in whole, and only if accompanied by the appropriate prepayment premium (no partial prepayments). The prepayment premiums are as follows: 5% of the O/S loan amount between the months of 61-72 4% of the O/S loan amount between the months of 73-84 3% of the O/S loan amount between the months of 8596 2% of the O/S loan amount between the months of 97-108 1% of the O/S loan amount between the months of 109-117 No premium due during the last three months. 1. Assuming the borrower wishes to prepay the loan after month 78 . What is the total amount due to the lender? 2. Assuming the borrower wishes to prepay the loan after month 93 . What is the total amount due to the lender? 3. Assume a borrower has the following loan situation and a yield maintenance clause in his documents: Initial Loan Amount: $25,000,000 Initial Loan Term (Maturity): 10 years Amortization: 30 years Initial Interest Rate: 7.25% Term to maturity: 3 years, 6 months Current Equivalent Yields: 5.25% What is the yield maintenance payment due to the lender? 4. Assume a borrower has the following loan situation and a yield maintenance clause in his documents: Initial Loan Amount: $50,000,000 Initial Loan Term (Maturity): 7 years Amortization: 25 years Initial Interest Rate: 6.55% Term to maturity: 2 years, 9 months Current Equivalent Yields: 4.85% What is the yield maintenance payment due to the lender? A 10-year loan of $75,000,000 was made to a Borrower at an annual rate of 6.25% payable monthly based on a 20 -year amortization. The loan documents stipulate that the Borrower can repay the loan at any time subsequent to the first 60 months (5 years) after it was funded, in whole, and only if accompanied by the appropriate prepayment premium (no partial prepayments). The prepayment premiums are as follows: 5% of the O/S loan amount between the months of 61-72 4% of the O/S loan amount between the months of 73-84 3% of the O/S loan amount between the months of 8596 2% of the O/S loan amount between the months of 97-108 1% of the O/S loan amount between the months of 109-117 No premium due during the last three months. 1. Assuming the borrower wishes to prepay the loan after month 78 . What is the total amount due to the lender? 2. Assuming the borrower wishes to prepay the loan after month 93 . What is the total amount due to the lender? 3. Assume a borrower has the following loan situation and a yield maintenance clause in his documents: Initial Loan Amount: $25,000,000 Initial Loan Term (Maturity): 10 years Amortization: 30 years Initial Interest Rate: 7.25% Term to maturity: 3 years, 6 months Current Equivalent Yields: 5.25% What is the yield maintenance payment due to the lender? 4. Assume a borrower has the following loan situation and a yield maintenance clause in his documents: Initial Loan Amount: $50,000,000 Initial Loan Term (Maturity): 7 years Amortization: 25 years Initial Interest Rate: 6.55% Term to maturity: 2 years, 9 months Current Equivalent Yields: 4.85% What is the yield maintenance payment due to the lender