Question

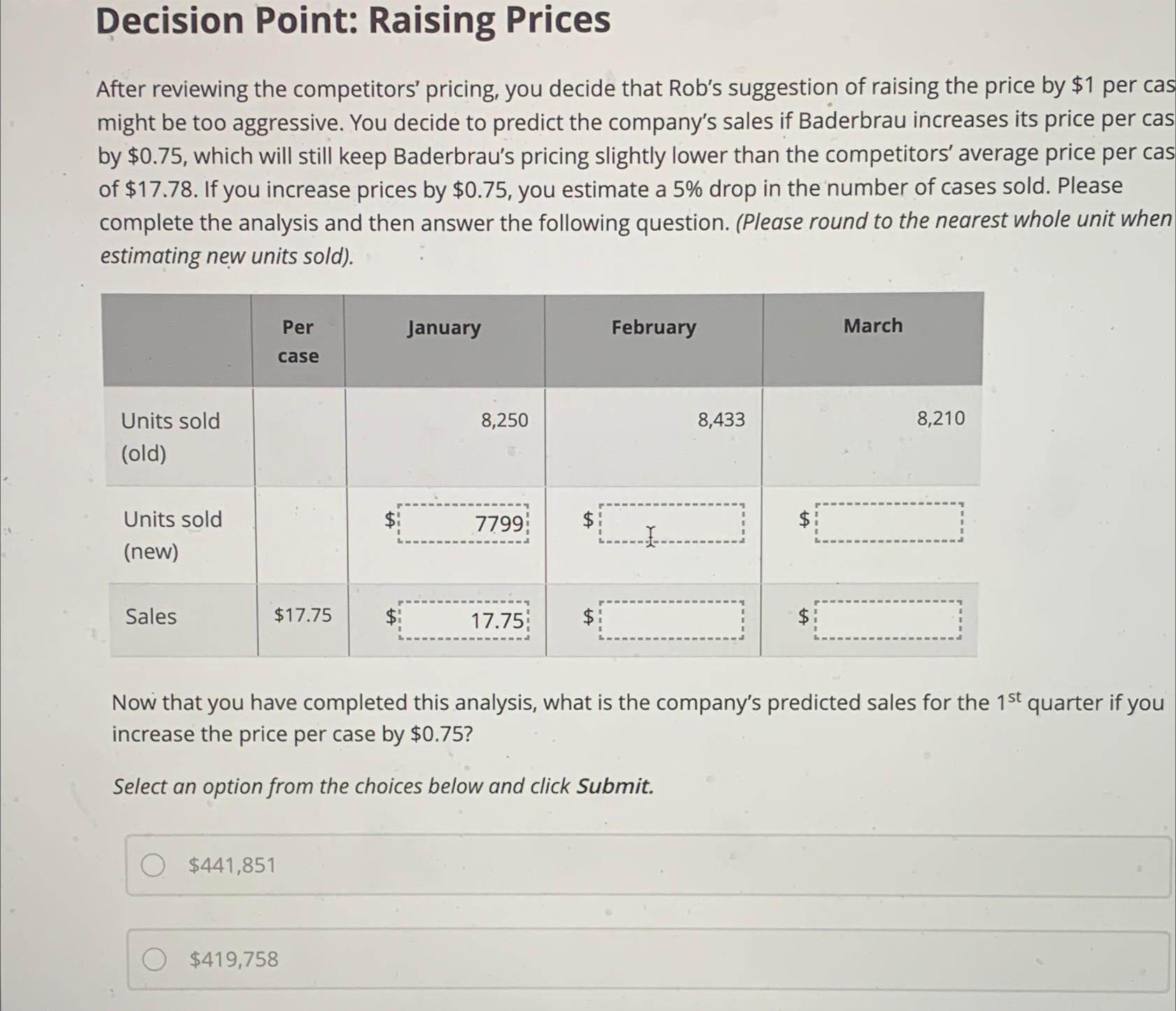

Decision Point: Raising Prices After reviewing the competitors' pricing, you decide that Rob's suggestion of raising the price by $1 per cas might be too

Decision Point: Raising Prices\ After reviewing the competitors' pricing, you decide that Rob's suggestion of raising the price by

$1per cas might be too aggressive. You decide to predict the company's sales if Baderbrau increases its price per cas by

$0.75, which will still keep Baderbrau's pricing slightly lower than the competitors' average price per cas of

$17.78. If you increase prices by

$0.75, you estimate a

5%drop in the number of cases sold. Please complete the analysis and then answer the following question. (Please round to the nearest whole unit when estimating new units sold).\ \\\\table[[,\\\\table[[Per],[case]],January,February,,March],[\\\\table[[Units sold],[(old)]],,8,250,8,433,,8,210],[\\\\table[[Units sold],[(new)]],,7799,,

$,],[Sales,

$17.75,17.75,,

$,]]\ Now that you have completed this analysis, what is the company's predicted sales for the

1^(st )quarter if you increase the price per case by

$0.75?\ Select an option from the choices below and click Submit.\

$441,851\

$419,758

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started