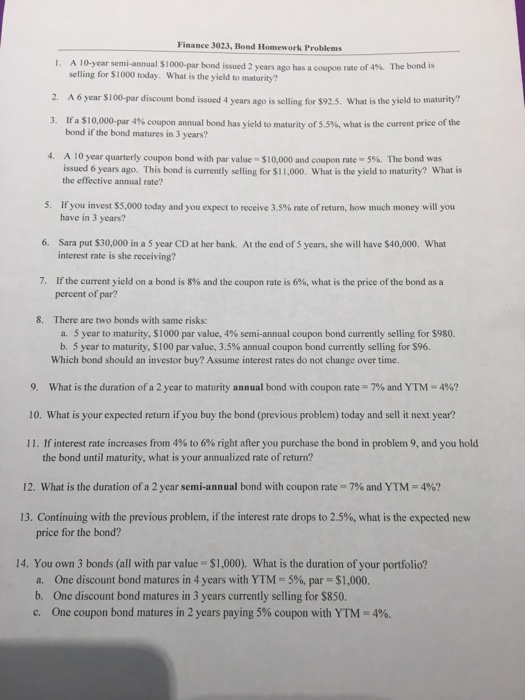

A 10-year semi-annual $1000-par bond issued 2 years ago has a coupon rate of 4%. The bond is selling for $1000 today. What it the yield to maturity? A 6 year $100-par discount bond issued 4 years ago it selling for $92.5. What is the yield to maturity? If a $10,000-par 4% coupon annual bond has yield to maturity of 5.5%, what it the current price of the bond if the bond matures in 3 years? A 10 year quarterly coupon bond with par value - $10,000 and coupon rate - 5%. The bond was issued 6 years ago. This bond is currently selling for $11,000. What is the yield to maturity? What is the effective annual rate? If you invest $5,000 today and you expect to receive 3.5% rate of return, how much money will you have in 3 years? Sara put $30,000 in a 5 year CD at her bank. At the end of 5 years, she will have $40,000. What interest rate is she receiving? If the current yield on a bond is 8% and the coupon rate is 6%, what is the price of the bond as a percent of par? There are two bonds with same risks: a. 5 year to maturity, $1000 par value, 4% semi-annual coupon bond currently selling for $980. b. 5 year to maturity, $100 par value, 3.5% annual coupon bond currently selling for $96. Which bond should an investor buy? Assume interest rates do not change over time. What is the duration of a 2 year to maturity annual bond with coupon rate = 7% and YTM = 4%? What is your expected return if you buy the bond (previous problem) today and sell it next year? If interest rate increases from 4% to 6% right after you purchase the bond in problem 9, and you hold the bond until maturity, what is your annualized rate of return? What is the duration of a 2 year semi-annual bond with coupon rate = 7% and YTM = 4%? Continuing with the previous problem, if the interest rate drops to 2.5%, what is the expected new price for the bond? You own 3 bonds (all with par value $1,000). What is the duration of your portfolio? a. One discount bond matures in 4 years with YTM = 5%, par = $1,000. b. One discount bond matures in 3 years currently selling for $850. c. One coupon bond matures in 2 years paying 5% coupon with YTM 4%